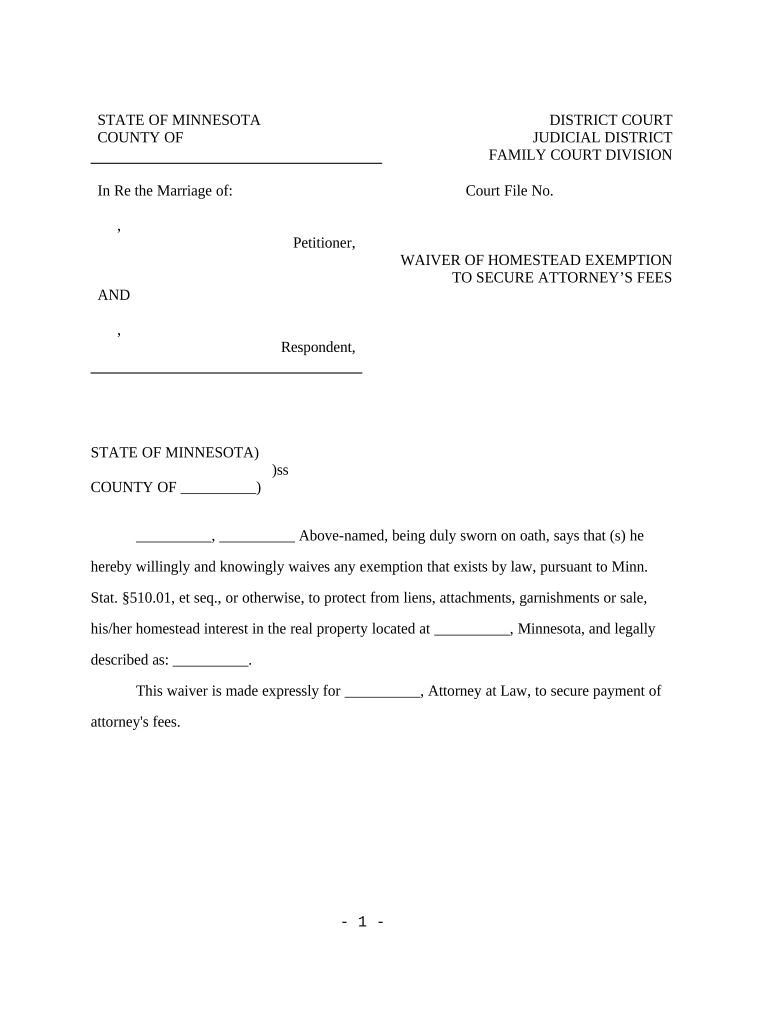

Minnesota Homestead Form

What is the Minnesota Homestead?

The Minnesota homestead exemption is a legal provision that allows homeowners to reduce their property taxes on their primary residence. This exemption is designed to provide financial relief to homeowners by lowering the taxable value of their property. To qualify, the property must be owned and occupied by the homeowner as their primary residence. The exemption can significantly decrease the amount of property taxes owed, making homeownership more affordable.

Eligibility Criteria for the Minnesota Homestead

To qualify for the Minnesota homestead exemption, certain criteria must be met. Homeowners must:

- Own the property and occupy it as their primary residence.

- Be a U.S. citizen or a qualified resident alien.

- Meet any income limitations set by the state, if applicable.

Additionally, properties used for rental purposes or as second homes do not qualify for this exemption. It is important for homeowners to confirm their eligibility to take full advantage of the benefits offered by the homestead exemption.

Steps to Complete the Minnesota Homestead Application

Filling out the Minnesota homestead application involves several key steps:

- Obtain the Minnesota homestead application form from your local county assessor's office or their website.

- Complete the form by providing necessary information, including property details and ownership status.

- Submit the completed application to your county assessor's office by the specified deadline. This can often be done online, by mail, or in person.

- Await confirmation of your application status from the county office.

It is crucial to ensure that all information is accurate and submitted on time to avoid delays or denial of the exemption.

Required Documents for the Minnesota Homestead Application

When applying for the Minnesota homestead exemption, specific documents may be required to verify eligibility. These can include:

- Proof of ownership, such as a deed or title.

- Identification documents, such as a driver's license or state ID.

- Any additional documentation requested by the county assessor's office, such as income verification if applicable.

Having these documents ready can streamline the application process and help ensure a successful submission.

Form Submission Methods for the Minnesota Homestead

Homeowners can submit their Minnesota homestead application through various methods, depending on their county's regulations:

- Online submission through the county assessor's website, if available.

- Mailing the completed application to the county assessor's office.

- Visiting the county assessor's office in person to submit the application.

Each method has its own advantages, so homeowners should choose the one that best suits their needs and circumstances.

Legal Use of the Minnesota Homestead

The Minnesota homestead exemption is governed by specific legal guidelines that dictate how it can be used. Homeowners must ensure that the property for which they are claiming the exemption is their primary residence. Misuse of the exemption, such as claiming it on multiple properties or on properties not occupied as a primary residence, can lead to penalties. Homeowners should familiarize themselves with these regulations to maintain compliance and avoid potential legal issues.

Quick guide on how to complete minnesota homestead 497312587

Prepare Minnesota Homestead effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents rapidly without delays. Manage Minnesota Homestead on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to alter and electronically sign Minnesota Homestead with ease

- Obtain Minnesota Homestead and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, either via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Minnesota Homestead and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a waiver homestead exemption?

A waiver homestead exemption is a legal provision that allows homeowners to exempt a certain portion of their property's value from taxes. This can signNowly reduce the overall tax burden for eligible homeowners. Understanding the specifics of this exemption can help you save money and maximize your property benefits.

-

How does airSlate SignNow support the waiver homestead exemption process?

airSlate SignNow streamlines the documentation necessary for applying for a waiver homestead exemption. Our easy-to-use platform allows you to create, send, and eSign necessary documents quickly, ensuring you meet deadlines. This efficiency makes managing the waiver homestead exemption less stressful and more accessible.

-

What are the benefits of using airSlate SignNow for my waiver homestead exemption documents?

Using airSlate SignNow for your waiver homestead exemption documents enhances efficiency and security. You can easily create templates, track document status, and ensure compliance with legal requirements. These features help expedite the exemption process and provide peace of mind.

-

Is there a cost associated with using airSlate SignNow for waiver homestead exemption forms?

Yes, airSlate SignNow offers various pricing plans tailored to your needs, which can accommodate your waiver homestead exemption forms without breaking the bank. Our cost-effective solutions ensure that you get the best value while managing your documentation smoothly. Consider starting with a free trial to see how our features benefit your waiver homestead exemption processes.

-

Can I integrate airSlate SignNow with other tools for managing my waiver homestead exemption?

Absolutely! airSlate SignNow offers integrations with various applications and services. This means you can connect it with your existing tools to manage your waiver homestead exemption documentation more efficiently, ensuring a seamless workflow tailored to your needs.

-

What types of documents can I manage related to the waiver homestead exemption?

With airSlate SignNow, you can manage various documents related to the waiver homestead exemption, like application forms, supporting documents, and compliance agreements. Our platform's versatility allows you to keep all relevant files organized and easily accessible. This comprehensive management ensures nothing is overlooked in your exemption applications.

-

How secure is airSlate SignNow when handling waiver homestead exemption documents?

Security is a top priority for airSlate SignNow. We employ advanced encryption and compliance protocols to protect your waiver homestead exemption documents. You can trust that your sensitive information is safe while using our platform to streamline your exemption paperwork.

Get more for Minnesota Homestead

- Loan application form1 affin bank berhad

- Pa 1000 property tax rent rebate form

- Jdf 398 temporary protection order colorado link project form

- 4 h horse project lease agreement form

- Notarized child custody agreement template form

- Notarized child custody without court agreement template form

- Double clos contract template form

- Motivational speaker contract template form

Find out other Minnesota Homestead

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe