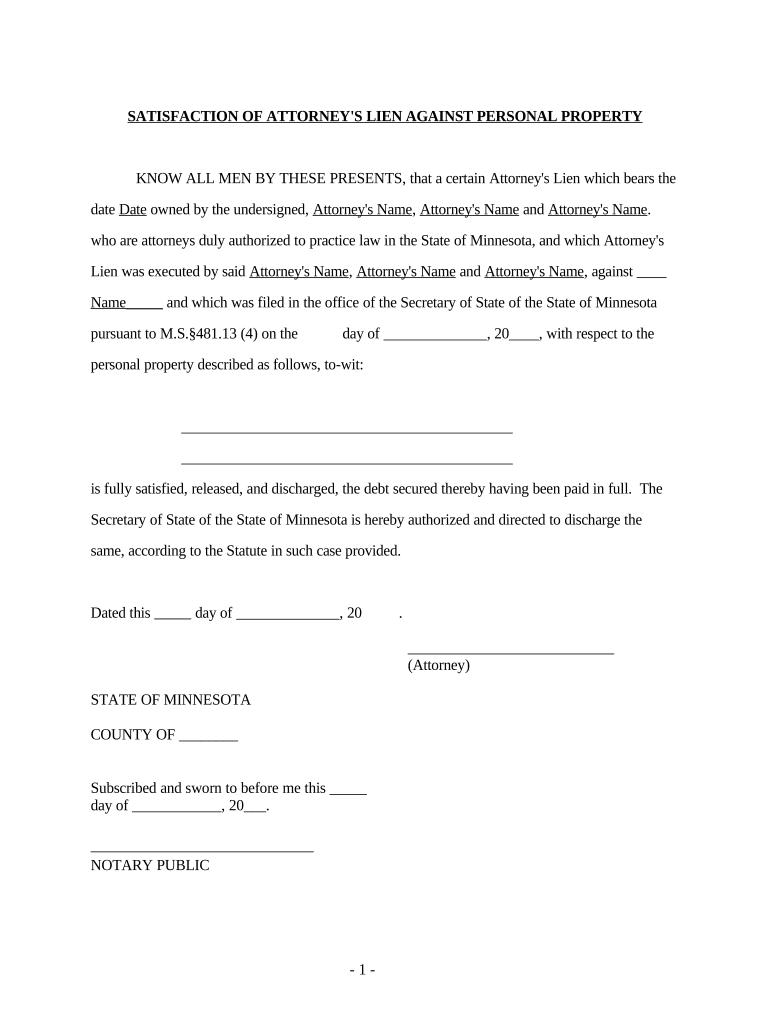

Mn Personal Property Form

What is the Mn Personal Property

The Mn personal property form is a legal document used in Minnesota to report and manage personal property taxes. This form is essential for individuals and businesses to declare their personal property, which may include items such as furniture, machinery, and equipment. By accurately completing this form, taxpayers ensure compliance with state tax regulations, allowing for proper assessment and taxation of their assets.

Steps to complete the Mn Personal Property

Completing the Mn personal property form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your personal property, including descriptions, values, and purchase dates. Next, fill out the form with this information, ensuring that you provide detailed descriptions for each item. After completing the form, review it for any errors or omissions. Finally, submit the form by the designated deadline, either online or by mail, as per the instructions provided by the Minnesota Department of Revenue.

Legal use of the Mn Personal Property

The legal use of the Mn personal property form is governed by state tax laws, which require individuals and businesses to report their personal property for taxation purposes. Failing to file this form can result in penalties and interest on unpaid taxes. It is important to understand that the information provided on this form is used by local assessors to determine property values, which directly impacts tax liabilities. Therefore, accurate and timely filing is crucial for legal compliance.

Key elements of the Mn Personal Property

Key elements of the Mn personal property form include the identification of the taxpayer, a detailed list of personal property items, their respective values, and the total assessed value of all reported property. Additionally, the form may require information about the location of the property and any exemptions that may apply. Understanding these elements is vital for ensuring that the form is completed correctly and that all relevant information is included.

Who Issues the Form

The Mn personal property form is issued by the Minnesota Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. Taxpayers can obtain the form directly from the department's website or through local county assessors' offices. It is important to use the most current version of the form to ensure compliance with any updates to tax laws or reporting requirements.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Mn personal property form can be done through various methods to accommodate taxpayer preferences. The form can be submitted online via the Minnesota Department of Revenue's e-filing system, which offers a convenient and efficient way to file. Alternatively, taxpayers can mail a printed version of the form to their local county assessor's office. In-person submission may also be available at local offices, allowing for direct assistance if needed. Each method has its own guidelines and deadlines, so it is important to choose the one that best fits your needs.

Penalties for Non-Compliance

Failure to comply with the requirements of the Mn personal property form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action for persistent non-compliance. The Minnesota Department of Revenue actively monitors filings and may impose penalties on those who fail to report their personal property accurately or on time. Understanding these consequences emphasizes the importance of timely and accurate completion of the form.

Quick guide on how to complete mn personal property

Effortlessly Prepare Mn Personal Property on Any Device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Mn Personal Property on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Mn Personal Property with Ease

- Find Mn Personal Property and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign Mn Personal Property to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to MN personal property?

airSlate SignNow is an electronic signature solution that simplifies the document signing process for various applications, including transactions involving MN personal property. It allows users to securely send, eSign, and manage documents, making it an invaluable tool for real estate professionals dealing with personal property in Minnesota.

-

How can airSlate SignNow benefit transactions involving MN personal property?

Using airSlate SignNow for MN personal property transactions streamlines the signing process, reduces paperwork, and enhances communication between parties. Its intuitive interface ensures that all documents are signed quickly and securely, which is essential in the fast-paced real estate market.

-

What features does airSlate SignNow offer for managing MN personal property documents?

airSlate SignNow offers features like template creation, bulk sending, and document tracking, which are perfect for managing MN personal property documents. With these features, users can easily customize their document workflows and ensure compliance with Minnesota's real estate regulations.

-

Is airSlate SignNow cost-effective for managing MN personal property transactions?

Yes, airSlate SignNow provides a cost-effective solution for managing MN personal property transactions. Its pricing plans are designed to accommodate businesses of all sizes, ensuring you get the features you need without breaking the bank, helping you streamline your process efficiently.

-

What integrations does airSlate SignNow support for MN personal property management?

airSlate SignNow seamlessly integrates with popular business applications like Salesforce and Google Drive, making it easier to manage MN personal property-related tasks. These integrations enhance productivity and ensure that all your documents and data are connected in one streamlined platform.

-

Can airSlate SignNow ensure compliance for MN personal property transactions?

Absolutely! airSlate SignNow is built with compliance in mind, addressing the legal requirements surrounding MN personal property transactions. It provides an auditable trail for all documents, ensuring that you meet Minnesota’s legal standards when it comes to electronic signatures.

-

How secure is airSlate SignNow when handling MN personal property documents?

Security is a top priority for airSlate SignNow. It utilizes advanced encryption protocols and complies with industry standards to protect MN personal property documents from unauthorized access, ensuring that your data remains safe and secure throughout the signing process.

Get more for Mn Personal Property

- Sample scholarship application form

- Bill of sale nevada form

- Emergency amp disaster release form1 a doc pm 171a bilingual ccusd

- Law enforcement employment application form gulf county sheriffamp39s

- Ecq examples form

- Consumer complaint insurance form

- Bicycle drawing test form

- Form 40 pv corporation return payment voucher

Find out other Mn Personal Property

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile