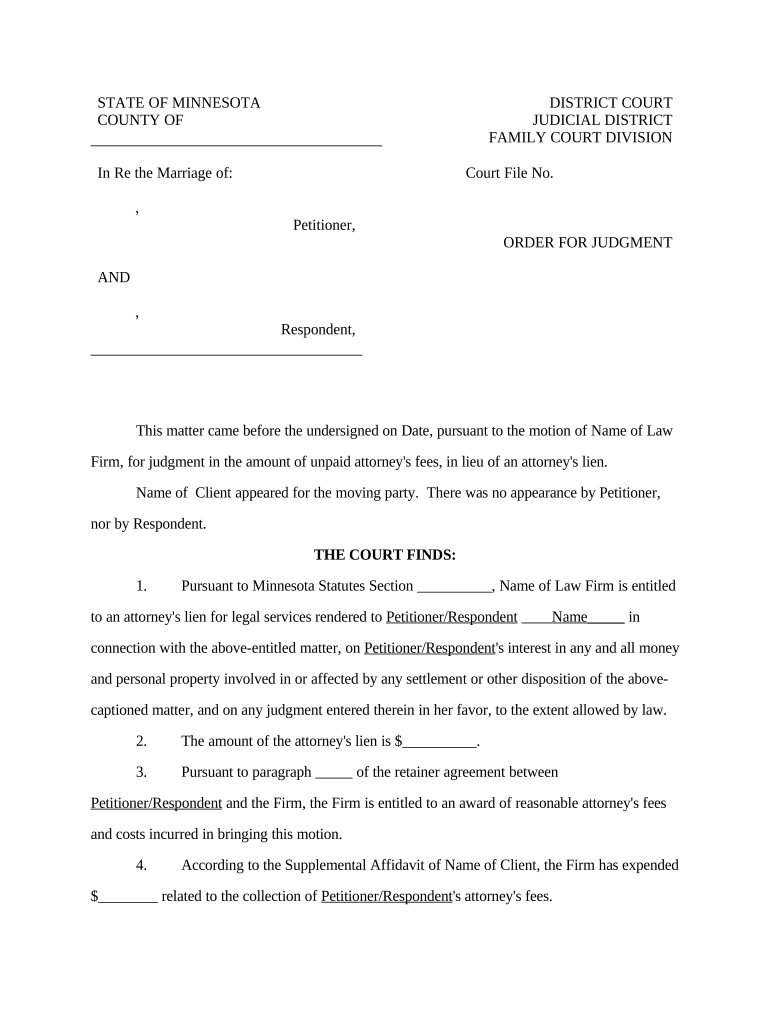

Mn Fees Form

What is the Mn Fees

The Mn fees form is a specific document used in the state of Minnesota, primarily related to various fees associated with business operations, licensing, or regulatory compliance. This form is essential for individuals and businesses to ensure they meet state requirements and maintain good standing. Understanding the purpose and implications of the Mn fees form is critical for compliance and effective business management.

How to use the Mn Fees

Using the Mn fees form involves several straightforward steps. First, identify the specific fees applicable to your situation, whether they pertain to business licenses, permits, or other regulatory requirements. Next, gather all necessary information and documentation required to complete the form accurately. Once filled out, the form can be submitted through the designated channels, which may include online submission, mailing, or in-person delivery to the appropriate state agency.

Steps to complete the Mn Fees

Completing the Mn fees form requires careful attention to detail. Follow these steps:

- Review the form instructions thoroughly to understand the requirements.

- Gather all required information, including business details and fee amounts.

- Fill out the form accurately, ensuring all sections are completed.

- Double-check your entries for any errors or omissions.

- Submit the form as directed, keeping a copy for your records.

Legal use of the Mn Fees

The legal use of the Mn fees form is essential for compliance with Minnesota state laws. This form must be filled out correctly and submitted on time to avoid penalties. It serves as a formal declaration of the fees owed and ensures that businesses adhere to state regulations. Failure to comply with the requirements outlined in the Mn fees form can result in fines or other legal repercussions.

Key elements of the Mn Fees

Several key elements are crucial to the Mn fees form. These include:

- The specific fees being assessed, which can vary based on the type of business or activity.

- Accurate identification of the business or individual responsible for the fees.

- Clear instructions for payment methods and submission deadlines.

- Contact information for state agencies for any questions or clarifications.

Required Documents

When completing the Mn fees form, certain documents may be required to support your submission. These could include:

- Proof of business registration or licensing.

- Financial statements or tax documents relevant to the fees being assessed.

- Any previous correspondence with state agencies regarding fees.

Form Submission Methods

The Mn fees form can typically be submitted through various methods, including:

- Online submission via the state’s official website.

- Mailing the completed form to the appropriate state agency.

- In-person submission at designated state offices.

Quick guide on how to complete mn fees

Prepare Mn Fees effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly without delays. Manage Mn Fees on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Mn Fees with ease

- Locate Mn Fees and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about documents that are lost or misplaced, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Mn Fees and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the current MN tax rates?

The state levies a 6.875 percent sales tax. Local sales tax rates are as high as 2.15 percent, with an average of 1.16 percent. The average combined state and local sales tax rate is at 8.04 percent, ing to Tax Foundation data from January 2024.

-

How much are MN tabs?

Plate fees Type of FeeCost Filing fee - Due with each application for: Special plates or transfer of special plates Duplicate plates, stickers or registration card Any temporary permit $12 Registration Technology Surcharge $2.25 Passenger Vehicle Plate Fees $15.50 (Double Plates) $13.50 (Single Plate)*10 more rows

-

What does Minnesota charge tax on?

The sales tax is a tax on final retail sales. Items purchased for resale (i.e., goods bought by a retailer from a wholesaler) are exempt. In Minnesota, the rule of thumb is that tangible personal property is taxable unless specifically exempted, and services are not taxable unless specifically included.

-

What services are subject to sales tax in Minnesota?

Furthermore, services are not taxable unless specifically included by law. Examples of taxable services include lodging, laundry and cleaning services, pet grooming, lawn care, digital downloads, and telecommunications. A remote seller is a retailer that does not have a physical presence in the state.

-

What is the MN minimum fee?

Minimum Fee Brackets If your total minnesota property, payroll, and sales is:your minimum fee is: Less than $1,160,000 $0 $1,160,000 to $2,309,999 $240 $2,310,000 to $11,569,999 $690 $11,570,000 to $23,139,999 $2,3102 more rows • Oct 17, 2023

-

What percent does MN take out for taxes?

The income tax rate ranges from 5.35% to 9.85%. The state tax is pretty high compared to other states, but at least Minnesota doesn't impose any local taxes.

-

What are Minnesota tax fees?

Sales tax: The state levies a 6.875 percent sales tax, and local sales tax rates are as high as 2.15 percent. The average combined state and local sales tax rate is at 8.04 percent, ing to January 2024 Tax Foundation data. The Minnesota Department of Revenue has a map showing sales tax rates statewide.

-

What are the fees when buying a car in MN?

Typical fees to transfer and title a vehicle: Title Fee: $8.25 (plus $2 for each lien recorded) Transfer Tax: $10. Public Safety Vehicle Fee: $3.50. Technology Surcharge: $2.25.

Get more for Mn Fees

Find out other Mn Fees

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed