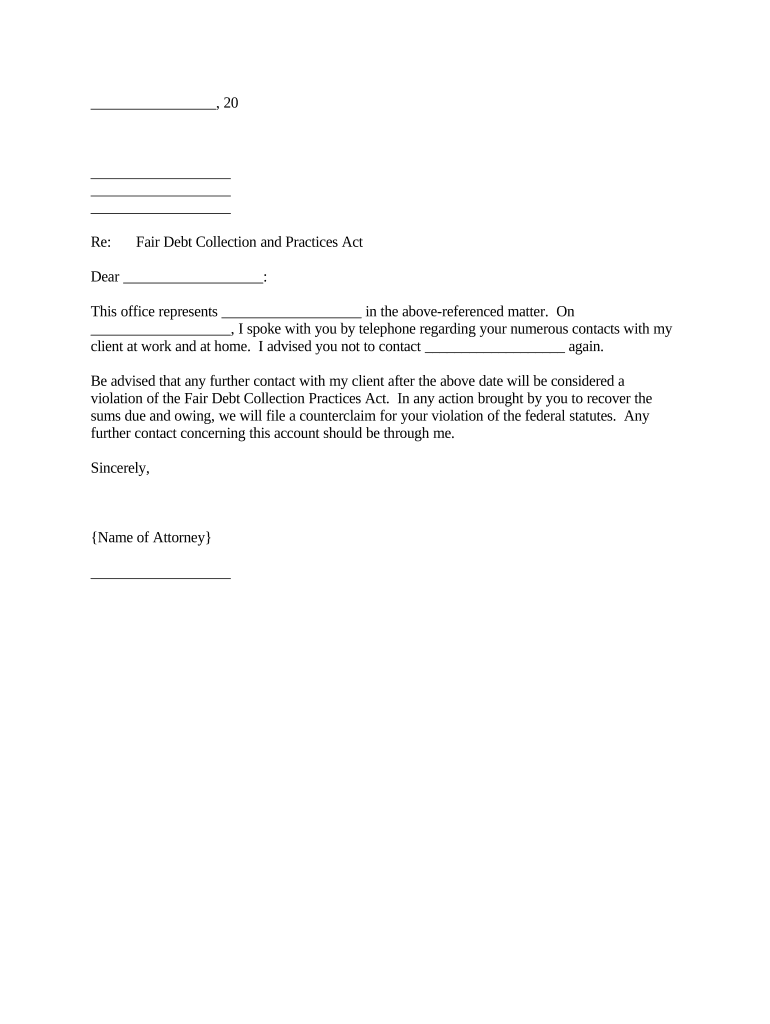

Letter Debt Collection Form

What is the letter debt collection?

The letter debt collection is a formal document used by creditors to request payment from individuals or businesses that owe money. This document serves as a crucial step in the debt recovery process and outlines the amount owed, the nature of the debt, and any relevant payment terms. It is essential for creditors to ensure that the letter is clear, concise, and compliant with applicable laws to facilitate effective communication and collection.

Key elements of the letter debt collection

A well-structured letter debt collection includes several key elements that enhance its effectiveness:

- Creditor Information: The name, address, and contact details of the creditor or collection agency.

- Debtor Information: The name and address of the individual or business that owes the debt.

- Debt Details: A clear description of the debt, including the amount owed and any relevant account numbers.

- Payment Instructions: Specific instructions on how to make the payment, including accepted payment methods.

- Legal Disclaimers: Any required legal notices or disclaimers that inform the debtor of their rights.

Steps to complete the letter debt collection

Completing a letter debt collection involves several steps to ensure clarity and compliance:

- Gather all necessary information about the debtor and the debt.

- Draft the letter, ensuring all key elements are included.

- Review the letter for accuracy and compliance with relevant laws.

- Send the letter via a reliable method, ensuring it is documented for future reference.

- Follow up with the debtor if no response is received within a specified timeframe.

Legal use of the letter debt collection

Using a letter debt collection legally requires adherence to federal and state regulations. The Fair Debt Collection Practices Act (FDCPA) outlines the rights of consumers and the obligations of collectors. It is crucial for creditors to avoid practices that could be deemed harassing or deceptive. Ensuring that the letter is compliant with these regulations not only protects the creditor but also helps maintain a professional relationship with the debtor.

How to obtain the letter debt collection

Creditors can obtain a letter debt collection template from various sources, including legal websites, financial institutions, or by consulting with a legal professional. Many online platforms offer customizable templates that can be tailored to specific needs. It is advisable to use a template that complies with local laws and regulations to ensure its effectiveness.

Examples of using the letter debt collection

Examples of situations where a letter debt collection may be utilized include:

- A business seeking payment for unpaid invoices from a client.

- A landlord requesting overdue rent from a tenant.

- A service provider pursuing payment for services rendered.

In each case, the letter serves as a formal reminder and initiates the collection process, providing the debtor with clear information regarding their obligations.

Quick guide on how to complete letter debt collection

Complete Letter Debt Collection effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and safely archive it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without interruptions. Manage Letter Debt Collection on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign Letter Debt Collection without any hassle

- Locate Letter Debt Collection and click on Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Emphasize key sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional pen-and-ink signature.

- Review the details and click on the Done button to save your edits.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Letter Debt Collection and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter debt collection and how does airSlate SignNow facilitate it?

A letter debt collection is a formal written request to a debtor for payment of outstanding debts. airSlate SignNow streamlines this process by allowing businesses to create, send, and eSign debt collection letters quickly and securely. This ensures faster follow-up and improves the chances of recovery.

-

What features does airSlate SignNow offer for managing letter debt collection?

airSlate SignNow provides essential features for letter debt collection, including customizable templates, electronic signatures, secure document storage, and tracking. These tools enhance your ability to manage documents effectively and ensure timely communication with debtors.

-

How can I integrate airSlate SignNow with my existing debt collection systems?

airSlate SignNow offers seamless integrations with popular platforms, which helps you connect with your existing debt collection systems. You can streamline your workflow by syncing data and automating processes to enhance your letter debt collection efforts.

-

What is the pricing structure for airSlate SignNow in relation to letter debt collection?

airSlate SignNow provides flexible pricing plans suitable for businesses of all sizes. The affordable pricing enables effortless management of letter debt collection without compromising on features, making it a cost-effective solution for managing your collections.

-

Can I customize the letter debt collection templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize letter debt collection templates to fit your specific branding and messaging needs. This versatility enhances your communication with debtors and ensures that your letters are professional and effective.

-

How does airSlate SignNow ensure the security of my letter debt collection documents?

AirSlate SignNow employs advanced security measures such as encryption, two-factor authentication, and compliant data storage to protect your letter debt collection documents. This guarantees that sensitive information remains confidential and reduces the risk of unauthorized access.

-

Are there tools for tracking the status of letter debt collection letters sent through airSlate SignNow?

Indeed, airSlate SignNow comes with tracking tools that allow you to monitor the status of your letter debt collection letters. You can see when a document has been sent, viewed, and signed, enabling better follow-up and accountability throughout the collection process.

Get more for Letter Debt Collection

Find out other Letter Debt Collection

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF