Form 3372 Rev 11 09

What is the Form 3372 Rev 11 09

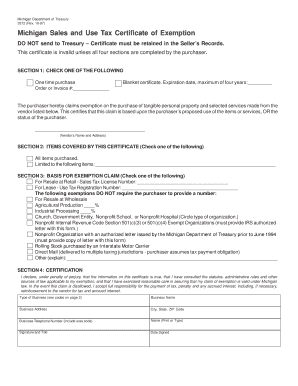

The Form 3372 Rev 11 09 is a specific document used in various administrative and regulatory processes. It is essential for individuals and businesses to understand its purpose and implications. This form typically pertains to applications or requests that require formal submission to a governing body. Understanding the context and requirements of this form is crucial for compliance and successful processing.

How to use the Form 3372 Rev 11 09

Using the Form 3372 Rev 11 09 involves several straightforward steps. First, ensure that you have the most recent version of the form. Next, gather all necessary information and documentation required for completion. Carefully fill out each section of the form, ensuring accuracy and clarity. Once completed, review the form for any errors before submission. Utilizing digital tools can streamline this process, allowing for easy editing and signing.

Steps to complete the Form 3372 Rev 11 09

Completing the Form 3372 Rev 11 09 requires attention to detail. Follow these steps for effective completion:

- Obtain the latest version of the form from a reliable source.

- Read the instructions carefully to understand each section's requirements.

- Fill in personal or business information accurately, ensuring all fields are completed.

- Attach any required supporting documents as specified in the instructions.

- Review the entire form for completeness and accuracy.

- Sign the form using a legally recognized method, such as an electronic signature.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Form 3372 Rev 11 09

The legal use of the Form 3372 Rev 11 09 hinges on compliance with applicable regulations. When filled out correctly and submitted through the proper channels, this form is recognized as valid. It is crucial to ensure that all signatures are executed in accordance with legal standards, which may include electronic signature laws. Understanding the legal framework surrounding this form can help prevent issues related to its acceptance.

Key elements of the Form 3372 Rev 11 09

Several key elements are integral to the Form 3372 Rev 11 09. These include:

- Identification Information: Personal or business details that identify the applicant.

- Purpose of the Form: A clear statement of the reason for submitting the form.

- Signature Section: Where the applicant must sign, indicating acknowledgment and agreement.

- Supporting Documentation: Any additional files or forms that must accompany the submission.

Form Submission Methods (Online / Mail / In-Person)

The Form 3372 Rev 11 09 can typically be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online Submission: Many agencies allow for electronic submission through their websites.

- Mail: Physical copies can be sent via postal service to the designated address.

- In-Person: Some forms may require or allow for direct submission at specific offices.

Quick guide on how to complete form 3372 rev 11 09 16963247

Complete Form 3372 Rev 11 09 seamlessly on any device

Managing documents online has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it on the internet. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 3372 Rev 11 09 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and electronically sign Form 3372 Rev 11 09 effortlessly

- Obtain Form 3372 Rev 11 09 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 3372 Rev 11 09 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3372 rev 11 09 16963247

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3372 rev 11 09 used for?

The form 3372 rev 11 09 is primarily used for importation purposes within the shipping and logistics sector. It helps businesses to accurately declare imports and ensure compliance with regulations. By utilizing this form, companies can streamline their import processes and reduce potential delays.

-

How does airSlate SignNow simplify the process of filling out the form 3372 rev 11 09?

airSlate SignNow offers an intuitive platform that makes filling out the form 3372 rev 11 09 straightforward and efficient. Users can easily input their information, save templates, and access the form from any device. This flexibility ensures that businesses can manage their documentation quickly and effectively.

-

Are there any costs associated with using the form 3372 rev 11 09 through airSlate SignNow?

Yes, airSlate SignNow provides a range of pricing plans that cater to different business needs when using the form 3372 rev 11 09. The pricing is competitive, and you'll find features that ensure you get the most value for your investment. For a detailed breakdown, you can visit our pricing page.

-

What features does airSlate SignNow offer for the form 3372 rev 11 09?

airSlate SignNow includes several features that enhance the usability of the form 3372 rev 11 09, such as templates, electronic signatures, and cloud storage. Furthermore, users can track document status in real-time and set up reminders, making the overall experience more efficient and user-friendly.

-

Can I integrate airSlate SignNow with other applications while using the form 3372 rev 11 09?

Absolutely! AirSlate SignNow offers seamless integrations with popular business applications, allowing you to enhance the workflow of managing the form 3372 rev 11 09. This includes integrations with CRM systems, cloud storage solutions, and collaboration tools to keep all your documents organized.

-

What are the benefits of using airSlate SignNow for the form 3372 rev 11 09?

Using airSlate SignNow for the form 3372 rev 11 09 allows businesses to save time and reduce errors associated with manual documentation processes. The platform provides enhanced security features to protect sensitive information, while also ensuring that all your documents are easily accessible and manageable.

-

Is the form 3372 rev 11 09 compliant with industry regulations when using airSlate SignNow?

Yes, the form 3372 rev 11 09 is compliant with industry regulations when processed through airSlate SignNow. The platform adheres to legal standards for electronic signatures, ensuring that your documents maintain their integrity and are legally binding. This compliance gives users peace of mind while handling their documentation.

Get more for Form 3372 Rev 11 09

- Angle pair relationships form

- Getting things done flowchart pdf 100283233 form

- Maryland new hire form

- School withdrawal form sample

- Proof of aboriginality form qld

- Bbq cook off competition registration form

- Florida auto insurance card template 101075546 form

- International driving permit template form

Find out other Form 3372 Rev 11 09

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template