Living Trust for Husband and Wife with No Children Minnesota Form

What is the Living Trust For Husband And Wife With No Children Minnesota

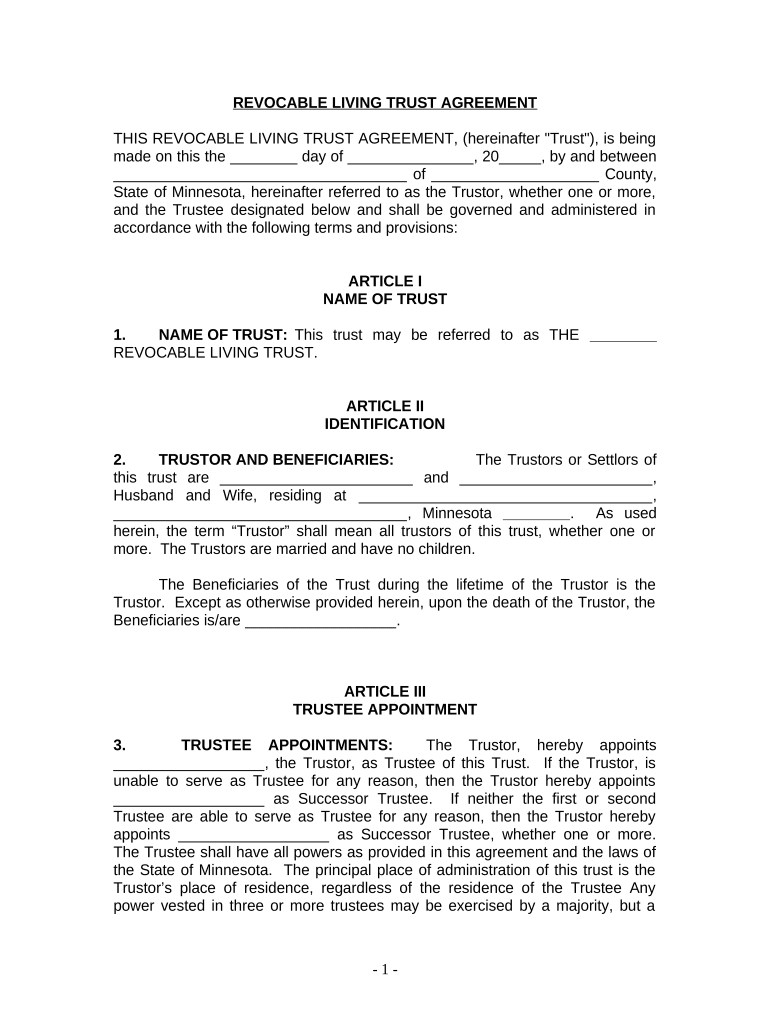

A living trust for husband and wife with no children in Minnesota is a legal arrangement that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This type of trust is particularly beneficial for couples without children, as it provides a straightforward method for asset management and can help avoid probate. The trust remains flexible, allowing the couple to make changes as needed while they are alive. Upon the death of one spouse, the surviving spouse typically retains control over the trust assets.

How to Use the Living Trust For Husband And Wife With No Children Minnesota

Using a living trust involves several key steps. First, couples should gather all relevant financial information, including property titles, bank accounts, and investment details. Next, they can create the trust document, which outlines the terms of the trust, including the designation of a trustee and beneficiaries. Once the document is drafted, it must be signed and notarized to ensure its legal validity. Finally, transferring assets into the trust is essential, as this step ensures that the trust can manage these assets according to the couple's wishes.

Steps to Complete the Living Trust For Husband And Wife With No Children Minnesota

Completing a living trust involves the following steps:

- Gather financial documents and information about assets.

- Draft the living trust document, specifying terms and conditions.

- Sign the document in the presence of a notary public.

- Transfer ownership of assets into the trust, ensuring all titles and deeds reflect the trust's name.

- Review and update the trust periodically to reflect any changes in circumstances or wishes.

Key Elements of the Living Trust For Husband And Wife With No Children Minnesota

Key elements of this living trust include the identification of the grantors (the couple), the trustee (who manages the trust), and the beneficiaries (who receive the assets). The trust document should specify how assets are to be managed during the couple's lifetime and distributed after their passing. It is also important to include provisions for incapacity, detailing how decisions will be made if one spouse is unable to manage the trust. Additionally, the trust should comply with Minnesota state laws to ensure its enforceability.

State-Specific Rules for the Living Trust For Husband And Wife With No Children Minnesota

In Minnesota, living trusts must adhere to specific state laws to be valid. The trust document must be signed by both spouses and notarized. Minnesota law also allows for the revocation or amendment of the trust at any time while both spouses are alive. It is crucial to ensure that the trust is properly funded by transferring assets into it, as failure to do so may lead to unintended consequences regarding asset distribution. Consulting with a legal professional familiar with Minnesota estate law can help ensure compliance.

Legal Use of the Living Trust For Husband And Wife With No Children Minnesota

The legal use of a living trust in Minnesota provides couples with a mechanism to manage their assets and plan for the future. It allows for the seamless transfer of assets upon death, avoiding the lengthy and often costly probate process. The trust can also provide privacy, as it does not become part of the public record like a will. Furthermore, it can help in managing assets in case of incapacity, ensuring that decisions regarding the couple's finances are made according to their wishes.

Quick guide on how to complete living trust for husband and wife with no children minnesota

Prepare Living Trust For Husband And Wife With No Children Minnesota effortlessly on any device

Web-based document management has become favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents rapidly without wait times. Manage Living Trust For Husband And Wife With No Children Minnesota on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Living Trust For Husband And Wife With No Children Minnesota with ease

- Find Living Trust For Husband And Wife With No Children Minnesota and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any preferred device. Modify and eSign Living Trust For Husband And Wife With No Children Minnesota and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in Minnesota?

A Living Trust For Husband And Wife With No Children in Minnesota is a legal document that allows spouses to manage their assets collectively while avoiding probate. This trust provides a straightforward way for couples to pass their assets on to their chosen beneficiaries without the complications that come with traditional wills.

-

How much does it cost to set up a Living Trust For Husband And Wife With No Children in Minnesota?

The cost of establishing a Living Trust For Husband And Wife With No Children in Minnesota can vary signNowly based on factors such as attorney fees and the complexity of the trust. Typically, you can expect to pay between $1,000 to $3,000 for professional assistance, but online services may offer more cost-effective solutions.

-

What are the benefits of creating a Living Trust For Husband And Wife With No Children in Minnesota?

Creating a Living Trust For Husband And Wife With No Children in Minnesota offers several key benefits, including avoiding probate, maintaining privacy, and providing a clear outline for asset distribution. Additionally, it prevents potential family disputes and allows for easier management of assets during incapacity.

-

Can I modify or revoke my Living Trust For Husband And Wife With No Children in Minnesota?

Yes, one of the main advantages of a Living Trust For Husband And Wife With No Children in Minnesota is that it can be modified or revoked at any time during the couple's lifetime. This flexibility allows you to adapt the trust to changing circumstances or preferences.

-

How does a Living Trust For Husband And Wife With No Children in Minnesota compare to a will?

A Living Trust For Husband And Wife With No Children in Minnesota typically avoids the probate process, which can save time and legal costs compared to a will. While a will becomes effective only after death, a living trust can be utilized during your lifetime, providing immediate management of assets.

-

Is it necessary to have an attorney to create a Living Trust For Husband And Wife With No Children in Minnesota?

While it is not legally required to have an attorney, it is highly recommended, as creating a Living Trust For Husband And Wife With No Children in Minnesota involves complex legal language and requirements. An experienced attorney can help ensure that your trust is valid and meets your specific needs.

-

What assets can be included in a Living Trust For Husband And Wife With No Children in Minnesota?

A Living Trust For Husband And Wife With No Children in Minnesota can include a wide range of assets, including real estate, bank accounts, investments, and personal property. Almost any asset that you own can be transferred into the trust, providing unified management and smoother distribution upon death.

Get more for Living Trust For Husband And Wife With No Children Minnesota

- Affidavit of non military service form

- Transcript request forms redan high school

- Provider adverse incident reporting form magellan provideramp39s

- Funeral cost budget sheet form

- Link market services direct credit form

- Bof 4542a 73996381 form

- Www utrgv educhemistryfilesverified department of chemistry pre registration form for

- The adoption birth certificate what you need to know form

Find out other Living Trust For Husband And Wife With No Children Minnesota

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later