Living Trust for Husband and Wife with One Child Minnesota Form

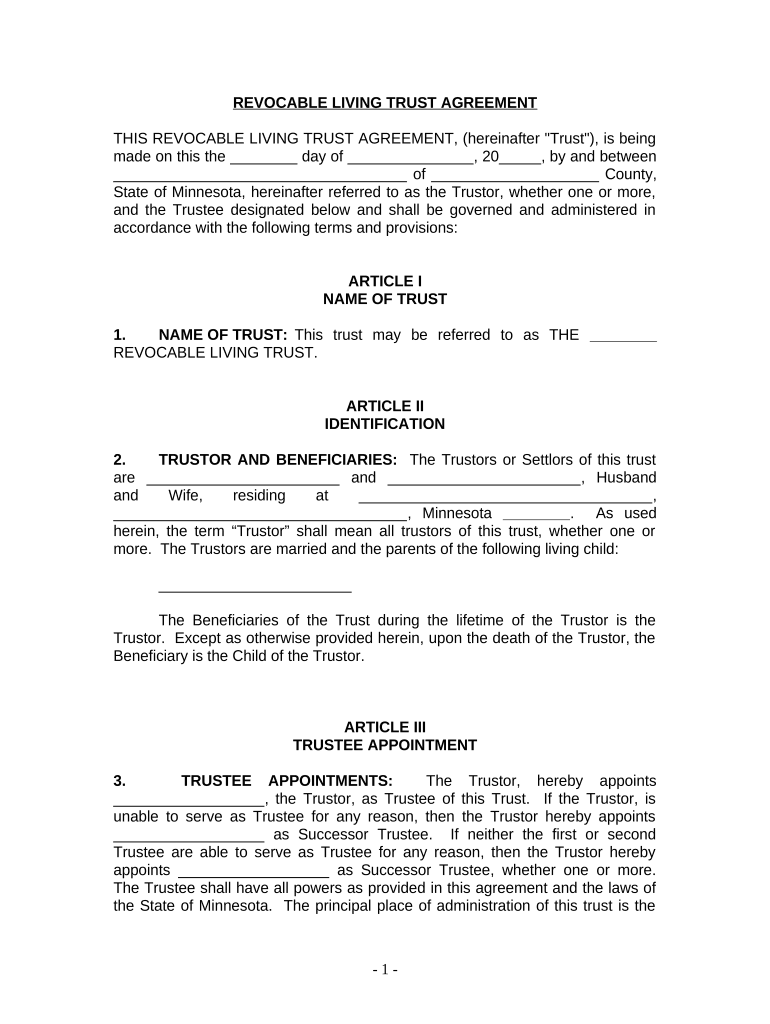

What is the Living Trust for Husband and Wife with One Child in Minnesota

A living trust for husband and wife with one child in Minnesota is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust can help avoid probate, ensuring a smoother transition of assets to the surviving spouse and child. It provides flexibility in managing assets and can be altered or revoked as needed while both spouses are alive. In Minnesota, this trust is particularly beneficial for couples seeking to secure their child's inheritance while simplifying the estate management process.

How to Use the Living Trust for Husband and Wife with One Child in Minnesota

Using a living trust involves several steps to ensure it meets legal requirements and serves its intended purpose. First, both spouses need to gather information about their assets, including real estate, bank accounts, and investments. Next, they must decide how to title the trust and appoint a trustee, which can be either one of the spouses or a third party. Once the trust document is drafted, it should be signed in accordance with Minnesota law, which may require witnesses or notarization. Finally, assets should be transferred into the trust to ensure they are managed according to the trust's terms.

Key Elements of the Living Trust for Husband and Wife with One Child in Minnesota

Several key elements define a living trust for husband and wife with one child in Minnesota. These include:

- Trustees: The individuals responsible for managing the trust assets, typically the spouses themselves.

- Beneficiaries: The individuals or entities that will receive the trust assets, usually the surviving spouse and child.

- Asset Management: Guidelines on how assets are to be managed during the couple's lifetime and distributed after their passing.

- Revocation Clause: A provision allowing the trust to be altered or revoked as circumstances change.

Steps to Complete the Living Trust for Husband and Wife with One Child in Minnesota

Completing a living trust involves a systematic approach. The steps include:

- Gather all necessary financial information and asset documentation.

- Consult with a legal professional to draft the trust document, ensuring it complies with Minnesota laws.

- Review and sign the trust document, ensuring all legal formalities are observed.

- Transfer ownership of assets into the trust, updating titles and accounts as needed.

- Store the trust document in a safe place and inform relevant parties of its existence.

State-Specific Rules for the Living Trust for Husband and Wife with One Child in Minnesota

In Minnesota, specific rules govern the creation and execution of living trusts. These include the requirement for the trust document to be in writing, the necessity of having the trust signed by the grantors, and the potential need for notarization or witnesses. Additionally, Minnesota law allows for the creation of joint trusts for married couples, which can simplify the management of shared assets. It is essential to comply with state laws to ensure the trust is valid and enforceable.

Legal Use of the Living Trust for Husband and Wife with One Child in Minnesota

The legal use of a living trust in Minnesota allows couples to manage their estate effectively. It serves to avoid probate, ensuring that assets are transferred directly to beneficiaries without court intervention. This trust can also provide specific instructions regarding asset distribution, including conditions that must be met for the child to inherit. Furthermore, it can protect assets from creditors and ensure privacy, as trust documents are not public records like wills.

Quick guide on how to complete living trust for husband and wife with one child minnesota

Effortlessly Complete Living Trust For Husband And Wife With One Child Minnesota on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle Living Trust For Husband And Wife With One Child Minnesota on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Living Trust For Husband And Wife With One Child Minnesota with Ease

- Find Living Trust For Husband And Wife With One Child Minnesota and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and eSign Living Trust For Husband And Wife With One Child Minnesota and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with One Child in Minnesota?

A Living Trust for Husband and Wife with One Child in Minnesota is a legal document that allows couples to manage and distribute their assets during their lifetime and after death. This type of trust ensures that both partners' wishes are honored, simplifying the estate planning process for families with one child.

-

What are the benefits of creating a Living Trust for Husband and Wife with One Child in Minnesota?

Creating a Living Trust for Husband and Wife with One Child in Minnesota offers numerous benefits, including avoiding probate, providing privacy, and minimizing estate taxes. Additionally, it ensures that your child is taken care of according to your specific wishes, making it an essential tool for family estate planning.

-

How much does it cost to set up a Living Trust for Husband and Wife with One Child in Minnesota?

The cost to establish a Living Trust for Husband and Wife with One Child in Minnesota can vary depending on the complexity of your assets and the legal fees involved. However, many find it to be a worthwhile investment to protect their family's future. Using airSlate SignNow, you can create a Living Trust efficiently and affordably.

-

Can I customize my Living Trust for Husband and Wife with One Child in Minnesota?

Yes, a Living Trust for Husband and Wife with One Child in Minnesota can be tailored to fit your unique needs. You can specify how assets should be managed and distributed, ensuring that both partners' preferences are accounted for. With airSlate SignNow, you can easily make these customizations online.

-

What happens to a Living Trust for Husband and Wife with One Child in Minnesota after one spouse passes away?

When one spouse passes away, the Living Trust for Husband and Wife with One Child in Minnesota remains in effect and continues to manage the assets according to the trust's terms. This arrangement helps in the seamless transfer of assets to the surviving spouse and ultimately to your child. It alleviates the stress and complications of probate.

-

How do I update my Living Trust for Husband and Wife with One Child in Minnesota?

Updating your Living Trust for Husband and Wife with One Child in Minnesota is simple and can be done at any time. You need to amend the trust document to reflect any changes in your assets or family circumstances. airSlate SignNow provides an easy-to-use platform for making these updates securely online.

-

Is a Living Trust for Husband and Wife with One Child in Minnesota revocable?

Yes, most Living Trusts for Husband and Wife with One Child in Minnesota are revocable, meaning you can alter or revoke them at any point during your lifetime. This flexibility allows you to adapt to changes in your financial situation or family dynamics while ensuring your child's future is protected.

Get more for Living Trust For Husband And Wife With One Child Minnesota

Find out other Living Trust For Husband And Wife With One Child Minnesota

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online