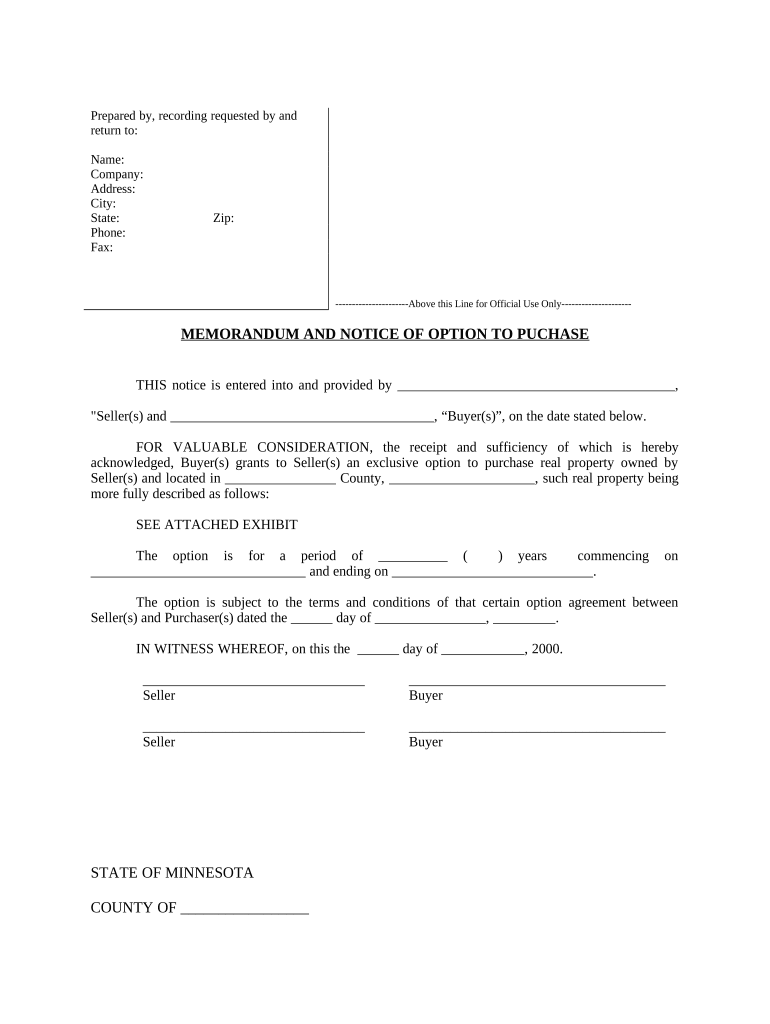

Minnesota Option Form

What is the Minnesota Option

The Minnesota Option is a specific provision that allows certain individuals to choose an alternative method for filing their taxes in Minnesota. It is designed to simplify the tax process for eligible taxpayers, particularly those who may not meet the standard filing requirements. This option can be beneficial for individuals who have unique financial situations or specific income types that warrant a different approach to tax reporting.

How to use the Minnesota Option

To utilize the Minnesota Option, taxpayers must first determine their eligibility based on income levels and other criteria set by the state. Once eligibility is confirmed, individuals can select this option when completing their tax forms. It is essential to follow the specific guidelines provided by the Minnesota Department of Revenue to ensure compliance and accuracy in reporting income and deductions.

Steps to complete the Minnesota Option

Completing the Minnesota Option involves several key steps:

- Review eligibility criteria to ensure you qualify for the Minnesota Option.

- Gather all necessary financial documents, including income statements and previous tax returns.

- Fill out the appropriate tax forms, ensuring you select the Minnesota Option where indicated.

- Double-check all entries for accuracy and completeness.

- Submit your completed forms by the designated deadline, either online or via mail.

Legal use of the Minnesota Option

The Minnesota Option is legally recognized and must be used according to the regulations set forth by the Minnesota Department of Revenue. This includes adhering to specific filing deadlines and ensuring that all reported income is accurate. Failure to comply with these regulations may result in penalties or additional scrutiny from tax authorities.

Key elements of the Minnesota Option

Several key elements define the Minnesota Option:

- Eligibility requirements based on income and filing status.

- Specific forms that must be completed to utilize this option.

- Deadlines for submission to avoid penalties.

- Compliance with state tax laws and regulations.

Examples of using the Minnesota Option

Examples of situations where the Minnesota Option may be beneficial include:

- Self-employed individuals who have fluctuating income throughout the year.

- Taxpayers with significant deductions that may not fit standard filing methods.

- Individuals who receive income from multiple sources that complicate traditional tax reporting.

Quick guide on how to complete minnesota option

Effortlessly Prepare Minnesota Option on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Minnesota Option on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Minnesota Option with Ease

- Obtain Minnesota Option and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Sai goodbye to missing or disorganized files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Minnesota Option to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Minnesota option for electronic signatures?

The Minnesota option refers to specific legal provisions that allow the use of electronic signatures for contracts and agreements in Minnesota. Using airSlate SignNow, you can easily comply with these regulations while benefiting from a user-friendly interface and secure eSigning capabilities. This feature simplifies document handling for businesses that operate in the state.

-

How does airSlate SignNow support the Minnesota option?

airSlate SignNow is designed to meet the requirements of the Minnesota option by providing legally binding electronic signatures that comply with state laws. This ensures that all eSigned documents are valid and enforceable in Minnesota. With its advanced features, airSlate SignNow enhances the efficiency of obtaining signatures while adhering to legal standards.

-

What are the pricing options available for the Minnesota option with airSlate SignNow?

airSlate SignNow offers several pricing tiers to accommodate various business needs, all of which support the Minnesota option for electronic signatures. Whether you're a small business or a large enterprise, you can find a plan that fits your budget. Our cost-effective solutions make it easy to leverage the benefits of eSigning in accordance with Minnesota law.

-

What features are included with the Minnesota option on airSlate SignNow?

The Minnesota option on airSlate SignNow includes features like customizable templates, real-time tracking, and secure document storage. Additionally, users can obtain signatures quickly and efficiently while ensuring compliance with Minnesota laws. These features enhance the overall signing experience, making it simple for businesses to manage their documents.

-

Can I integrate airSlate SignNow with other software while using the Minnesota option?

Yes, airSlate SignNow supports a variety of integrations that work seamlessly with the Minnesota option. You can connect it with numerous applications such as CRM, project management tools, and more. This flexibility allows you to streamline your workflow while managing eSigning processes in compliance with Minnesota regulations.

-

What benefits does airSlate SignNow provide for businesses in Minnesota?

For businesses in Minnesota, airSlate SignNow provides the benefit of fast and legally compliant electronic signatures under the Minnesota option. This saves time and reduces administrative burdens by eliminating paper-based processes. Moreover, the platform's security features ensure that your documents remain protected, fostering trust among clients and stakeholders.

-

Is airSlate SignNow suitable for all types of businesses in Minnesota?

Absolutely! airSlate SignNow is versatile and can be used by a wide range of businesses in Minnesota, from startups to established enterprises. The platform's features cater to various industries, ensuring that all types of organizations can efficiently manage their eSigning needs under the Minnesota option. Its ease of use makes it accessible for all team members.

Get more for Minnesota Option

- Model cerere inscriere politie completata form

- Tpri student summary sheet form

- Laptop checkout form 367911859

- Schedule z additional information required for net nstar

- Petition for an incomplete columbus college of art and design ccad form

- Parenting plan co parenting agreement template form

- Parenting plan custody agreement template form

- Import contract template form

Find out other Minnesota Option

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online