Chapter 13 Form Missouri

What is the Chapter 13 Form Missouri

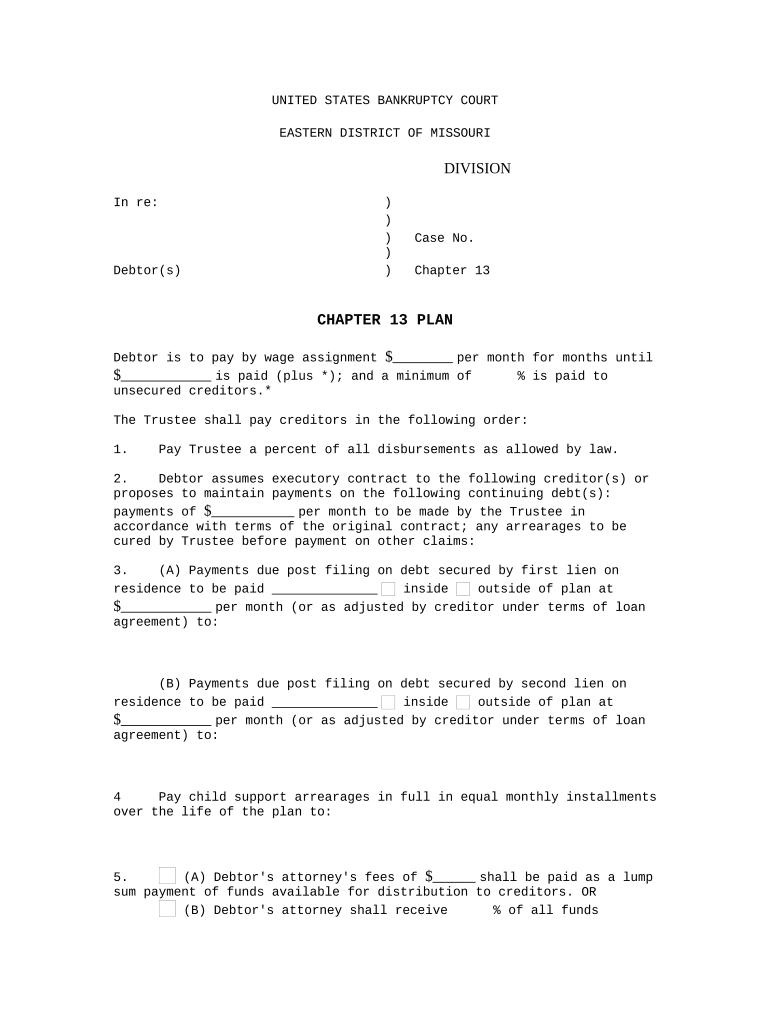

The Chapter 13 form Missouri is a legal document used in the bankruptcy process, specifically for individuals seeking to reorganize their debts under Chapter 13 of the U.S. Bankruptcy Code. This form allows debtors to propose a repayment plan to make installments to creditors over a specified period, typically three to five years. The goal of this form is to provide a structured way for individuals to manage their debts while retaining their assets and avoiding foreclosure or repossession.

How to use the Chapter 13 Form Missouri

To effectively use the Chapter 13 form Missouri, individuals must first gather all necessary financial information, including income, expenses, and debts. Once this information is compiled, the form can be filled out to reflect the proposed repayment plan. It's essential to ensure that the plan meets the requirements set forth by the bankruptcy court, including feasibility and fairness to creditors. After completing the form, it must be submitted to the appropriate bankruptcy court for approval.

Steps to complete the Chapter 13 Form Missouri

Completing the Chapter 13 form Missouri involves several key steps:

- Gather financial documents, including pay stubs, tax returns, and a list of debts.

- Fill out the form accurately, providing detailed information about income, expenses, and debts.

- Draft a repayment plan that outlines how debts will be repaid over the proposed period.

- Review the completed form for accuracy and completeness.

- File the form with the bankruptcy court and pay any required filing fees.

Legal use of the Chapter 13 Form Missouri

The legal use of the Chapter 13 form Missouri is governed by federal bankruptcy laws and local court rules. This form must be completed and submitted in compliance with these regulations to ensure its validity. Proper use of the form allows individuals to initiate the bankruptcy process legally, protecting them from creditor actions while their repayment plan is considered by the court.

Eligibility Criteria

To be eligible to file using the Chapter 13 form Missouri, individuals must meet specific criteria, including:

- Having a regular income to support the repayment plan.

- Unsecured debts must be less than a specified limit, which is subject to change.

- Secured debts must also fall within certain thresholds.

- Individuals must not have had a bankruptcy case dismissed within the previous 180 days due to failure to comply with court orders.

Form Submission Methods

The Chapter 13 form Missouri can be submitted through various methods, including:

- Online submission through the bankruptcy court's electronic filing system.

- Mailing the completed form to the appropriate bankruptcy court.

- In-person submission at the court clerk's office.

Quick guide on how to complete chapter 13 form missouri

Complete Chapter 13 Form Missouri effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools you need to generate, modify, and eSign your files swiftly without delays. Manage Chapter 13 Form Missouri on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to adjust and eSign Chapter 13 Form Missouri effortlessly

- Find Chapter 13 Form Missouri and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign Chapter 13 Form Missouri and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the chapter 13 form Missouri?

The chapter 13 form Missouri is a legal document used in Missouri for individuals seeking to file for Chapter 13 bankruptcy protection. This form outlines a repayment plan for debtors and requires detailed financial information. Using airSlate SignNow, you can easily access, complete, and eSign the chapter 13 form Missouri online.

-

How do I fill out the chapter 13 form Missouri?

To fill out the chapter 13 form Missouri, you need to gather your financial documents, including income statements, debts, and assets. With airSlate SignNow, you can utilize templates designed for ease of use, allowing for efficient data entry and submission. This simplifies the process of completing the chapter 13 form Missouri and speeds up your filing.

-

Is there a fee for the chapter 13 form Missouri?

Yes, there are fees associated with filing the chapter 13 form Missouri, including court filing fees. However, airSlate SignNow offers an affordable solution that can save you time and money when preparing your documents. By using our platform, you minimize the costs associated with traditional document preparation.

-

What are the benefits of using airSlate SignNow for the chapter 13 form Missouri?

Using airSlate SignNow for the chapter 13 form Missouri streamlines the filing process with eSigning and easy document management. Our platform offers a secure environment to ensure your information is protected. Additionally, it saves you time compared to manual completion and delivers immediate access to your saved documents.

-

Can I integrate airSlate SignNow with other tools for the chapter 13 form Missouri?

Absolutely! airSlate SignNow seamlessly integrates with various applications, making it easier for you to manage your workflow. You can connect it with platforms like Google Drive and Dropbox to retrieve your chapter 13 form Missouri, or incorporate it into your existing systems for an enhanced experience.

-

How long does it take to process the chapter 13 form Missouri?

The processing time for the chapter 13 form Missouri varies depending on the court's workload, but using airSlate SignNow can signNowly accelerate your submission. Once you have completed and eSigned the document, you can submit it directly through our platform. This expedites the process and keeps you informed every step of the way.

-

What if I make a mistake on my chapter 13 form Missouri?

If you make a mistake on your chapter 13 form Missouri, airSlate SignNow allows you to easily edit and update your document before final submission. Our user-friendly interface simplifies corrections, and you can quickly make changes without starting over. This ensures that your chapter 13 form Missouri is accurate and complete before filing.

Get more for Chapter 13 Form Missouri

- My weekly meal planner green child magazine form

- Chesapeake dog license form

- Occupational and physical therapy service needs checklist form

- Cal oes name request justification gacc nifc form

- Dbs amendment form

- Pam 10 00 pa army reserve force development manual form

- Purchase money security agreement template form

- Home renovation contract template form

Find out other Chapter 13 Form Missouri

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online