Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Aka Land Contr Form

What is the Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Aka Land Contract Mississippi

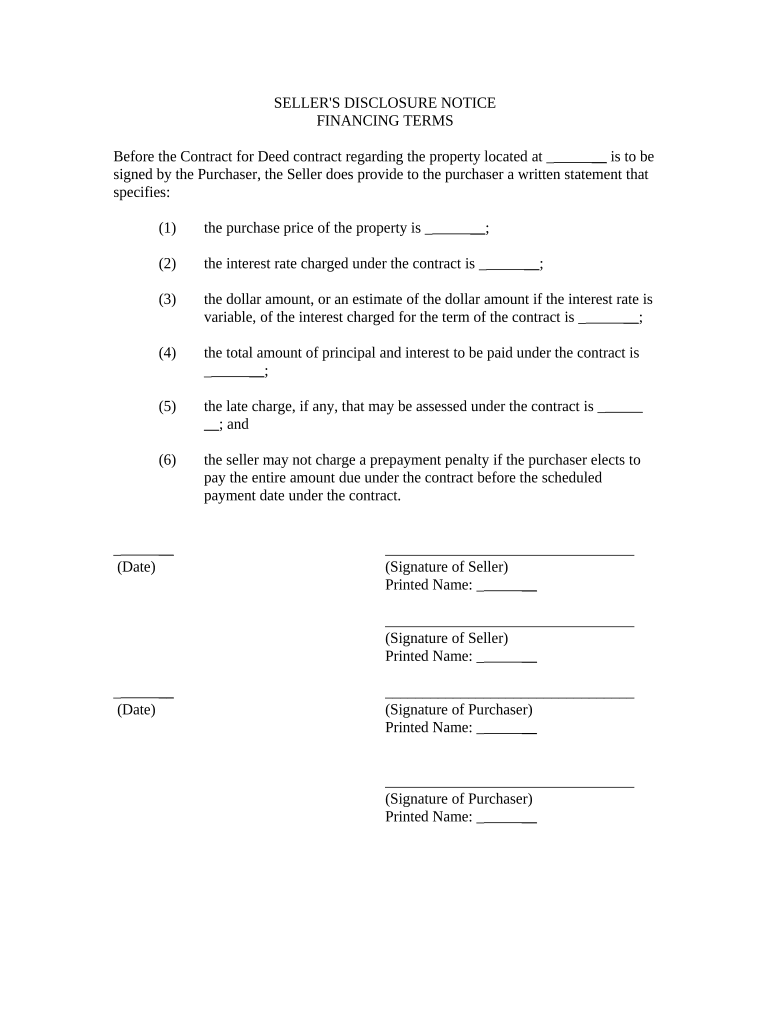

The Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed, commonly referred to as a land contract in Mississippi, is a legal document that outlines the financing terms agreed upon between the seller and the buyer. This document is crucial in real estate transactions, particularly in seller financing scenarios, where the seller provides financing to the buyer instead of a traditional mortgage. It includes essential information such as the purchase price, down payment, interest rate, payment schedule, and any other terms pertinent to the agreement. Understanding this disclosure is vital for both parties to ensure clarity and prevent future disputes.

Steps to Complete the Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Aka Land Contract Mississippi

Completing the Seller's Disclosure of Financing Terms involves several steps to ensure accuracy and compliance with Mississippi laws. First, gather all relevant property information, including legal descriptions and any existing liens. Next, outline the financing terms clearly, specifying the total purchase price, down payment amount, interest rate, and payment schedule. It is also important to include any contingencies or special conditions that may apply. After drafting the document, both parties should review it thoroughly to confirm that all terms are understood and agreed upon. Finally, both the seller and buyer must sign the document, ideally in the presence of a notary, to ensure its legal validity.

Key Elements of the Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Aka Land Contract Mississippi

Several key elements must be included in the Seller's Disclosure of Financing Terms to ensure it serves its purpose effectively. These elements include:

- Purchase Price: The total amount the buyer agrees to pay for the property.

- Down Payment: The initial amount paid upfront by the buyer.

- Interest Rate: The rate at which interest will accrue on the unpaid balance.

- Payment Schedule: Details on how often payments are due and the duration of the loan.

- Late Fees: Any penalties for late payments should be clearly stated.

- Default Terms: Conditions under which the seller may take action if the buyer defaults on the agreement.

Legal Use of the Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Aka Land Contract Mississippi

The legal use of the Seller's Disclosure of Financing Terms is paramount in protecting both parties involved in the transaction. This document must comply with Mississippi state laws regarding real estate transactions and financing agreements. It serves as a binding contract once signed, meaning both the seller and buyer are legally obligated to adhere to the terms outlined within it. To ensure enforceability, it is advisable to consult with a legal professional familiar with real estate law in Mississippi. This can help clarify any obligations and rights under the agreement and ensure that the document meets all necessary legal standards.

How to Obtain the Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Aka Land Contract Mississippi

Obtaining the Seller's Disclosure of Financing Terms can be done through various means. Many real estate professionals, including agents and brokers, can provide templates or examples of this document. Additionally, legal resources and real estate websites may offer downloadable forms that comply with Mississippi regulations. It is important to ensure that any form used is up-to-date and reflects current laws. Once acquired, the form should be customized to fit the specific transaction details between the seller and buyer.

State-Specific Rules for the Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Aka Land Contract Mississippi

In Mississippi, specific rules govern the Seller's Disclosure of Financing Terms. These rules include the requirement that all financing terms be clearly stated and understood by both parties. Additionally, sellers must disclose any known defects or issues with the property that could affect its value or the buyer's decision. Failure to comply with these regulations can lead to legal repercussions, including potential lawsuits for misrepresentation. It is essential for both sellers and buyers to be aware of these state-specific rules to ensure a smooth transaction.

Quick guide on how to complete sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497313590

Effortlessly Prepare Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr with Ease

- Obtain Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr and click Get Form to begin.

- Employ the tools we provide to fill in your form.

- Emphasize relevant sections of your documents or conceal sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal value as a traditional wet ink signature.

- Review all the details and click on the Done button to save your alterations.

- Choose your preferred method to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Edit and eSign Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Seller's Disclosure Of Financing Terms For Residential Property in Mississippi?

A Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract Mississippi is a legal document that outlines the financing details involved in a property transaction. This document ensures transparency between the seller and buyer regarding the sale of residential property under a land contract, including payment terms and interest rates.

-

Why is the Seller's Disclosure Important for Buyers?

The Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract Mississippi is crucial for buyers as it protects their interests. It provides essential information about the financing aspects of the sale, allowing buyers to make informed decisions and avoid potential issues later in the transaction.

-

How does airSlate SignNow assist in creating a Seller's Disclosure?

airSlate SignNow simplifies the creation of a Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract Mississippi by providing easy-to-use templates. Our platform allows users to customize disclosures quickly, ensuring compliance with local regulations while saving time in document preparation.

-

What are the benefits of using airSlate SignNow for document eSigning?

Using airSlate SignNow for eSigning the Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract Mississippi offers numerous benefits. It is cost-effective, enhances the efficiency of document management, ensures security, and allows for easy tracking of signed agreements, streamlining the closing process.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow seamlessly integrates with various business applications, making it easier to manage your real estate transactions. Whether you use CRM systems, document storage solutions, or other tools, our platform supports these integrations to help you manage the Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract Mississippi efficiently.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of different users, whether you are a small business or a large organization. Each plan provides access to essential features for managing documents, including the Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract Mississippi, making it a cost-effective solution for any real estate business.

-

How secure is the data when using airSlate SignNow?

Data security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your documents, including the Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract Mississippi. You can trust that your sensitive information remains confidential throughout the eSigning process.

Get more for Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr

- Sample contingent fee agreement tennessee bar association tba form

- Nj division of taxation form

- Forsyth county environmental health department form

- Britcay claim form pdf international medical group

- Designer agreement template form

- Developer agreement template form

- Development agreement template form

- Hair brand ambassador contract template form

Find out other Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document