Nj Division of Taxation Form

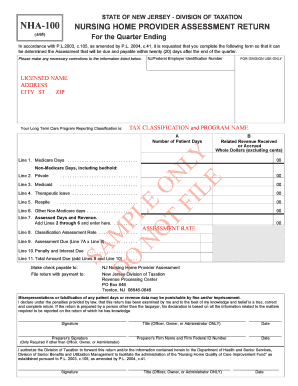

What is the Nj Division Of Taxation Form

The Nj Division Of Taxation Form is an essential document used for various tax-related purposes within the state of New Jersey. This form can encompass several types of tax filings, including income tax returns, business tax registrations, and other financial disclosures required by the New Jersey Division of Taxation. Understanding the specific purpose of the form you are filling out is crucial for compliance with state tax laws.

How to obtain the Nj Division Of Taxation Form

Obtaining the Nj Division Of Taxation Form is straightforward. You can access the form directly from the New Jersey Division of Taxation's official website. The site provides downloadable versions of the forms in PDF format, which can be printed and filled out manually. Alternatively, you can request a physical copy by contacting the Division of Taxation through their customer service channels.

Steps to complete the Nj Division Of Taxation Form

Completing the Nj Division Of Taxation Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, such as income statements, identification numbers, and any previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. Pay attention to any specific instructions provided with the form, as these may vary based on the type of tax being reported. Finally, review the completed form for errors before submitting it.

Legal use of the Nj Division Of Taxation Form

The legal use of the Nj Division Of Taxation Form is governed by state tax laws and regulations. To be considered valid, the form must be completed accurately and submitted by the required deadlines. Additionally, electronic submissions are allowed, provided that they comply with the state’s eSignature laws. Utilizing a secure platform for digital submission can enhance the legal standing of your completed form.

Form Submission Methods (Online / Mail / In-Person)

The Nj Division Of Taxation Form can be submitted through various methods, depending on your preference and the specific requirements of the form. You may choose to submit it online through the New Jersey Division of Taxation's e-filing system, which offers a quick and efficient way to file. Alternatively, you can mail the completed form to the designated address provided on the form itself. In-person submissions may also be possible at local tax offices, allowing for direct assistance if needed.

Required Documents

When filling out the Nj Division Of Taxation Form, certain documents are typically required to support your submission. These may include proof of income, identification numbers (such as Social Security or Employer Identification Numbers), and any relevant tax documents from previous years. Ensuring that you have all necessary documentation ready will facilitate a smoother filing process and help avoid delays.

Quick guide on how to complete nj division of taxation form

Easily Prepare Nj Division Of Taxation Form on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow offers all the tools required to swiftly create, edit, and eSign your documents without any delays. Manage Nj Division Of Taxation Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

Effortlessly Edit and eSign Nj Division Of Taxation Form

- Locate Nj Division Of Taxation Form and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Select important sections of your documents or conceal sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign Nj Division Of Taxation Form and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj division of taxation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nj Division Of Taxation Form and how can airSlate SignNow help?

The Nj Division Of Taxation Form is a legal document required for tax-related purposes in New Jersey. airSlate SignNow simplifies the process of completing and signing this form by providing an intuitive platform that streamlines document management, making it easy for users to eSign and send the Nj Division Of Taxation Form securely and efficiently.

-

Is there a cost to use airSlate SignNow for the Nj Division Of Taxation Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Users can choose a plan that fits their budget while enjoying all the features needed to efficiently manage the Nj Division Of Taxation Form, ensuring value for their investment.

-

Can I integrate airSlate SignNow with other software for handling the Nj Division Of Taxation Form?

Absolutely! airSlate SignNow provides integration capabilities with several popular applications, allowing users to streamline their workflow when handling the Nj Division Of Taxation Form. This integration makes it easier to send, receive, and manage tax forms directly from their preferred software environment.

-

How secure is airSlate SignNow when eSigning the Nj Division Of Taxation Form?

Security is a top priority at airSlate SignNow. When eSigning the Nj Division Of Taxation Form, users benefit from advanced encryption and compliance with industry standards, ensuring that all sensitive information remains protected throughout the signing process.

-

What features does airSlate SignNow offer for managing the Nj Division Of Taxation Form?

airSlate SignNow offers features like customizable templates, automated reminders, and real-time tracking for the Nj Division Of Taxation Form. These tools help facilitate a smoother signing experience and allow users to manage their documents efficiently.

-

Can multiple parties sign the Nj Division Of Taxation Form using airSlate SignNow?

Yes, airSlate SignNow allows multiple parties to eSign the Nj Division Of Taxation Form seamlessly. This collaborative feature ensures that all necessary signatures are collected in a timely manner, making the document handling process more efficient.

-

How do I access the Nj Division Of Taxation Form templates in airSlate SignNow?

To access Nj Division Of Taxation Form templates in airSlate SignNow, simply log in to your account and navigate to the template library. You can easily find and customize templates to meet your specific requirements for the Nj Division Of Taxation Form.

Get more for Nj Division Of Taxation Form

- Care facility to emergency department transfer form

- Fidelity co executor affidavit and indemnification form

- Maryland gift deed one individual to two individuals as joint tenants form

- Lg220a exempt permit financial reporting form

- Po box 14326 reading pa 19612 form

- Influenza vaccination consent form for insurance claims

- Certificate of attendance erasmus template form

- Application for bodily injury benefits form

Find out other Nj Division Of Taxation Form

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form