Mississippi Lien Form

What is the Mississippi Lien

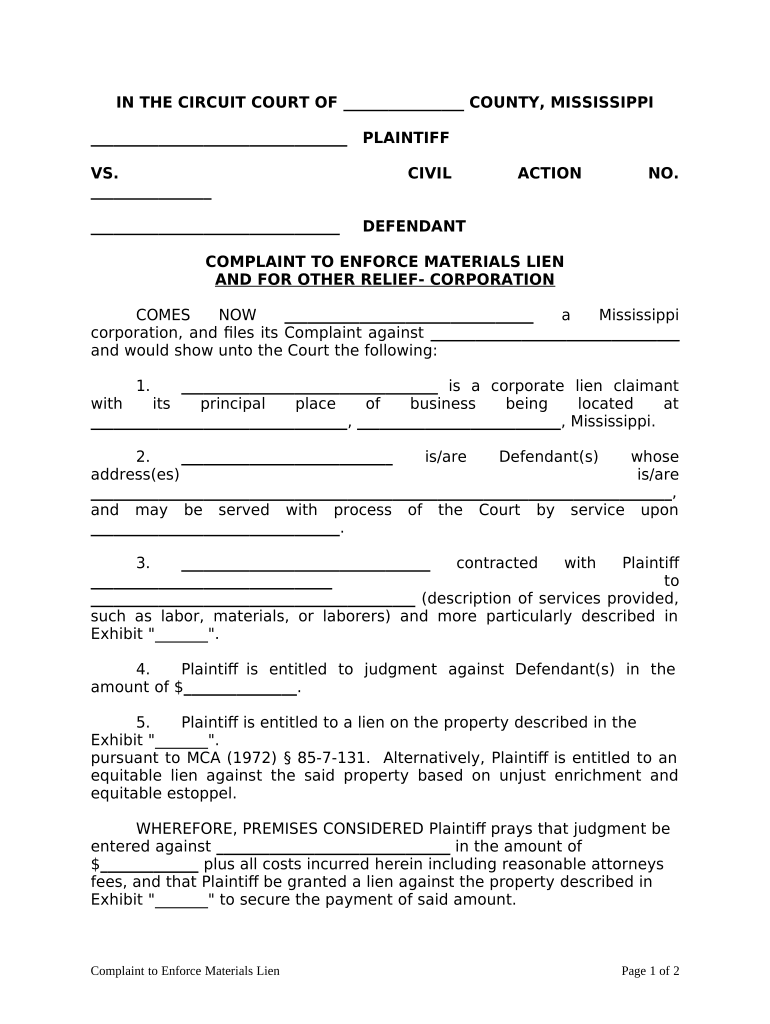

The Mississippi lien is a legal claim against a property or asset that secures the payment of a debt or obligation. This lien can arise from various circumstances, such as unpaid taxes, loans, or judgments. In Mississippi, liens can be placed on real estate, vehicles, and other personal property, providing creditors with a means to recover owed amounts. Understanding the specifics of a Mississippi lien is essential for both individuals and businesses to manage their financial obligations effectively.

How to Use the Mississippi Lien

Using the Mississippi lien involves several steps, including understanding the legal implications and ensuring compliance with state regulations. When a lien is filed, it must be properly documented and recorded with the appropriate county office. This process typically includes filling out the necessary forms, providing supporting documentation, and paying any required fees. It is crucial to follow these steps to ensure that the lien is enforceable and protects the creditor's interests.

Steps to Complete the Mississippi Lien

Completing the Mississippi lien involves a series of methodical steps:

- Gather all relevant information regarding the debt, including the amount owed and the debtor's details.

- Obtain the appropriate forms from the county clerk's office or online.

- Fill out the forms accurately, ensuring all required fields are completed.

- Attach any necessary documentation that supports the lien claim.

- Submit the completed forms to the appropriate office, along with any filing fees.

- Keep a copy of the filed lien for your records.

Legal Use of the Mississippi Lien

The legal use of the Mississippi lien is governed by state laws that outline how and when liens can be filed. Creditors must ensure that they have a valid claim before filing a lien. This includes having proper documentation of the debt and following the correct procedures for filing. Misuse of liens can lead to legal penalties, so it is essential to consult with a legal professional if there are any uncertainties regarding the process.

Key Elements of the Mississippi Lien

Several key elements define the Mississippi lien, including:

- Type of Debt: The lien must be associated with a specific debt, such as unpaid taxes or loans.

- Property Description: A clear description of the property subject to the lien must be included.

- Creditor Information: The name and contact details of the creditor filing the lien.

- Debtor Information: The name and address of the individual or entity against whom the lien is filed.

- Filing Date: The date the lien is officially recorded is crucial for establishing priority over other claims.

Filing Deadlines / Important Dates

Filing deadlines for the Mississippi lien can vary based on the type of lien and the nature of the debt. Generally, it is advisable to file the lien as soon as the debt becomes due to secure the creditor's position. Specific timelines may apply for different types of liens, such as tax liens or mechanics' liens. Keeping track of these deadlines is essential to avoid losing the right to enforce the lien.

Quick guide on how to complete mississippi lien 497314084

Complete Mississippi Lien easily on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Mississippi Lien on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Mississippi Lien effortlessly

- Locate Mississippi Lien and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant portions of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, frustrating form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from your chosen device. Edit and eSign Mississippi Lien and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Mississippi lien and how does it affect property ownership?

A Mississippi lien is a legal claim against a property to secure payment for a debt or obligation. It can affect property ownership by encumbering the title, making it difficult to sell or refinance the property. Understanding how a Mississippi lien works is crucial for property owners and buyers alike.

-

How can airSlate SignNow help with managing Mississippi liens?

airSlate SignNow provides an efficient way to create, send, and eSign documents related to Mississippi liens. With its easy-to-use interface, you can streamline the processes for lien creation, filing, and management. This can save you time and prevent errors in document handling.

-

Are there any fees associated with using airSlate SignNow for Mississippi lien documents?

Yes, airSlate SignNow offers transparent pricing plans that are designed to be cost-effective. Depending on your usage and features required for managing Mississippi lien documents, you can choose a plan that fits your budget and needs. This ensures that you get the best value for your business without hidden fees.

-

What features does airSlate SignNow offer for handling Mississippi lien transactions?

airSlate SignNow offers various features that are beneficial for handling Mississippi lien transactions, including secure eSigning, document tracking, and templates. These features ensure that all parties can sign documents quickly and securely, thus enhancing the efficiency of the lien process. You can also easily manage multiple lien documents in one centralized platform.

-

Is airSlate SignNow compliant with Mississippi lien filing requirements?

Yes, airSlate SignNow is designed to comply with various regulatory requirements, including Mississippi lien filings. The platform allows you to create and maintain documents that meet legal standards. This compliance helps ensure that your filings are valid and recognized by authorities.

-

Can airSlate SignNow integrate with other software for managing Mississippi liens?

Absolutely! airSlate SignNow integrates seamlessly with various software tools to aid in the management of Mississippi liens. Whether you're using project management software or a CRM system, these integrations enhance workflow automation and improve efficiency in handling lien-related tasks.

-

What are the benefits of using airSlate SignNow for Mississippi lien processing?

Using airSlate SignNow for Mississippi lien processing offers numerous benefits, including increased speed, enhanced security, and cost savings. The platform simplifies the entire signing process and reduces paperwork. It also ensures that all documents are safely stored and easily accessible whenever needed.

Get more for Mississippi Lien

- Unemployment work search activity log examples form

- Colorado health care professional credentials application form

- Caroline middle school keyboardingcomputer applications 20142015 classroom management plan class expectations always listen and form

- Chili cook off sign up sheet form

- Visa undertaking letter sample filled sialkot chamber of commerce form

- Baker hughes drilling fluids non dot ok pdf form

- Flexelect form

- Village of hamler ohio fill on line form

Find out other Mississippi Lien

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure