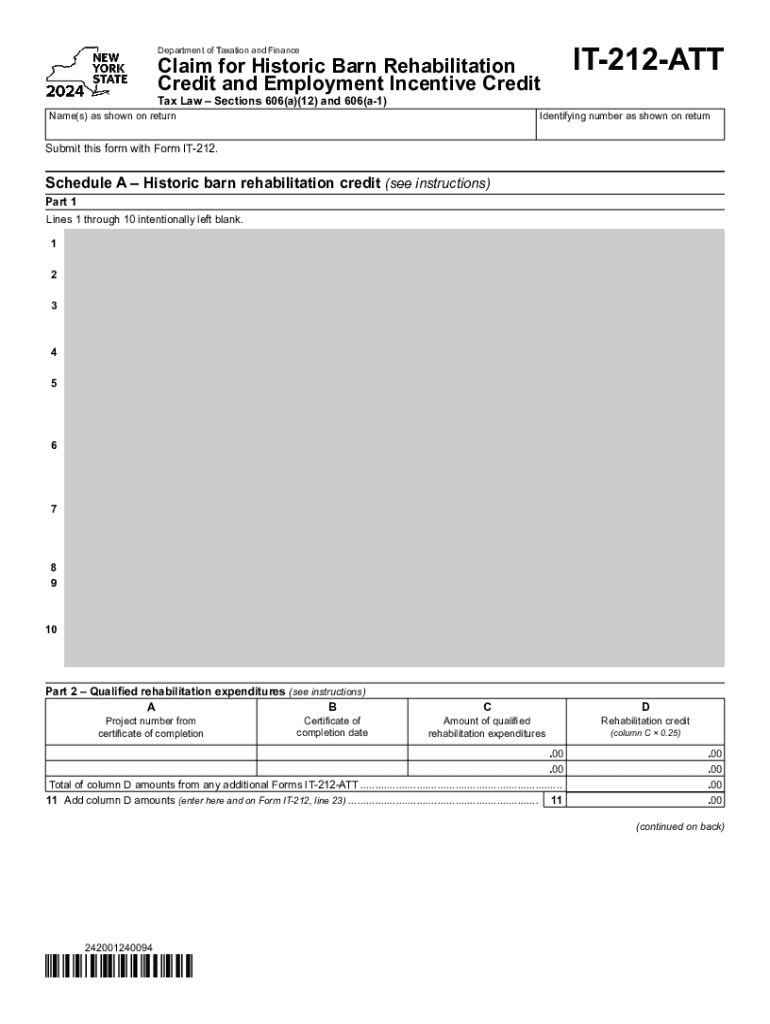

Form it 212 ATT Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit Tax Year 2024-2026

What is the IT 212 Form for Historic Barn Rehabilitation Credit?

The IT 212 form, also known as the IT 212 printable, is a tax document used to claim the Historic Barn Rehabilitation Credit and the Employment Incentive Credit for the tax year. This form is specifically designed for taxpayers in New York who have undertaken rehabilitation projects on historic barns. The credits aim to encourage the preservation of these structures while also providing financial incentives for job creation in the local economy. By completing this form, eligible taxpayers can reduce their tax liability based on the costs incurred during the rehabilitation process.

How to Use the IT 212 Form

To use the IT 212 form effectively, taxpayers must first ensure they meet the eligibility criteria for the Historic Barn Rehabilitation Credit. This includes confirming that the barn qualifies as a historic structure and that the rehabilitation work meets the necessary standards. Once eligibility is established, taxpayers should accurately fill out the form, detailing the rehabilitation expenses and any employment incentives related to the project. It is essential to keep all supporting documentation, such as receipts and contracts, as these may be required for verification during the filing process.

Steps to Complete the IT 212 Form

Completing the IT 212 form involves several key steps:

- Gather all necessary documentation, including proof of barn status and receipts for rehabilitation expenses.

- Fill out the form with accurate information, ensuring that all sections are completed as required.

- Calculate the total amount of credit being claimed based on the eligible expenses.

- Review the completed form for accuracy before submission.

- Submit the form along with your tax return by the designated filing deadline.

Eligibility Criteria for the IT 212 Form

To qualify for the Historic Barn Rehabilitation Credit using the IT 212 form, taxpayers must meet specific eligibility criteria. The barn must be recognized as a historic structure, and the rehabilitation work must adhere to guidelines set forth by the state. Additionally, the taxpayer must demonstrate that the project has resulted in job creation or retention. It is advisable to consult the relevant state guidelines to ensure compliance with all requirements before submitting the form.

Required Documents for the IT 212 Form

When preparing to submit the IT 212 form, taxpayers should gather the following required documents:

- Proof of barn's historic status, such as a certificate or designation letter.

- Receipts and invoices for all rehabilitation expenses incurred.

- Documentation demonstrating job creation or retention linked to the project.

- Any additional forms or schedules that may be required by the state tax authority.

Filing Deadlines for the IT 212 Form

It is crucial to be aware of the filing deadlines associated with the IT 212 form. Typically, the form must be submitted along with your annual tax return by the established tax deadline, which is usually April fifteenth for most taxpayers. However, if you are filing for an extension, ensure that the IT 212 form is included in your extended submission. Staying informed about these deadlines helps avoid penalties and ensures that you receive your credits in a timely manner.

Create this form in 5 minutes or less

Find and fill out the correct form it 212 att claim for historic barn rehabilitation credit and employment incentive credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 212 att claim for historic barn rehabilitation credit and employment incentive credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 212 printable form?

The it 212 printable form is a tax document used for reporting specific income and deductions. It is essential for individuals and businesses to accurately complete this form to ensure compliance with tax regulations. Using airSlate SignNow, you can easily fill out and eSign the it 212 printable form online.

-

How can I access the it 212 printable form?

You can access the it 212 printable form directly through the airSlate SignNow platform. Our user-friendly interface allows you to find and download the form quickly. Once you have the it 212 printable form, you can fill it out and eSign it seamlessly.

-

Is there a cost associated with using the it 212 printable form on airSlate SignNow?

Using the it 212 printable form on airSlate SignNow is part of our subscription plans, which are designed to be cost-effective for businesses of all sizes. We offer various pricing tiers to suit your needs, ensuring you get the best value for your document management. Check our pricing page for more details.

-

What features does airSlate SignNow offer for the it 212 printable form?

airSlate SignNow provides several features for the it 212 printable form, including easy editing, eSigning, and secure storage. You can collaborate with others in real-time, ensuring that all necessary parties can review and sign the document. Our platform also allows you to track the status of your it 212 printable form.

-

Can I integrate airSlate SignNow with other applications for the it 212 printable form?

Yes, airSlate SignNow offers integrations with various applications, making it easy to manage your it 212 printable form alongside your other business tools. You can connect with popular platforms like Google Drive, Dropbox, and more. This integration streamlines your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the it 212 printable form?

Using airSlate SignNow for the it 212 printable form offers numerous benefits, including time savings and increased efficiency. Our platform simplifies the signing process, allowing you to complete documents faster. Additionally, you can ensure that your forms are securely stored and easily accessible.

-

Is it safe to use airSlate SignNow for the it 212 printable form?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your it 212 printable form and other documents are protected. We use advanced encryption and secure servers to safeguard your information. You can trust us to keep your data safe while you eSign your documents.

Get more for Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Tax Year

- Employee locker agreement form 23343588

- Hebephilia form

- Procedure consent form se pa pain management

- Peripheral arterial disease screening form midwestvascular

- Fillable invoice form

- Customer care warranty service request formrt urban homes

- Public university research grant application budget form

- Commercial film policy 9 21 20 docx form

Find out other Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Tax Year

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast