Hhs 745 2013-2026

What is the HHS 745?

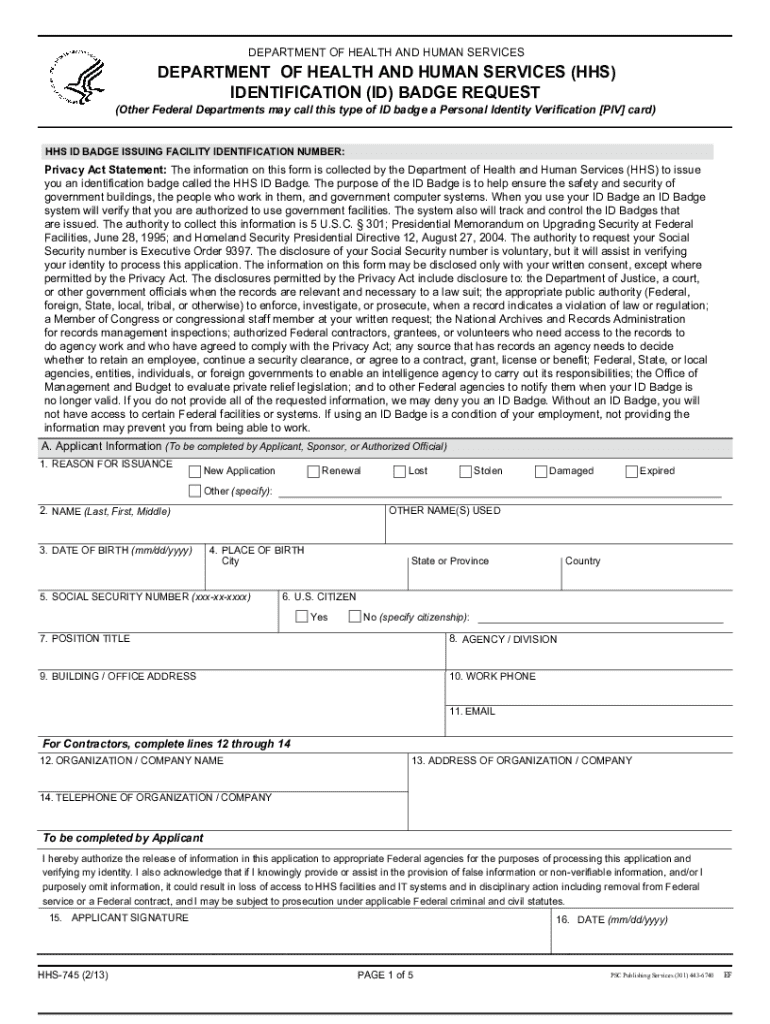

The HHS 745 form is a document used primarily for identification and verification purposes within the U.S. Department of Health and Human Services (HHS). This form is essential for individuals seeking access to various HHS programs or services. It serves as a means to establish identity, ensuring that applicants meet specific eligibility criteria. The form collects personal information, including name, address, and identification details, which are crucial for processing applications and maintaining security protocols.

How to use the HHS 745

Using the HHS 745 form involves several steps to ensure accurate completion and submission. First, gather all necessary personal information, including identification numbers and contact details. Next, carefully fill out the form, ensuring that all required fields are completed. After completing the form, review it for accuracy and completeness. Finally, submit the form according to the instructions provided, whether online, by mail, or in person, depending on the specific requirements of the program you are applying for.

Steps to complete the HHS 745

Completing the HHS 745 form requires attention to detail. Follow these steps for successful completion:

- Read the instructions carefully to understand the requirements.

- Fill in your personal information accurately, ensuring all required fields are completed.

- Attach any necessary supporting documents, such as identification proof.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the designated method, ensuring you keep a copy for your records.

Legal use of the HHS 745

The HHS 745 form is legally recognized as a valid means of identification and verification for accessing HHS services. It is crucial to use the most current version of the form to ensure compliance with legal standards. Submitting outdated forms may result in delays or rejection of applications. Additionally, the information provided must be truthful and accurate, as providing false information can lead to penalties or legal consequences.

Form Submission Methods

The HHS 745 form can be submitted through various methods, depending on the specific requirements of the program. Common submission methods include:

- Online: Many programs allow for electronic submission through secure portals.

- Mail: Completed forms can often be sent to designated addresses via postal service.

- In-Person: Some applicants may be required to submit forms directly at HHS offices or designated locations.

Required Documents

When submitting the HHS 745 form, certain documents may be required to support your application. These typically include:

- A valid government-issued identification, such as a driver's license or passport.

- Proof of residency, which may include utility bills or lease agreements.

- Any additional documents specified in the program guidelines that pertain to eligibility.

Quick guide on how to complete form hhs 745 ors ors od nih

Explore the most efficient method to complete and endorse your Hhs 745

Are you still spending time preparing your official paperwork on physical copies instead of doing it digitally? airSlate SignNow offers a superior way to fill out and validate your Hhs 745 and associated documents for public services. Our advanced eSignature solution equips you with all the tools you need to handle documents swiftly and in compliance with official standards - robust PDF editing, managing, securing, endorsing, and sharing capabilities are all at your fingertips within a user-friendly interface.

Only a few steps are needed to fill out and endorse your Hhs 745:

- Upload the editable template to the editor using the Get Form button.

- Review what details you need to provide in your Hhs 745.

- Navigate between the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the gaps with your information.

- Revise the content with Text boxes or Images from the main toolbar.

- Highlight what is truly signNow or Blackout fields that are no longer relevant.

- Click on Sign to create a legally binding eSignature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Hhs 745 in the Documents folder within your account, download it, or transfer it to your chosen cloud storage. Our platform also offers flexible form sharing. There’s no requirement to print your forms when you need to submit them to the appropriate public office - do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct form hhs 745 ors ors od nih

FAQs

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

How can I fill out the form of the BHU biology honors or zoology honors?

Banaras Hindu University : Entrance Exam by going to the website and fallowing the process Banaras Hindu University : Entrance Exam you can fill the desired form for UG and PG admission.

Create this form in 5 minutes!

How to create an eSignature for the form hhs 745 ors ors od nih

How to generate an eSignature for your Form Hhs 745 Ors Ors Od Nih online

How to generate an eSignature for your Form Hhs 745 Ors Ors Od Nih in Chrome

How to make an eSignature for putting it on the Form Hhs 745 Ors Ors Od Nih in Gmail

How to make an electronic signature for the Form Hhs 745 Ors Ors Od Nih from your smartphone

How to generate an eSignature for the Form Hhs 745 Ors Ors Od Nih on iOS devices

How to make an electronic signature for the Form Hhs 745 Ors Ors Od Nih on Android devices

People also ask

-

What is the HHS 745 form and how does airSlate SignNow assist with it?

The HHS 745 is a crucial form for healthcare providers to comply with federal regulations. airSlate SignNow streamlines the process of sending and signing the HHS 745, ensuring that your documents are completed efficiently and securely.

-

What features does airSlate SignNow offer for managing HHS 745 forms?

airSlate SignNow provides a user-friendly platform that includes eSignature capabilities, document templates, and status tracking for HHS 745 forms. These features enable businesses to manage their documentation process effectively while maintaining compliance.

-

How does airSlate SignNow ensure the security of HHS 745 documents?

Security is paramount at airSlate SignNow, especially for sensitive documents like the HHS 745. The platform employs advanced encryption and secure cloud storage to protect your data and ensure compliance with industry regulations.

-

Is there a cost associated with using airSlate SignNow for HHS 745 forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to provide businesses with a cost-effective solution for managing HHS 745 and other essential documents.

-

Can airSlate SignNow integrate with other systems for HHS 745 management?

Absolutely! airSlate SignNow offers seamless integrations with popular CRM, ERP, and document management systems. This makes it easier for businesses to incorporate the HHS 745 into their existing workflows.

-

What are the benefits of using airSlate SignNow for HHS 745 transactions?

Using airSlate SignNow for HHS 745 transactions signNowly reduces the time spent on paperwork and enhances collaboration among stakeholders. Its efficiency leads to quicker approvals and improved compliance with federal regulations.

-

How can I set up airSlate SignNow for processing HHS 745 forms?

Setting up airSlate SignNow for processing HHS 745 forms is quick and straightforward. Simply create an account, explore the template library for HHS 745, and customize your documents to fit your business’s needs.

Get more for Hhs 745

- Residential lease renewal agreement arkansas form

- Notice to lessor exercising option to purchase arkansas form

- Assignment of lease and rent from borrower to lender arkansas form

- Assignment of lease from lessor with notice of assignment arkansas form

- Letter from landlord to tenant as notice of abandoned personal property arkansas form

- Guaranty or guarantee of payment of rent arkansas form

- Letter from landlord to tenant as notice of default on commercial lease arkansas form

- Residential or rental lease extension agreement arkansas form

Find out other Hhs 745

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document