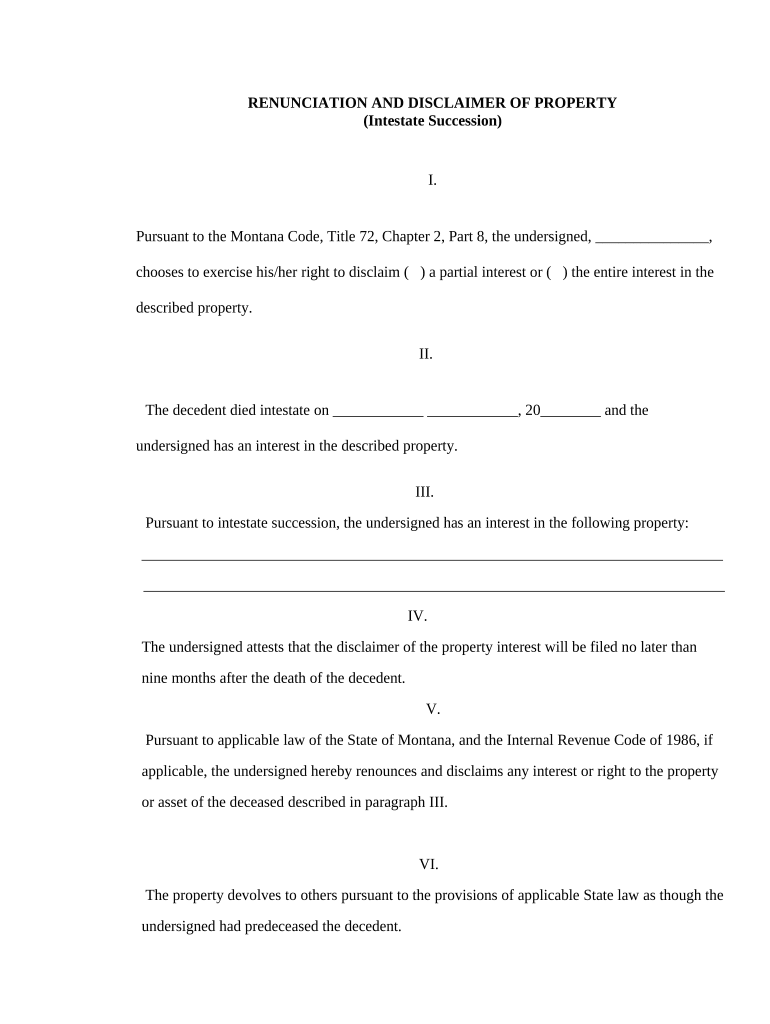

Property Intestate Succession Form

What is the property intestate succession?

The property intestate succession refers to the legal process that determines how a deceased person's assets are distributed when they die without a valid will. In the absence of a will, state laws dictate the distribution of property among surviving relatives. This process ensures that the deceased's estate is settled fairly and according to the laws of intestacy, which vary by state. Typically, the estate is divided among the closest relatives, such as spouses, children, parents, and siblings, depending on the specific laws applicable in the state where the deceased resided.

Steps to complete the property intestate succession

Completing the property intestate succession involves several key steps:

- Identify the deceased's assets, including real estate, bank accounts, and personal property.

- Determine the legal heirs according to state intestacy laws.

- File the necessary documents with the probate court, which may include a petition for probate and an inventory of the estate.

- Notify all interested parties, including heirs and creditors, about the probate proceedings.

- Administer the estate by settling debts and distributing assets to the heirs as per the intestate succession laws.

Legal use of the property intestate succession

The property intestate succession is legally recognized in all U.S. states, providing a framework for distributing assets when a person dies without a will. This legal process is essential for ensuring that the deceased's estate is handled according to established laws, protecting the rights of heirs and creditors. Courts oversee the administration of intestate estates to ensure compliance with state laws, making it crucial for executors and administrators to understand their legal obligations throughout the process.

State-specific rules for the property intestate succession

Each state has its own intestacy laws that dictate how property is distributed among heirs. These laws can vary significantly, affecting the share each relative receives. For example, some states may prioritize spouses over children, while others may provide equal shares to all children. Understanding these state-specific rules is vital for anyone navigating the intestate succession process, as they determine the rightful heirs and the distribution of the estate.

Required documents for property intestate succession

To initiate the property intestate succession process, certain documents are typically required:

- Death certificate of the deceased.

- Petition for probate, which requests the court to appoint an administrator for the estate.

- Inventory of the deceased's assets, detailing all property and debts.

- Notice of the probate proceedings to inform heirs and creditors.

How to use the property intestate succession

Using the property intestate succession involves understanding the legal framework and following the required steps to ensure a smooth process. Executors or administrators must gather all necessary documents, file them with the probate court, and communicate with heirs and creditors throughout the process. Utilizing digital tools can streamline the completion and signing of necessary forms, making it easier to manage the estate efficiently and securely.

Quick guide on how to complete property intestate succession

Prepare Property Intestate Succession effortlessly on any device

Digital document management has become increasingly favored by both organizations and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents quickly and smoothly. Handle Property Intestate Succession on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Property Intestate Succession with ease

- Find Property Intestate Succession and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet-ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, either via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Property Intestate Succession and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is property intestate succession?

Property intestate succession refers to the process through which a deceased person's assets are distributed when they die without a valid will. In such cases, the state laws dictate how the property is divided among heirs, which can lead to complications and disputes. Understanding property intestate succession is crucial to ensure that your assets are managed according to your wishes.

-

How does airSlate SignNow help with property intestate succession?

airSlate SignNow provides a streamlined platform to create, send, and eSign important documents related to property intestate succession. Our solution simplifies the process, making it easy for individuals to handle their estate planning and inheritance documents efficiently. With airSlate SignNow, you can focus on what matters most, without the worry of complicated paperwork.

-

What features does airSlate SignNow offer for managing intestate succession documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document management tools designed to assist in property intestate succession. These features enable users to quickly prepare and sign documents related to their estate, ensuring that all legal requirements are met. This efficient process helps in reducing potential conflicts among heirs.

-

Is airSlate SignNow cost-effective for handling property intestate succession?

Yes, airSlate SignNow is a cost-effective solution for managing property intestate succession. Our subscription plans are designed to fit various budgets, and the time saved using our platform can signNowly reduce overall costs associated with estate management. Investing in airSlate SignNow ensures you get value without compromising on service quality.

-

Can I integrate airSlate SignNow with other applications for property intestate succession?

Absolutely! airSlate SignNow supports integrations with various applications to enhance your property intestate succession management. Whether you need to connect with accounting software, CRM systems, or other document management tools, our platform facilitates seamless integration. This versatility helps ensure a comprehensive workflow for your estate planning.

-

How secure is airSlate SignNow for managing sensitive documents related to intestate succession?

airSlate SignNow prioritizes security, offering advanced encryption and compliance with industry regulations to protect your sensitive documents related to property intestate succession. Our platform ensures that your data remains confidential, and access is regulated to prevent unauthorized viewing or modifications. Feel confident in using our solution for your estate management needs.

-

Can airSlate SignNow assist with electronic notarization for property intestate succession documents?

Yes, airSlate SignNow can assist with electronic notarization for property intestate succession documents. Our platform allows you to connect with certified notaries, making it easy to signNow essential documents quickly and securely. This capability ensures that your estate planning is both efficient and legally compliant.

Get more for Property Intestate Succession

Find out other Property Intestate Succession

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors

- Can I Use eSign in Doctors

- How To Install eSign in Doctors

- How To Add eSign in Doctors

- How To Set Up eSign in Doctors

- How To Save eSign in Doctors

- How To Implement eSign in Doctors

- How To Use eSign in Government

- Help Me With Use eSign in Government

- How To Install eSign in Government