Complex Will with Credit Shelter Marital Trust for Large Estates Montana Form

What is the Complex Will With Credit Shelter Marital Trust For Large Estates Montana

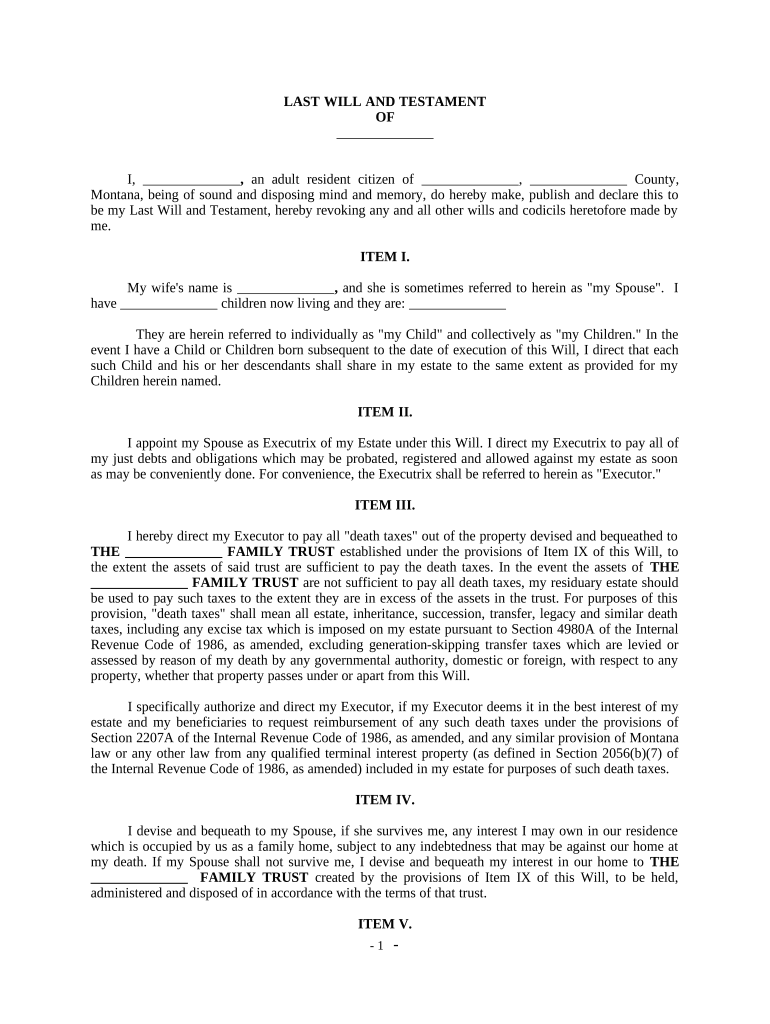

The Complex Will With Credit Shelter Marital Trust for Large Estates in Montana is a legal document designed to manage the distribution of a deceased person's estate while minimizing estate taxes. This type of will incorporates a credit shelter trust, which allows a portion of the estate to be sheltered from estate taxes, benefiting the surviving spouse and heirs. By establishing this trust, individuals can ensure that their estate is handled according to their wishes while providing financial advantages for their beneficiaries.

Key Elements of the Complex Will With Credit Shelter Marital Trust For Large Estates Montana

Several key elements characterize the Complex Will With Credit Shelter Marital Trust for Large Estates in Montana:

- Credit Shelter Trust: This trust holds assets up to the federal estate tax exemption limit, protecting them from taxes upon the death of the surviving spouse.

- Marital Trust: This component allows the surviving spouse to benefit from the trust's assets during their lifetime, ensuring financial support.

- Distribution Instructions: The will outlines how assets are to be distributed among heirs, specifying conditions and timelines for distribution.

- Tax Considerations: The document is structured to minimize tax liabilities for the estate, taking advantage of applicable tax laws.

Steps to Complete the Complex Will With Credit Shelter Marital Trust For Large Estates Montana

Completing the Complex Will With Credit Shelter Marital Trust for Large Estates in Montana involves several important steps:

- Gather Information: Collect details about your assets, liabilities, and beneficiaries.

- Consult a Legal Professional: Work with an estate planning attorney to ensure the will meets legal requirements and reflects your wishes.

- Draft the Will: Create the document, including the credit shelter and marital trust provisions.

- Review and Revise: Carefully review the draft for accuracy and completeness, making necessary adjustments.

- Sign the Document: Execute the will in accordance with Montana state laws, typically in the presence of witnesses.

- Store Safely: Keep the signed will in a safe place, such as a safe deposit box or with your attorney.

Legal Use of the Complex Will With Credit Shelter Marital Trust For Large Estates Montana

The legal use of the Complex Will With Credit Shelter Marital Trust for Large Estates in Montana is governed by state laws regarding wills and trusts. It is essential to comply with Montana's legal requirements for execution and validity, including proper witnessing and notarization. This ensures that the document is enforceable in probate court and that the wishes of the deceased are honored. Additionally, the trust must be properly funded to ensure its effectiveness in minimizing estate taxes and providing for beneficiaries.

State-Specific Rules for the Complex Will With Credit Shelter Marital Trust For Large Estates Montana

Montana has specific rules governing the creation and execution of wills and trusts. Key considerations include:

- Witness Requirements: Montana requires that wills be signed in the presence of at least two witnesses who are not beneficiaries.

- Notarization: While notarization is not mandatory, it can help verify the authenticity of the document.

- Probate Process: The will must go through the probate process, which involves validating the will and distributing assets according to its terms.

- Tax Laws: Understanding state and federal tax laws is crucial for effective estate planning and minimizing tax liabilities.

Quick guide on how to complete complex will with credit shelter marital trust for large estates montana

Complete Complex Will With Credit Shelter Marital Trust For Large Estates Montana effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Complex Will With Credit Shelter Marital Trust For Large Estates Montana on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Complex Will With Credit Shelter Marital Trust For Large Estates Montana with ease

- Locate Complex Will With Credit Shelter Marital Trust For Large Estates Montana and click on Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Select relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, be it email, text message (SMS), an invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form hunts, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Complex Will With Credit Shelter Marital Trust For Large Estates Montana and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Complex Will With Credit Shelter Marital Trust For Large Estates Montana?

A Complex Will With Credit Shelter Marital Trust For Large Estates Montana is a legal document designed to protect your assets and minimize tax implications for your heirs. This type of will incorporates a marital trust that can help shield part of your estate from estate taxes, ensuring that your loved ones inherit more of your wealth.

-

What are the primary benefits of using a Complex Will With Credit Shelter Marital Trust For Large Estates Montana?

The primary benefits include tax savings through effective estate planning and the ability to control how your assets are distributed among your beneficiaries. It also provides flexibility in managing properties and investments for larger estates, ensuring they are handled according to your wishes.

-

How can airSlate SignNow help with creating a Complex Will With Credit Shelter Marital Trust For Large Estates Montana?

AirSlate SignNow provides an easy-to-use platform to create, edit, and eSign your Complex Will With Credit Shelter Marital Trust For Large Estates Montana documents securely. Our templates and document management features simplify the process, making legal document preparation as straightforward as possible.

-

Is there a pricing structure for using airSlate SignNow for complex estate documents?

Yes, airSlate SignNow offers a flexible pricing structure based on your needs. Whether you're a business or an individual needing a Complex Will With Credit Shelter Marital Trust For Large Estates Montana, our plans are designed to be cost-effective while providing the features necessary for effective estate management.

-

Are there integrations available with airSlate SignNow for managing complex wills?

Yes, airSlate SignNow integrates seamlessly with various business applications, such as CRM and document management systems. This enables you to manage your Complex Will With Credit Shelter Marital Trust For Large Estates Montana alongside other essential business operations, facilitating better workflow and organization.

-

How long does it take to set up a Complex Will With Credit Shelter Marital Trust For Large Estates Montana using airSlate SignNow?

Setting up a Complex Will With Credit Shelter Marital Trust For Large Estates Montana with airSlate SignNow can be done in just a few hours. With our user-friendly interface and templates, you can quickly draft and finalize your will, ensuring you are protected without unnecessary delays.

-

Can I make updates to my Complex Will With Credit Shelter Marital Trust For Large Estates Montana after it is created?

Absolutely! With airSlate SignNow, you can easily edit your Complex Will With Credit Shelter Marital Trust For Large Estates Montana whenever needed. Our platform allows you to make updates, ensuring your estate plan reflects your current wishes and circumstances.

Get more for Complex Will With Credit Shelter Marital Trust For Large Estates Montana

- 5th grade mini mafs 3 to be used after lesson 32 mafs5 form

- 032 03 729a 13 eng form

- How to connect to tableau goprimarius com form

- Redifix tile adhesive additive form

- Printable articulation worksheets form

- City mill credit application form

- Dever dental child patient intake form

- How to fill nsnp 200 form for nova scotia pnp

Find out other Complex Will With Credit Shelter Marital Trust For Large Estates Montana

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure