Financial Account Transfer to Living Trust Montana Form

What is the Financial Account Transfer To Living Trust Montana

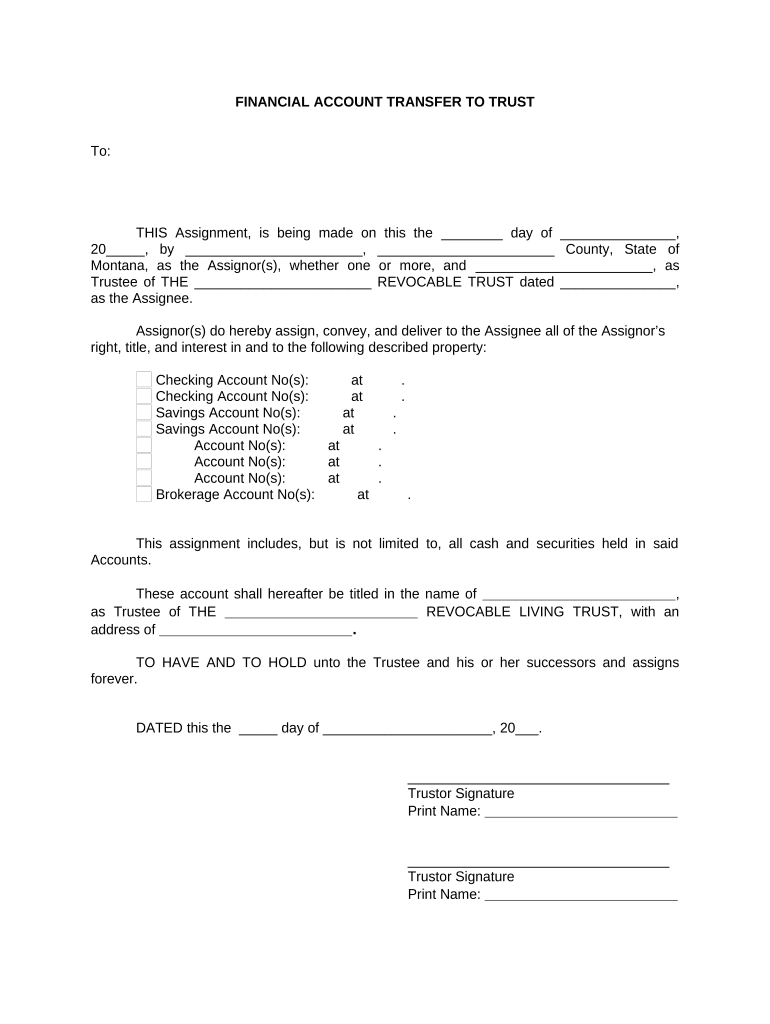

The Financial Account Transfer To Living Trust Montana form is a legal document used to transfer ownership of financial accounts into a living trust. This process helps individuals manage their assets during their lifetime and facilitates the distribution of those assets upon death, avoiding probate. By placing financial accounts such as bank accounts, investment accounts, and retirement accounts into a living trust, individuals can ensure a smoother transition of their assets to beneficiaries while maintaining control over their finances.

Steps to complete the Financial Account Transfer To Living Trust Montana

Completing the Financial Account Transfer To Living Trust Montana involves several key steps:

- Review your living trust document to ensure it is current and accurately reflects your wishes.

- Gather necessary information about the financial accounts you wish to transfer, including account numbers and financial institution details.

- Obtain the Financial Account Transfer To Living Trust Montana form from your financial institution or legal advisor.

- Fill out the form with accurate details, including the name of the trust, trustee information, and account specifics.

- Sign the form in accordance with the requirements set forth by your financial institution.

- Submit the completed form to your financial institution for processing.

- Confirm with your institution that the transfer has been completed successfully.

Legal use of the Financial Account Transfer To Living Trust Montana

This form is legally binding when executed correctly. To ensure its validity, it must comply with Montana state laws governing trusts and estate planning. This includes proper notarization and witnessing, if required by the financial institution. The form should also meet the standards set by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) if executed electronically.

State-specific rules for the Financial Account Transfer To Living Trust Montana

Montana has specific regulations regarding the establishment and management of living trusts. These rules dictate how assets can be transferred into a trust, including the necessity for clear identification of the trust and the trustee. It is important to consult Montana state laws or a legal professional to ensure compliance with local regulations, which may include specific language or clauses that must be included in the trust document.

Required Documents

To successfully complete the Financial Account Transfer To Living Trust Montana, you will need several key documents:

- Your living trust document, which outlines the terms and conditions of the trust.

- The Financial Account Transfer To Living Trust Montana form itself.

- Identification documents, such as a driver's license or passport, to verify your identity as the trustee.

- Any additional documentation required by the financial institution, which may include proof of address or tax identification numbers.

Examples of using the Financial Account Transfer To Living Trust Montana

Individuals may use the Financial Account Transfer To Living Trust Montana in various scenarios, such as:

- A retiree wishing to simplify their estate planning by consolidating assets into a living trust.

- A young couple wanting to ensure their children's financial security by transferring their savings accounts into a trust.

- An individual who has recently created a living trust and needs to transfer multiple investment accounts to align with their estate planning goals.

Quick guide on how to complete financial account transfer to living trust montana

Complete Financial Account Transfer To Living Trust Montana effortlessly on any device

Online document administration has become increasingly popular among enterprises and individuals. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, as you can locate the right form and securely save it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Financial Account Transfer To Living Trust Montana on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Financial Account Transfer To Living Trust Montana without difficulty

- Acquire Financial Account Transfer To Living Trust Montana and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Decide how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Edit and eSign Financial Account Transfer To Living Trust Montana and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for a Financial Account Transfer To Living Trust Montana?

The process for a Financial Account Transfer To Living Trust Montana involves several key steps. First, you need to create a living trust document that outlines the terms of the trust. Then, you will transfer your financial accounts into the trust by updating the account titles and providing the necessary documentation to your financial institutions.

-

What documents do I need for Financial Account Transfer To Living Trust Montana?

To complete a Financial Account Transfer To Living Trust Montana, you will typically need your living trust document, account statements, and identification. Financial institutions may also require additional forms specific to their policies. Make sure all documents are up-to-date to ensure a smooth transfer process.

-

Are there fees associated with the Financial Account Transfer To Living Trust Montana?

Yes, there may be fees associated with the Financial Account Transfer To Living Trust Montana depending on the financial institutions involved and the complexity of your trust. Common fees may include document preparation, filing fees, and potential legal fees. It's advisable to inquire with your financial institution for specific pricing.

-

What are the benefits of a Financial Account Transfer To Living Trust Montana?

One of the main benefits of a Financial Account Transfer To Living Trust Montana is the avoidance of probate, allowing for a more efficient transfer of assets upon death. Additionally, it provides privacy as the trust details do not become public record. Lastly, it can offer greater control over asset distribution according to your wishes.

-

How can airSlate SignNow assist in the Financial Account Transfer To Living Trust Montana?

airSlate SignNow can assist in the Financial Account Transfer To Living Trust Montana by providing a seamless way to prepare, send, and eSign necessary documents. Our platform ensures that all documents are securely stored and easy to access, making the process streamlined and efficient. Plus, it's cost-effective, allowing you to manage legal documentation without breaking the bank.

-

Is it necessary to hire a lawyer for Financial Account Transfer To Living Trust Montana?

While it's not strictly necessary to hire a lawyer for a Financial Account Transfer To Living Trust Montana, it is advisable for complex trusts or situations. A lawyer can ensure that your trust is properly structured and compliant with Montana laws. If you choose to go it alone, using tools like airSlate SignNow can be a great alternative.

-

What types of financial accounts can I transfer into a living trust in Montana?

You can transfer various types of financial accounts into a living trust in Montana, including savings accounts, checking accounts, and investment accounts. It's important to review each account’s transfer requirements, as they can vary by institution. Additionally, retirement accounts may have specific rules surrounding their transfer into trusts.

Get more for Financial Account Transfer To Living Trust Montana

- Material safety data sheet national salon supplies form

- Airtel ownership transfer form pdf

- Mcdonalds maintenance checklist form

- Psira check with id form

- Uspa kilo chart form

- Reading comprehension b1 multiple choice pdf form

- Third party litigation funding agreement template form

- Third party logistics service agreement template form

Find out other Financial Account Transfer To Living Trust Montana

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter