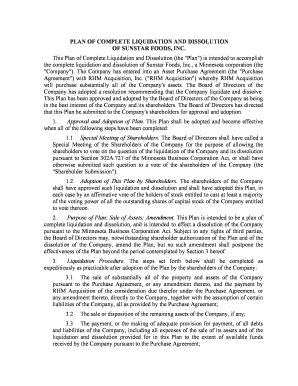

Second Amended Chapter 11 Plan of Liquidation Corporate Form

What is the Second Amended Chapter 11 Plan Of Liquidation Corporate

The Second Amended Chapter 11 Plan of Liquidation Corporate is a legal document that outlines the strategy for liquidating a corporation's assets during bankruptcy proceedings. This plan is typically developed after a corporation has filed for Chapter 11 bankruptcy, allowing it to restructure its debts while providing a clear process for asset distribution to creditors. The plan must be approved by the bankruptcy court and is essential for ensuring that all parties involved understand how the liquidation will occur.

Steps to complete the Second Amended Chapter 11 Plan Of Liquidation Corporate

Completing the Second Amended Chapter 11 Plan of Liquidation Corporate involves several key steps:

- Gather necessary financial documents, including balance sheets and income statements.

- Identify all creditors and categorize debts to determine priority claims.

- Outline the proposed method of liquidation, detailing how assets will be sold or distributed.

- Draft the plan, ensuring compliance with legal requirements and including all necessary disclosures.

- Submit the plan to the bankruptcy court for approval, along with any required supporting documentation.

- Attend the confirmation hearing where the court will review and approve the plan.

Legal use of the Second Amended Chapter 11 Plan Of Liquidation Corporate

The legal use of the Second Amended Chapter 11 Plan of Liquidation Corporate is critical for ensuring that the liquidation process adheres to federal bankruptcy laws. The plan must comply with the Bankruptcy Code, which governs how assets are managed and distributed. It serves as a binding agreement between the corporation and its creditors, detailing how claims will be settled and ensuring that the rights of all parties are respected. Failure to comply with the legal stipulations outlined in the plan can result in complications or dismissal of the bankruptcy case.

How to use the Second Amended Chapter 11 Plan Of Liquidation Corporate

Using the Second Amended Chapter 11 Plan of Liquidation Corporate involves following the established legal framework for bankruptcy proceedings. Corporations must first file this plan with the bankruptcy court, detailing their strategy for asset liquidation. Once filed, the corporation must communicate the plan to all creditors and stakeholders, allowing them to review and vote on its approval. After the court confirms the plan, it becomes legally binding, and the corporation must execute the liquidation process as outlined.

Key elements of the Second Amended Chapter 11 Plan Of Liquidation Corporate

Key elements of the Second Amended Chapter 11 Plan of Liquidation Corporate include:

- A detailed description of the corporation's assets and liabilities.

- Identification of creditors and the classification of claims.

- The proposed method for liquidating assets, including timelines.

- Provisions for the distribution of proceeds to creditors.

- Compliance statements with relevant bankruptcy laws.

Form Submission Methods (Online / Mail / In-Person)

The submission methods for the Second Amended Chapter 11 Plan of Liquidation Corporate can vary by jurisdiction. Typically, the plan can be submitted electronically through the court's online filing system, which streamlines the process and provides immediate confirmation of receipt. Alternatively, the plan may be submitted via mail or in person at the courthouse. It is essential to check with the local bankruptcy court for specific submission guidelines and requirements to ensure compliance.

Quick guide on how to complete second amended chapter 11 plan of liquidation corporate

Complete Second Amended Chapter 11 Plan Of Liquidation Corporate effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Second Amended Chapter 11 Plan Of Liquidation Corporate on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest way to edit and eSign Second Amended Chapter 11 Plan Of Liquidation Corporate with ease

- Find Second Amended Chapter 11 Plan Of Liquidation Corporate and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced papers, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Second Amended Chapter 11 Plan Of Liquidation Corporate to ensure superb communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Second Amended Chapter 11 Plan Of Liquidation Corporate?

A Second Amended Chapter 11 Plan Of Liquidation Corporate is a legal document that outlines the strategy for repaying creditors during bankruptcy proceedings. This plan details how a corporation intends to liquidate its assets and distribute the proceeds among creditors while complying with court requirements.

-

How can airSlate SignNow assist with the Second Amended Chapter 11 Plan Of Liquidation Corporate?

airSlate SignNow provides a user-friendly platform for electronically signing and sending the Second Amended Chapter 11 Plan Of Liquidation Corporate. Our solution enhances efficiency, allowing businesses to quickly obtain necessary signatures and streamline their bankruptcy documentation processes.

-

What features does airSlate SignNow offer for managing the Second Amended Chapter 11 Plan Of Liquidation Corporate?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for documents related to the Second Amended Chapter 11 Plan Of Liquidation Corporate. These features help ensure that all parties are informed and compliant throughout the signing process.

-

Is airSlate SignNow cost-effective for handling the Second Amended Chapter 11 Plan Of Liquidation Corporate?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing the Second Amended Chapter 11 Plan Of Liquidation Corporate. By reducing paper usage and minimizing administrative overhead, our platform helps companies save money while ensuring a smooth document workflow.

-

Can airSlate SignNow integrate with other tools for the Second Amended Chapter 11 Plan Of Liquidation Corporate?

Absolutely! airSlate SignNow offers seamless integration with various third-party applications, which can enhance the management of your Second Amended Chapter 11 Plan Of Liquidation Corporate. These integrations allow for improved collaboration and efficiency in handling bankruptcy documentation.

-

What are the benefits of using airSlate SignNow for the Second Amended Chapter 11 Plan Of Liquidation Corporate?

Using airSlate SignNow for the Second Amended Chapter 11 Plan Of Liquidation Corporate provides benefits such as faster turnaround times for document signing, enhanced security features, and easier compliance with legal requirements. Our platform simplifies the entire process, making it less burdensome for businesses.

-

How secure is airSlate SignNow when handling sensitive documents like the Second Amended Chapter 11 Plan Of Liquidation Corporate?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption standards and secure access controls to protect sensitive documents like the Second Amended Chapter 11 Plan Of Liquidation Corporate, ensuring that your information remains confidential throughout its management.

Get more for Second Amended Chapter 11 Plan Of Liquidation Corporate

- Form w 8 ben rev january certificate of foreign status of beneficial owner for united states tax withholding and reporting

- Applicable law checklist city of kawartha lakes kawarthalakes form

- Form 12981

- Saraswat bank login form

- Cpa form 2

- Michigan cdl self certification online form

- Migrationsverket 241011 form

- 1 list the name role attorney party witness etc and contact form

Find out other Second Amended Chapter 11 Plan Of Liquidation Corporate

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form