North Carolina Partnership Form

What is the North Carolina Partnership

The North Carolina partnership is a formal business structure that allows two or more individuals or entities to collaborate in conducting business activities. This arrangement enables partners to share profits, losses, and management responsibilities. In North Carolina, partnerships can take various forms, including general partnerships, limited partnerships, and limited liability partnerships, each with specific legal implications and operational guidelines. Understanding these distinctions is essential for partners to navigate their rights and obligations effectively.

Key Elements of the North Carolina Partnership

Several key elements define a North Carolina partnership. First, the partnership agreement outlines the roles, responsibilities, and profit-sharing arrangements among partners. Second, partnerships must comply with state regulations, including registration requirements with the North Carolina Secretary of State. Third, liability is a critical consideration; in general partnerships, all partners share unlimited liability, while limited partners in a limited partnership have liability restricted to their investment. Lastly, partnerships must maintain proper records and adhere to tax obligations as stipulated by state and federal laws.

Steps to Complete the North Carolina Partnership

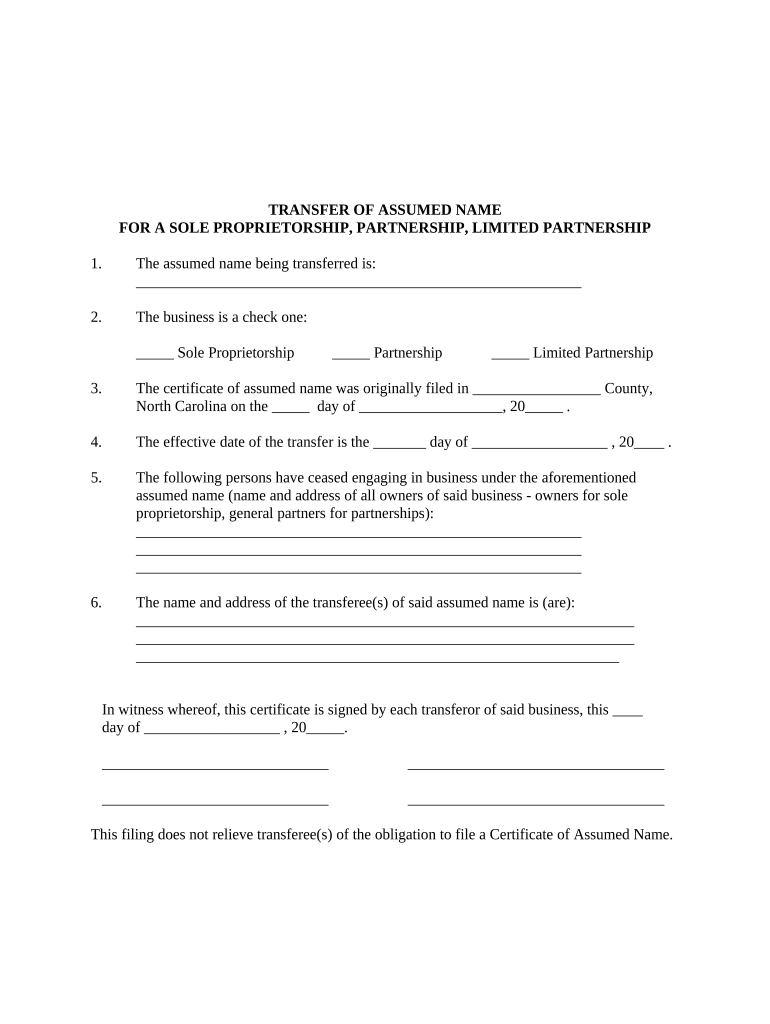

Completing the North Carolina partnership involves several steps. Initially, partners should draft a partnership agreement that clearly states the terms of their collaboration. Next, they must register the partnership with the North Carolina Secretary of State, which may require filing specific forms and paying a registration fee. After registration, partners should obtain any necessary licenses or permits relevant to their business operations. Finally, it is crucial to establish a system for maintaining records and handling tax filings to ensure compliance with legal requirements.

Legal Use of the North Carolina Partnership

The legal use of the North Carolina partnership is governed by state law, which outlines the rights and responsibilities of partners. Partnerships must operate within the framework of the North Carolina Uniform Partnership Act, which provides guidelines on formation, operation, and dissolution. Legal considerations include ensuring that the partnership agreement complies with state laws, maintaining accurate records, and fulfilling tax obligations. Additionally, partnerships should be aware of liability issues, as partners may be held personally liable for the partnership's debts and obligations.

State-Specific Rules for the North Carolina Partnership

North Carolina has specific rules that govern partnerships, including registration requirements and compliance with state tax laws. Partnerships must file an annual report with the Secretary of State and may need to register for state taxes, depending on their business activities. Additionally, certain industries may have additional licensing requirements. Understanding these state-specific rules is essential for partners to operate legally and avoid penalties.

Required Documents

To establish a North Carolina partnership, certain documents are required. These typically include a partnership agreement, which outlines the terms of the partnership, and a registration form submitted to the North Carolina Secretary of State. Depending on the nature of the business, additional documents such as licenses or permits may also be necessary. Keeping these documents organized and accessible is crucial for compliance and operational efficiency.

Form Submission Methods

Submitting the North Carolina partnership registration can be done through various methods. Partners can file online through the North Carolina Secretary of State's website, which offers a streamlined process for registration. Alternatively, they may submit the required forms by mail or in person at the Secretary of State's office. Each submission method may have different processing times and requirements, so partners should choose the option that best fits their needs.

Quick guide on how to complete north carolina partnership

Complete North Carolina Partnership effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage North Carolina Partnership on any device with airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to alter and eSign North Carolina Partnership with ease

- Find North Carolina Partnership and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your selected device. Edit and eSign North Carolina Partnership and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a North Carolina partnership?

A North Carolina partnership is a business structure in which two or more individuals share ownership and responsibilities. It offers flexibility in management and tax advantages. Understanding the legal framework of a North Carolina partnership is essential for any entrepreneur looking to establish their business.

-

How can airSlate SignNow streamline my North Carolina partnership agreements?

airSlate SignNow allows you to create, send, and eSign partnership agreements seamlessly. By using our platform, you can reduce the time spent on paperwork and enhance collaboration among partners in your North Carolina partnership. This helps in maintaining clear communication and legal compliance.

-

What are the costs associated with forming a North Carolina partnership?

The costs for forming a North Carolina partnership include filing fees and potential legal consultations. With airSlate SignNow, you can manage these documents efficiently, keeping track of all expenses associated with your North Carolina partnership formation. This cost-effective solution simplifies the entire process.

-

What features does airSlate SignNow offer for partnerships in North Carolina?

airSlate SignNow offers features such as customizable templates, document tracking, and secure eSigning that cater specifically to partnerships in North Carolina. By using these tools, partners can easily manage documentation, ensuring that every agreement is executed smoothly and efficiently.

-

What are the benefits of using airSlate SignNow for my North Carolina partnership?

Using airSlate SignNow provides numerous benefits for a North Carolina partnership, including improved efficiency and reduced paper waste. The platform enhances security and provides access from anywhere, making it easier for partners to collaborate on important documents, thus streamlining operations.

-

Can airSlate SignNow integrate with other tools for my North Carolina partnership?

Yes, airSlate SignNow can integrate with various business tools to enhance the productivity of your North Carolina partnership. This includes CRM software, accounting platforms, and other productivity applications. These integrations ensure a seamless workflow and simplify document management within your partnership.

-

How does airSlate SignNow ensure the security of my documents for a North Carolina partnership?

airSlate SignNow employs advanced security measures, such as encryption and secure cloud storage, to protect sensitive documents related to your North Carolina partnership. Compliance with industry standards further ensures that your data remains confidential and safe while you manage your business agreements.

Get more for North Carolina Partnership

Find out other North Carolina Partnership

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast