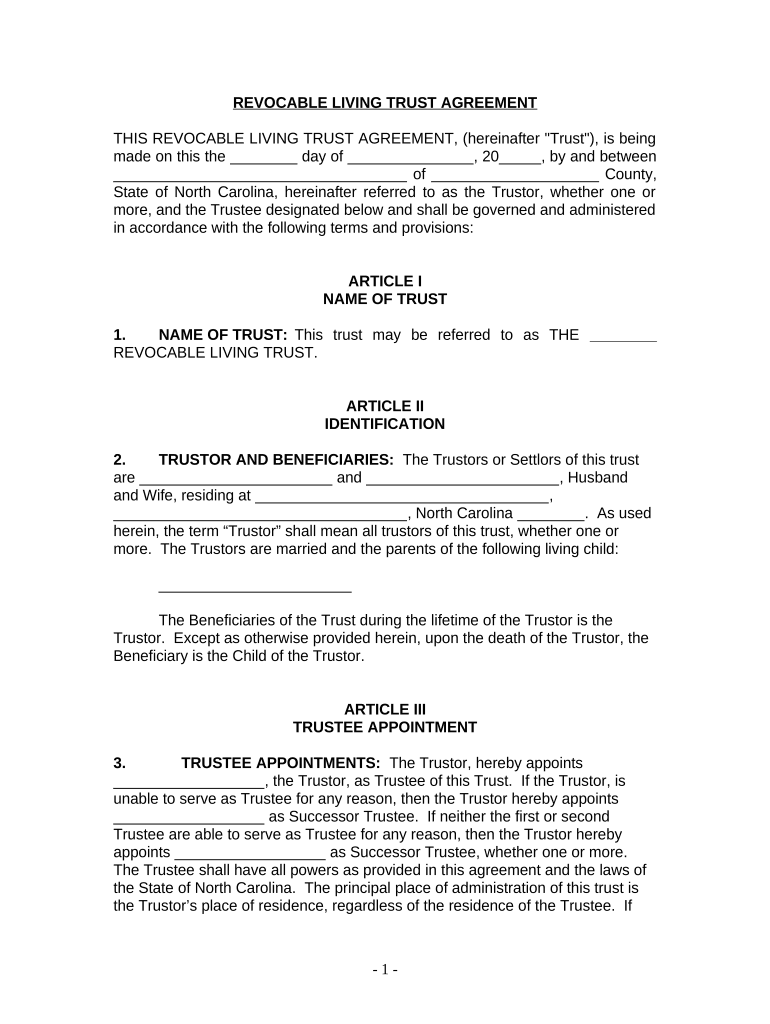

Living Trust for Husband and Wife with One Child North Carolina Form

What is the Living Trust For Husband And Wife With One Child North Carolina

A living trust for husband and wife with one child in North Carolina is a legal arrangement that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their death. This type of trust can help avoid the lengthy probate process, ensuring that the couple's child inherits their assets smoothly and efficiently. The trust becomes effective immediately upon creation, allowing the couple to retain control over their assets while providing for their child.

Key Elements of the Living Trust For Husband And Wife With One Child North Carolina

Several key elements define a living trust for husband and wife with one child in North Carolina:

- Grantors: The couple creating the trust, who will also be the initial trustees.

- Trustee: Typically, both spouses serve as trustees, managing the trust assets.

- Beneficiary: The couple's child is usually the primary beneficiary, entitled to the trust assets upon the death of the parents.

- Assets: The trust can hold various types of assets, including real estate, bank accounts, and investments.

- Revocability: The trust is revocable, meaning the couple can modify or dissolve it as their circumstances change.

Steps to Complete the Living Trust For Husband And Wife With One Child North Carolina

Completing a living trust for husband and wife with one child involves several steps:

- Consult an attorney: It's advisable to seek legal guidance to ensure the trust complies with North Carolina laws.

- Draft the trust document: Outline the terms, including details about the trustees, beneficiaries, and assets.

- Sign the document: Both spouses must sign the trust document in front of a notary public to validate it.

- Fund the trust: Transfer ownership of assets into the trust to ensure they are managed according to the trust's terms.

- Review periodically: Regularly review the trust to make necessary updates as family circumstances or laws change.

Legal Use of the Living Trust For Husband And Wife With One Child North Carolina

The legal use of a living trust for husband and wife with one child in North Carolina is to provide a clear plan for asset distribution upon death. This trust helps avoid probate, which can be a lengthy and costly process. It also allows the couple to manage their assets during their lifetime and make changes as needed. The trust document must comply with state laws to be enforceable, ensuring that the wishes of the grantors are honored.

State-Specific Rules for the Living Trust For Husband And Wife With One Child North Carolina

In North Carolina, specific rules govern the creation and execution of living trusts:

- Capacity: Both spouses must have the legal capacity to create a trust.

- Witnesses: The trust document must be signed in the presence of a notary public.

- Asset Transfer: Properly transferring assets into the trust is crucial to ensure they are protected under the trust's terms.

- Tax Implications: Consult a tax professional to understand any tax implications associated with the trust.

How to Obtain the Living Trust For Husband And Wife With One Child North Carolina

To obtain a living trust for husband and wife with one child in North Carolina, couples can follow these steps:

- Research: Gather information about living trusts and their benefits.

- Consult a legal professional: An attorney specializing in estate planning can provide tailored advice and draft the trust document.

- Complete the trust document: Work with the attorney to ensure all necessary details are included.

- Sign and notarize: Both spouses must sign the document in front of a notary to validate it.

Quick guide on how to complete living trust for husband and wife with one child north carolina

Effortlessly Prepare Living Trust For Husband And Wife With One Child North Carolina on Any Device

Managing documents online has gained signNow traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your documents quickly and without delay. Handle Living Trust For Husband And Wife With One Child North Carolina on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Living Trust For Husband And Wife With One Child North Carolina with Ease

- Obtain Living Trust For Husband And Wife With One Child North Carolina and click on Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or errors that necessitate printing additional copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Living Trust For Husband And Wife With One Child North Carolina to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with One Child in North Carolina?

A Living Trust for Husband and Wife with One Child in North Carolina is a legal document that allows couples to manage their assets during their lifetime and efficiently transfer them to their child upon death. This type of trust helps avoid probate, ensures privacy, and provides flexibility in asset management.

-

Why should we consider a Living Trust for Husband and Wife with One Child in North Carolina?

Establishing a Living Trust for Husband and Wife with One Child in North Carolina helps in streamlining the estate planning process. It not only safeguards your assets but ensures that your child inherits them without the complications of probate, thus providing peace of mind.

-

What are the main benefits of setting up a Living Trust for Husband and Wife with One Child in North Carolina?

Key benefits of a Living Trust for Husband and Wife with One Child in North Carolina include asset protection, the ability to specify terms for distributions, and reduced estate taxes. Moreover, it can be modified as family circumstances change, offering continued flexibility.

-

How much does it cost to create a Living Trust for Husband and Wife with One Child in North Carolina?

The cost of creating a Living Trust for Husband and Wife with One Child in North Carolina varies based on complexity and the professional services required. Generally, fees can range from a few hundred to several thousand dollars, depending on whether you use an attorney or an online service like airSlate SignNow.

-

Can I modify a Living Trust for Husband and Wife with One Child in North Carolina?

Yes, a Living Trust for Husband and Wife with One Child in North Carolina can be modified or revoked as long as both parties agree. This flexibility allows you to adapt the trust to changes in circumstances, assets, or family dynamics.

-

What documents are needed to establish a Living Trust for Husband and Wife with One Child in North Carolina?

To establish a Living Trust for Husband and Wife with One Child in North Carolina, you'll need identification documents, a list of assets, titles, deeds, and any existing wills or trusts. Gathering these documents ensures a smooth trust creation process.

-

How does airSlate SignNow simplify the process of creating a Living Trust for Husband and Wife with One Child in North Carolina?

airSlate SignNow provides an easy-to-use platform that allows couples to create a Living Trust for Husband and Wife with One Child in North Carolina efficiently. Its comprehensive templates and eSigning capabilities streamline the document preparation and signing process, saving time and reducing hassle.

Get more for Living Trust For Husband And Wife With One Child North Carolina

- Muscogee creek nation coronavirus citizen income form

- Archdiocese of edmonton form

- Registration form sutherland dixie youth baseball

- Request for student transcripts baltimore city public schools baltimorecityschools form

- Highland park high school transcript requesthighland park il form

- State of lease agreement template form

- Storage unit lease agreement template form

- Storage lease agreement template form

Find out other Living Trust For Husband And Wife With One Child North Carolina

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed