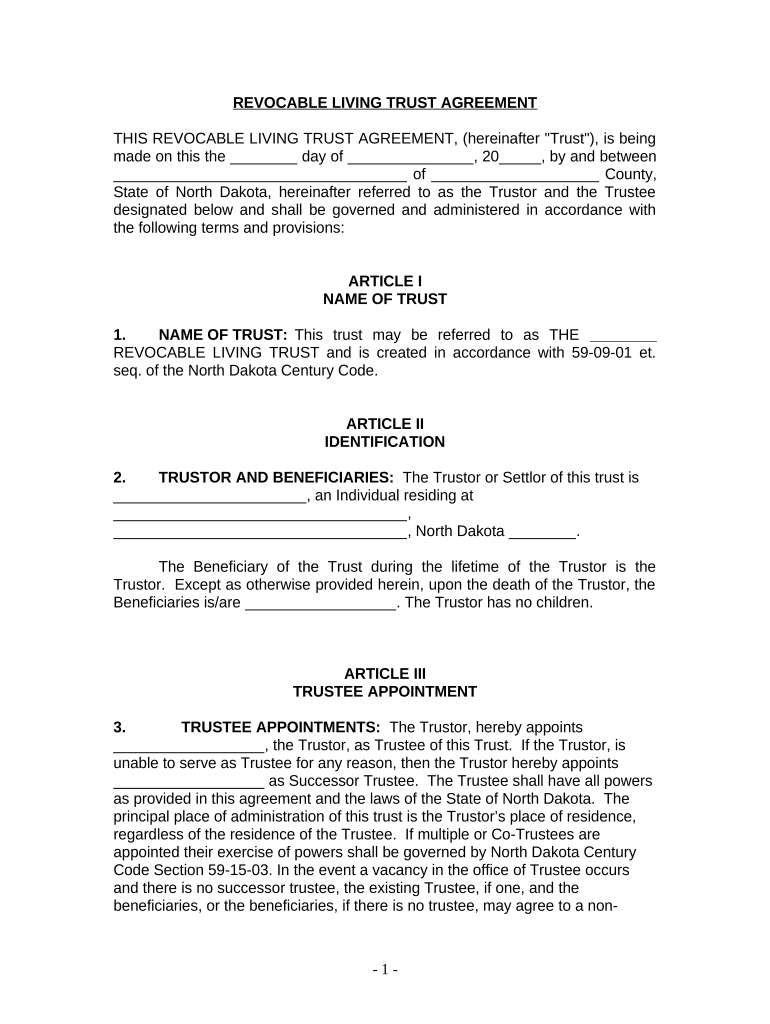

Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children North Dakota Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota

A living trust is a legal arrangement that allows an individual to manage their assets during their lifetime and specify how those assets should be distributed after their death. For individuals who are single, divorced, or widowed without children in North Dakota, a living trust can provide several benefits. It helps avoid probate, ensures privacy regarding asset distribution, and allows for more control over how and when assets are distributed to beneficiaries. This type of trust can be particularly useful for those who want to designate specific individuals or organizations as beneficiaries, ensuring their wishes are honored without the complications of probate court.

How to use the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota

Using a living trust involves several key steps. First, you need to create the trust document, which outlines the terms of the trust, including the assets included and the beneficiaries. Next, you will transfer ownership of your assets into the trust. This may include real estate, bank accounts, and investments. Once the trust is established and funded, you can manage your assets as usual. Upon your passing, the assets in the trust will be distributed according to your instructions, bypassing the probate process. It is advisable to consult with a legal professional to ensure the trust is set up correctly and in accordance with North Dakota laws.

Steps to complete the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota

Completing a living trust involves a series of straightforward steps:

- Determine your assets: List all properties, bank accounts, and investments you wish to include in the trust.

- Choose a trustee: Select an individual or institution to manage the trust. You can be your own trustee during your lifetime.

- Draft the trust document: This legal document outlines the terms of the trust, including asset distribution and trustee responsibilities.

- Fund the trust: Transfer ownership of your assets into the trust. This may require changing titles or account names.

- Review and update: Regularly review the trust to ensure it reflects your current wishes and circumstances.

Legal use of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota

The legal use of a living trust in North Dakota is governed by state laws that outline the requirements for creating and maintaining such a trust. It must be properly executed, which typically includes being signed and notarized. The trust document should clearly state the terms of asset management and distribution. Additionally, it is essential to ensure that all assets intended for the trust are properly transferred to avoid any legal complications. Consulting a legal expert can help ensure compliance with North Dakota's legal standards for living trusts.

State-specific rules for the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota

In North Dakota, specific rules govern the creation and management of living trusts. The trust must be in writing and signed by the grantor. It is advisable to have the trust document notarized to enhance its legal standing. North Dakota law allows for revocable living trusts, meaning the grantor can modify or revoke the trust at any time during their lifetime. Additionally, the state does not impose estate taxes, which can be beneficial for individuals establishing a living trust. Understanding these state-specific rules can help ensure that the trust is valid and effective in managing assets.

Key elements of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota

A living trust for individuals who are single, divorced, or widowed without children typically includes several key elements:

- Grantor: The individual creating the trust, who maintains control over the assets during their lifetime.

- Trustee: The person or entity responsible for managing the trust assets. This can be the grantor or another trusted individual.

- Beneficiaries: Individuals or organizations designated to receive the trust assets upon the grantor's death.

- Terms of distribution: Clear instructions on how and when assets will be distributed to beneficiaries.

- Revocability: The ability to modify or revoke the trust as circumstances change.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with no children north dakota

Effortlessly Prepare Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly solution to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly and without complications. Handle Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota with Ease

- Obtain Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you prefer. Alter and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota to ensure excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota?

A Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. It provides a way to avoid probate and can simplify the transfer of your assets, making it easier for your heirs.

-

How much does it cost to set up a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota?

The costs for setting up a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota can vary based on complexity and the services provided. Typically, fees may range from a few hundred to several thousand dollars. Utilizing airSlate SignNow can help reduce document preparation costs by providing an affordable eSigning solution.

-

What are the key benefits of a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota?

The primary benefits of a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota include avoiding probate, ensuring privacy, and flexibility in asset management. It allows you to maintain control over your assets during your lifetime and provides clarity about the distribution after your death.

-

Can I change my Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota once it is created?

Yes, you can change your Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota whenever necessary. As the grantor, you have the ability to amend or revoke the trust, as long as you are still of sound mind. It's advisable to consult with a legal professional when making signNow changes.

-

How does airSlate SignNow integrate with Living Trust creation in North Dakota?

airSlate SignNow streamlines the process of creating and signing documents related to a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota. With features such as electronic signatures and document management, you can efficiently manage the necessary paperwork and ensure that all parties can easily sign the documents securely.

-

Do I need a lawyer to create a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota?

While it's not mandatory to hire a lawyer to create a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota, consulting one can provide valuable insight into the process. Many individuals can successfully use online resources and tools, like airSlate SignNow, to create their trusts if they feel comfortable managing their estate planning.

-

What happens to my Living Trust for an Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota after I pass away?

After your death, the assets in your Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in North Dakota are managed and distributed according to your instructions within the trust document. This can occur without the need for probate, which often simplifies the process for your beneficiaries and ensures your wishes are honored.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota

- Philcare different modes of payment form

- Orcp 55 form

- Excursion form template 231656568

- Dna analysis form

- Nac 263annualreport032713v2 indd asset rebalancing form life ncaa

- Fedex express claim form

- Consent for disclosure of criminal record information fillable form

- Bronze award indd girl scouts of the usa girlscouts form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children North Dakota

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online