Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children North Dakota Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota

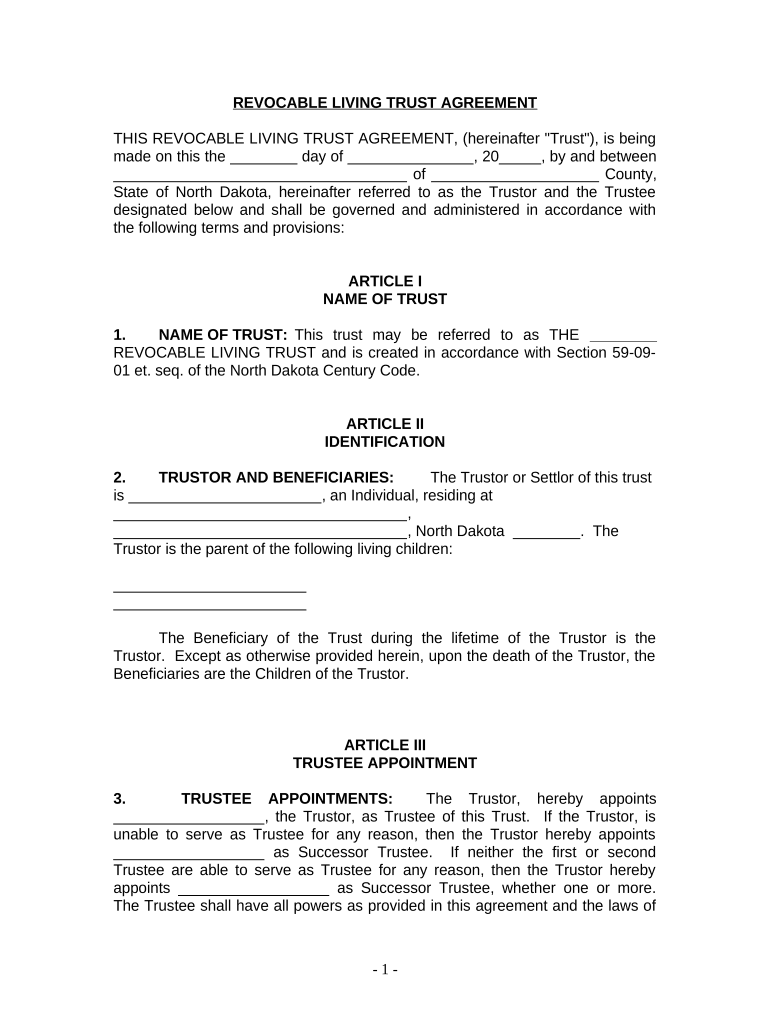

A living trust for individuals who are single, divorced, or widowed with children in North Dakota is a legal document that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust is particularly beneficial for individuals with children, as it ensures that their assets are protected and distributed according to their wishes. It helps avoid the probate process, which can be lengthy and costly, providing a more efficient way to transfer assets to beneficiaries.

How to use the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota

Using a living trust involves several key steps. First, an individual must create the trust document, outlining the terms and conditions of the trust, including the names of the beneficiaries and the assets included. Next, the individual transfers ownership of their assets into the trust. This can include real estate, bank accounts, and personal property. Once the trust is established and funded, the individual can manage the assets as they wish during their lifetime, and upon their death, the assets will be distributed according to the trust's terms without going through probate.

Steps to complete the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota

Completing a living trust involves several important steps:

- Determine the assets to include in the trust.

- Draft the trust document, detailing the terms and beneficiaries.

- Sign the trust document in accordance with North Dakota laws.

- Transfer ownership of assets into the trust, ensuring proper title changes.

- Review and update the trust as necessary, especially after major life events.

Legal use of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota

The legal use of a living trust in North Dakota is governed by state law. It is recognized as a valid estate planning tool, allowing individuals to manage their assets and outline their wishes for distribution after death. To ensure the trust is legally binding, it must be properly executed, which includes signing the document in front of witnesses or a notary, as required by state regulations. This legal framework protects the trust from challenges and ensures that the individual's intentions are honored.

State-specific rules for the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota

In North Dakota, specific rules govern the creation and execution of living trusts. The trust must be in writing and signed by the grantor. North Dakota law does not require a living trust to be recorded, but it is advisable to keep the trust document in a safe place and inform beneficiaries of its existence. Additionally, the trust should comply with the state’s laws regarding asset transfers and the rights of beneficiaries to ensure its validity and effectiveness.

Required Documents

To create a living trust in North Dakota, several documents are typically required:

- A trust agreement outlining the terms and conditions.

- List of assets to be included in the trust.

- Title documents for real estate and other property.

- Identification documents for the grantor and beneficiaries.

Eligibility Criteria

Eligibility to establish a living trust in North Dakota generally requires the individual to be at least eighteen years old and of sound mind. There are no specific restrictions based on marital status, making this an accessible option for singles, divorcees, and widows or widowers with children. Individuals should ensure they have the legal capacity to manage their assets and understand the implications of creating a trust.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children north dakota

Complete Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota easily on any device

Digital document management has become favored by both organizations and individuals. It serves as an excellent sustainable alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota effortlessly

- Obtain Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow particularly offers for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for individuals who are single, divorced, or widowed with children in North Dakota?

A Living Trust for individuals who are single, divorced, or widowed with children in North Dakota is a legal document that allows you to manage and distribute your assets during your lifetime and after your passing. This type of trust ensures that your children are cared for and inherit your assets according to your wishes, simplifying the estate planning process.

-

How does a Living Trust benefit those who are single, divorced, or widowed with children in North Dakota?

Having a Living Trust for individuals who are single, divorced, or widowed with children in North Dakota provides signNow benefits such as avoiding probate, maintaining privacy, and ensuring your assets are distributed efficiently. It allows for greater control over your estate and helps protect your children's inheritance.

-

What are the costs associated with setting up a Living Trust in North Dakota?

The costs associated with establishing a Living Trust for individuals who are single, divorced, or widowed with children in North Dakota can vary based on complexity and the services required. Generally, legal fees will be a part of the cost, and you may also consider additional expenses if you choose to use an online service or software for assistance.

-

Can I customize my Living Trust for my specific needs if I am single, divorced, or a widow/widower in North Dakota?

Yes, you can customize your Living Trust for individuals who are single, divorced, or widowed with children in North Dakota to meet your specific needs. This includes designating guardians for your children, setting conditions for distributions, and specifying how you want your assets managed.

-

How does a Living Trust ensure my children's future in North Dakota?

A Living Trust for individuals who are single, divorced, or widowed with children in North Dakota allows you to set clear instructions on how your assets should be managed and distributed to your children. By establishing conditions and appointing trustees, you can ensure that your children's futures are safeguarded according to your wishes.

-

What documents do I need to prepare for a Living Trust in North Dakota?

To create a Living Trust for individuals who are single, divorced, or widowed with children in North Dakota, you generally need documents that outline your assets, the details of the trust, and your beneficiaries. Additional documentation may include identification, property deeds, and any existing wills.

-

Is a Living Trust in North Dakota revocable or irrevocable?

Most Living Trusts for individuals who are single, divorced, or widowed with children in North Dakota are revocable, meaning you can make changes or dissolve the trust at any time during your lifetime. This flexibility allows you to adjust your estate plan as your circumstances change.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota

- Ny dos form

- Verzoek vrijstelling inhouding loonbelasting premie volksverzekeringen lh 020 1z 1pl pensioen wk form

- Aip myanmar form

- Request donation from ipfw athletics form

- Mortgage payoff statement template word form

- Iowa verified statement of account by corporation form

- Letter of authorization ace passport services form

- Email baseballoperationscooperstowndreamspark form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children North Dakota

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF