Living Trust for Husband and Wife with One Child North Dakota Form

What is the Living Trust For Husband And Wife With One Child North Dakota

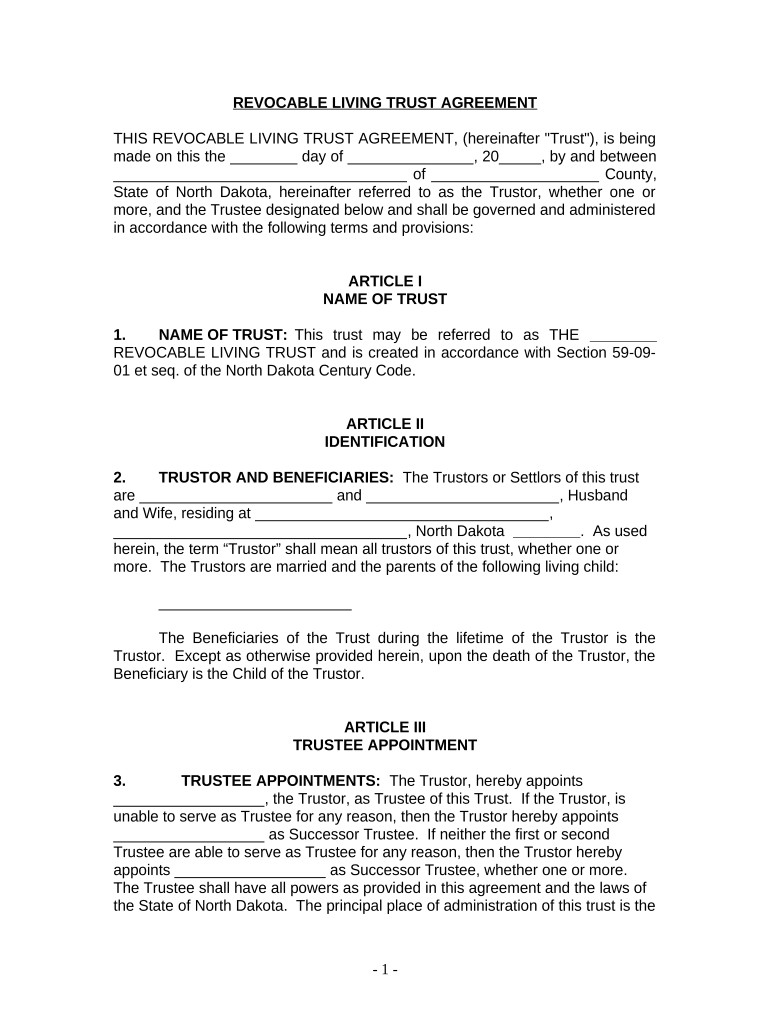

A living trust for husband and wife with one child in North Dakota is a legal arrangement that allows couples to manage their assets during their lifetime and determine how those assets will be distributed after their passing. This type of trust can simplify the estate planning process by avoiding probate, which can be time-consuming and costly. In this arrangement, both spouses typically serve as trustees, allowing them to maintain control over the trust assets while they are alive. Upon the death of one spouse, the surviving spouse often continues to manage the trust, and upon the death of both, the assets are distributed to their child according to the terms specified in the trust document.

Steps to Complete the Living Trust For Husband And Wife With One Child North Dakota

Completing a living trust involves several important steps to ensure that the document is legally binding and accurately reflects the couple's wishes. Here are the key steps:

- Gather necessary information: Collect details about all assets, including real estate, bank accounts, investments, and personal property.

- Choose a trustee: Typically, both spouses act as co-trustees, but it is essential to designate a successor trustee who will manage the trust after both spouses have passed away.

- Draft the trust document: This document should outline how assets will be managed and distributed. It may be beneficial to work with an attorney to ensure compliance with North Dakota laws.

- Transfer assets into the trust: This involves changing the titles of assets to reflect ownership by the trust, which may require additional paperwork.

- Sign the trust document: Both spouses must sign the document in the presence of a notary public to make it legally valid.

Key Elements of the Living Trust For Husband And Wife With One Child North Dakota

Several key elements must be included in a living trust for it to be effective and enforceable. These include:

- Identification of the trustors: Clearly state the names of both spouses creating the trust.

- Designation of trustees: Specify who will manage the trust during the lifetime of the trustors and after their passing.

- Asset description: Provide a detailed list of all assets included in the trust, ensuring clarity on ownership.

- Distribution instructions: Outline how the assets will be distributed to the child upon the death of both parents, including any specific conditions or stipulations.

- Revocation clause: Include a provision allowing the trustors to modify or revoke the trust at any time while they are alive.

State-Specific Rules for the Living Trust For Husband And Wife With One Child North Dakota

North Dakota has specific laws governing living trusts that must be adhered to for the trust to be valid. These include:

- Legal capacity: Both spouses must be of sound mind and at least eighteen years old to create a living trust.

- Notarization: The trust document must be signed in the presence of a notary public to ensure its legality.

- Asset transfer requirements: Properly transferring assets into the trust is essential to avoid probate and ensure that the trust operates as intended.

How to Use the Living Trust For Husband And Wife With One Child North Dakota

Using a living trust involves managing the assets held within the trust during the lifetime of the trustors and ensuring that the trust operates according to the established terms. Here are some ways to effectively use the trust:

- Manage assets: As co-trustees, both spouses can make decisions regarding the trust assets, including buying, selling, or managing property.

- Maintain records: Keep accurate records of all transactions involving trust assets to ensure transparency and accountability.

- Review and update: Periodically review the trust document to ensure it reflects current wishes and circumstances, making updates as necessary.

Legal Use of the Living Trust For Husband And Wife With One Child North Dakota

The legal use of a living trust in North Dakota encompasses several important aspects. It provides a framework for asset management and distribution that is recognized by the state. To ensure legal compliance:

- Follow state laws: Adhere to North Dakota's specific requirements for creating and managing living trusts.

- Consult legal professionals: Engage with an estate planning attorney to ensure that the trust is drafted correctly and meets all legal standards.

- Maintain compliance: Regularly review the trust to ensure it remains in compliance with any changes in state laws or personal circumstances.

Quick guide on how to complete living trust for husband and wife with one child north dakota

Finish Living Trust For Husband And Wife With One Child North Dakota seamlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and without interruptions. Manage Living Trust For Husband And Wife With One Child North Dakota on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Living Trust For Husband And Wife With One Child North Dakota effortlessly

- Find Living Trust For Husband And Wife With One Child North Dakota and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, invite link, or downloading it to your computer.

Forget about missing or lost documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Living Trust For Husband And Wife With One Child North Dakota while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child North Dakota?

A Living Trust For Husband And Wife With One Child North Dakota is a legal document that helps couples manage their assets in a way that benefits their child. This type of trust allows the parents to maintain control over their assets while also ensuring a smooth transition of those assets upon their passing. It is designed to avoid probate and can be customized to meet specific family needs.

-

How much does it cost to set up a Living Trust For Husband And Wife With One Child North Dakota?

The cost of setting up a Living Trust For Husband And Wife With One Child North Dakota can vary based on several factors, including the complexity of your estate and the service provider you choose. Typically, legal fees range from a few hundred to a few thousand dollars. It's essential to weigh the long-term savings from avoiding probate against initial setup costs.

-

What are the benefits of a Living Trust For Husband And Wife With One Child North Dakota?

A Living Trust For Husband And Wife With One Child North Dakota offers numerous benefits, including avoidance of probate, privacy regarding asset distribution, and potential tax advantages. Additionally, this trust allows parents to specify how and when their child receives assets, providing greater financial security for their family's future.

-

Can I change my Living Trust For Husband And Wife With One Child North Dakota after it's created?

Yes, you can modify a Living Trust For Husband And Wife With One Child North Dakota at any time during your lifetime. This flexibility allows you to adjust your trust to reflect changes in your circumstances, such as the birth of additional children, changes in marital status, or shifts in financial assets. It's important to keep your trust updated to ensure it meets your current needs.

-

Do I need an attorney to create a Living Trust For Husband And Wife With One Child North Dakota?

While it's not strictly necessary to have an attorney create a Living Trust For Husband And Wife With One Child North Dakota, it is highly recommended. An attorney can help ensure that the trust complies with North Dakota laws and accurately reflects your wishes regarding asset distribution. Legal assistance can also help you avoid costly mistakes in the future.

-

What happens to the Living Trust For Husband And Wife With One Child North Dakota if one spouse passes away?

If one spouse passes away, the Living Trust For Husband And Wife With One Child North Dakota remains in effect, and assets typically remain under the surviving spouse's control. This arrangement ensures that the surviving spouse can manage the trust assets without interruption or the need for probate. Additionally, the trust's terms will dictate how the assets are managed for the benefit of the child.

-

Can a Living Trust For Husband And Wife With One Child North Dakota include assets from both spouses?

Yes, a Living Trust For Husband And Wife With One Child North Dakota can include assets from both spouses, making it a shared trust. This flexibility allows couples to combine their assets into a single trust for effective management and distribution. It's crucial for couples to list all assets when establishing the trust to ensure everything is covered appropriately.

Get more for Living Trust For Husband And Wife With One Child North Dakota

- Application to replace permanent resident card i 90 pdf form

- Stride kafo orthometry form becker orthopedic

- C43 form

- Massachusetts small estate affidavit form

- Af formulario transferencia miami bcp miami agency

- Pli scholarship form

- Discrepancy form 5620157

- Tessera sanitariacodice fiscale modello aa48 form

Find out other Living Trust For Husband And Wife With One Child North Dakota

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF