Lincoln Ira Form

What is the Lincoln IRA?

The Lincoln IRA is a retirement savings account offered by Lincoln Financial Group, designed to help individuals save for retirement while enjoying tax advantages. This type of Individual Retirement Account (IRA) allows for various investment options, including stocks, bonds, and mutual funds. Contributions to a Lincoln IRA may be tax-deductible, depending on the individual's income and tax filing status. The funds in the account grow tax-deferred until withdrawal, making it an attractive option for long-term savings.

Steps to Complete the Lincoln IRA

Completing the Lincoln IRA involves several key steps to ensure that the account is set up correctly and in compliance with IRS regulations. Here are the essential steps:

- Choose the Type of IRA: Decide whether to open a traditional IRA or a Roth IRA based on your financial situation and retirement goals.

- Gather Required Documents: Collect necessary documentation, including identification, Social Security number, and financial information.

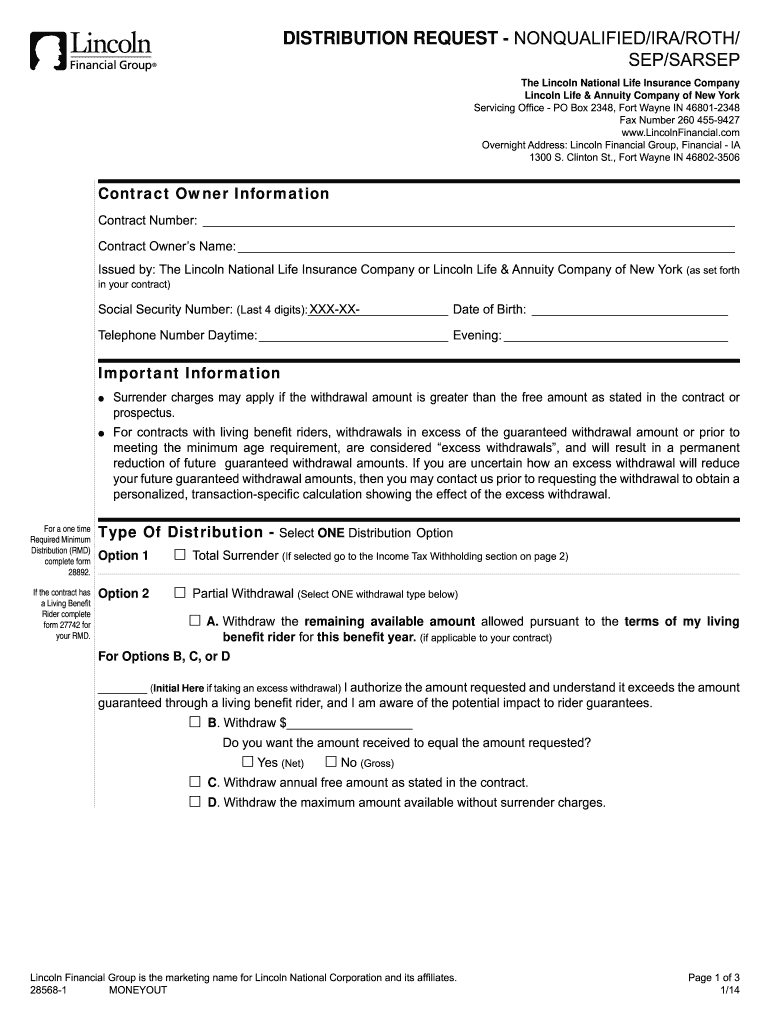

- Complete the Application Form: Fill out the Lincoln IRA application form accurately, providing all requested information.

- Fund the Account: Make an initial contribution to your Lincoln IRA, adhering to annual contribution limits set by the IRS.

- Review and Submit: Double-check all information for accuracy and submit the application to Lincoln Financial Group.

Legal Use of the Lincoln IRA

The Lincoln IRA is governed by IRS regulations, which dictate how contributions, withdrawals, and distributions are handled. To ensure legal compliance, account holders must adhere to specific rules, such as contribution limits and withdrawal restrictions. For instance, early withdrawals before age fifty-nine and a half may incur penalties unless certain exceptions apply. Understanding these legal guidelines is crucial for maintaining the tax-advantaged status of the account.

Eligibility Criteria

To open a Lincoln IRA, individuals must meet certain eligibility criteria established by the IRS. Generally, anyone under the age of seventy and earning taxable income can contribute to a traditional IRA. For a Roth IRA, eligibility is based on income limits. It is important for potential account holders to review these criteria to ensure they qualify for the type of IRA they wish to establish.

Required Documents

When applying for a Lincoln IRA, several documents are necessary to complete the process. These typically include:

- Identification: A government-issued ID, such as a driver's license or passport.

- Social Security Number: Required for tax reporting purposes.

- Financial Information: Details regarding income, employment, and existing retirement accounts.

Having these documents ready can streamline the application process and help avoid delays.

Form Submission Methods

The Lincoln financial distribution form can be submitted through various methods, providing flexibility for account holders. Options typically include:

- Online Submission: Many users prefer to complete and submit forms electronically for convenience.

- Mail: Forms can be printed and sent via postal service to the designated address provided by Lincoln Financial Group.

- In-Person: Some individuals may choose to visit a local Lincoln Financial office to submit their forms directly.

Choosing the right submission method can depend on personal preference and urgency.

Quick guide on how to complete distribution request nonqualifiediraroth sepsarsep lincoln

Effortlessly Prepare Lincoln Ira on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Lincoln Ira on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Lincoln Ira with Ease

- Locate Lincoln Ira and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Lincoln Ira to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I recently opened a Fidelity Roth IRA and it says my account is closed and I need to submit a W-9 form. Can anyone explain how this form relates to an IRA and why I need to fill it out?

Financial institutions are required to obtain tax ID numbers when opening an account, and the fact that it's an IRA doesn't exempt them from that requirement. They shouldn't have opened it without the W-9 in the first place, but apparently they did. So now they had to close it until they get the required documentation.

Create this form in 5 minutes!

How to create an eSignature for the distribution request nonqualifiediraroth sepsarsep lincoln

How to generate an electronic signature for your Distribution Request Nonqualifiediraroth Sepsarsep Lincoln in the online mode

How to generate an eSignature for your Distribution Request Nonqualifiediraroth Sepsarsep Lincoln in Chrome

How to create an electronic signature for putting it on the Distribution Request Nonqualifiediraroth Sepsarsep Lincoln in Gmail

How to create an electronic signature for the Distribution Request Nonqualifiediraroth Sepsarsep Lincoln right from your smartphone

How to make an eSignature for the Distribution Request Nonqualifiediraroth Sepsarsep Lincoln on iOS

How to generate an eSignature for the Distribution Request Nonqualifiediraroth Sepsarsep Lincoln on Android

People also ask

-

What is a Lincoln Ira and how does it work with airSlate SignNow?

A Lincoln Ira is a type of Individual Retirement Account that allows you to invest in a diverse range of assets, including stocks and bonds. With airSlate SignNow, you can easily manage and eSign documents related to your Lincoln Ira, ensuring a seamless and efficient process for your retirement planning.

-

How much does airSlate SignNow cost for Lincoln Ira document management?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Whether you need a basic plan for occasional Lincoln Ira document signing or a comprehensive solution for frequent use, you'll find an option that suits your budget and needs.

-

What features does airSlate SignNow provide for managing Lincoln Ira documents?

airSlate SignNow provides features such as electronic signatures, document templates, and real-time tracking, all designed to streamline your Lincoln Ira document management. With intuitive tools, you can easily create, send, and sign documents, facilitating a hassle-free experience.

-

Can airSlate SignNow integrate with other financial tools for Lincoln Ira management?

Yes, airSlate SignNow seamlessly integrates with various financial and accounting software to help you manage your Lincoln Ira more effectively. This integration allows you to automate workflows and enhance collaboration, making it easier to keep track of your investments.

-

What are the benefits of using airSlate SignNow for Lincoln Ira eSigning?

Using airSlate SignNow for Lincoln Ira eSigning offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can quickly sign documents from anywhere, ensuring timely management of your retirement accounts.

-

Is airSlate SignNow compliant with regulations for Lincoln Ira documentation?

Absolutely! airSlate SignNow prioritizes compliance with industry regulations, making it a reliable choice for managing Lincoln Ira documentation. Our platform ensures that all eSignatures and document processes meet legal standards.

-

How can I get started with airSlate SignNow for my Lincoln Ira?

Getting started with airSlate SignNow for your Lincoln Ira is simple. Sign up for an account, select the plan that fits your needs, and begin creating or uploading your Lincoln Ira documents for eSigning. It's that easy!

Get more for Lincoln Ira

- Attachment proof service form

- California workers compensation application form

- Permanent report form

- California independent review form

- California agent form

- Ca benefits workers compensation form

- Statement of decline of vocational rehabilitation for workers compensation california form

- Order show cause 497299497 form

Find out other Lincoln Ira

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online