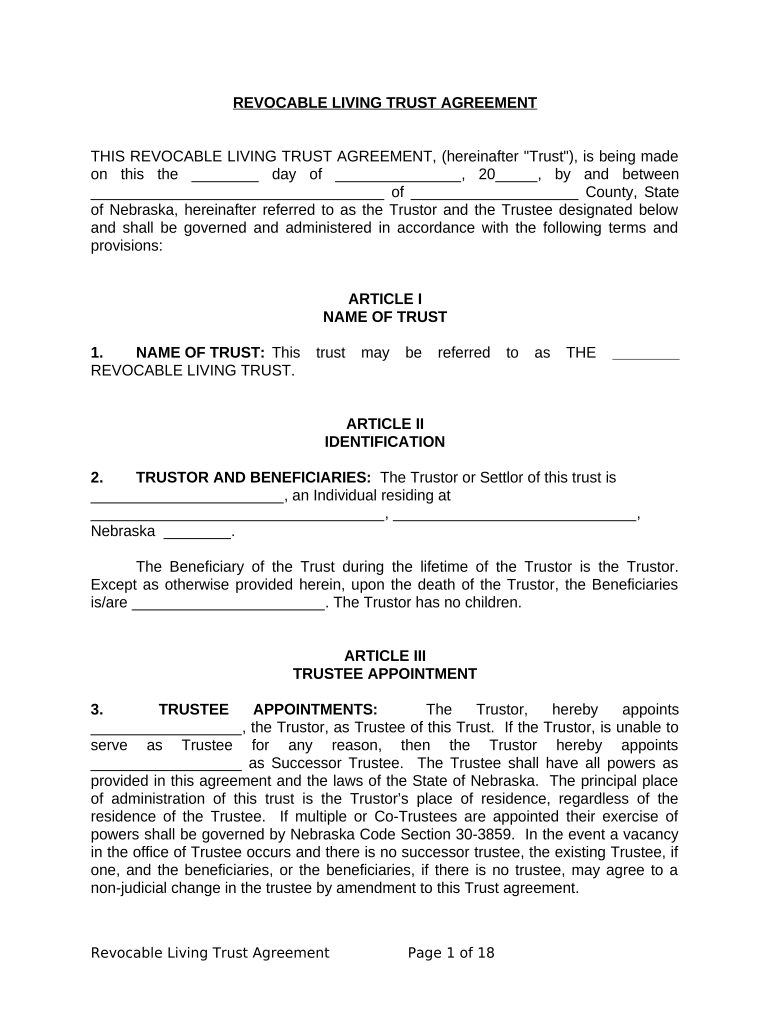

Nebraska Living Trust Form

What is the Nebraska Living Trust

A Nebraska living trust is a legal document that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust can help avoid probate, ensuring a smoother transition of assets to beneficiaries. Living trusts can be revocable or irrevocable, with revocable trusts allowing the grantor to change the terms or dissolve the trust at any time, while irrevocable trusts typically cannot be altered once established.

How to use the Nebraska Living Trust

Using a Nebraska living trust involves several key steps. First, you need to create the trust document, which outlines the terms, including the trustee and beneficiaries. Next, you will transfer ownership of your assets into the trust, which may include real estate, bank accounts, and investments. It is essential to keep the trust updated to reflect any changes in your assets or family situation. Regular reviews can help ensure that the trust continues to meet your needs and intentions.

Steps to complete the Nebraska Living Trust

Completing a Nebraska living trust involves a series of steps:

- Determine your assets and decide which ones to include in the trust.

- Draft the trust document, specifying the terms and conditions.

- Choose a trustee, who will manage the trust and distribute assets according to your wishes.

- Transfer the ownership of your assets into the trust, which may require changing titles or account names.

- Review and update the trust as necessary to reflect changes in your life or assets.

Legal use of the Nebraska Living Trust

The legal use of a Nebraska living trust is governed by state laws, which outline how trusts must be established and maintained. A properly executed living trust is recognized by Nebraska courts and can be used to manage assets and provide for beneficiaries without going through probate. It is crucial to ensure that the trust complies with all legal requirements, including proper signing and witnessing, to be considered valid.

State-specific rules for the Nebraska Living Trust

Nebraska has specific rules that govern living trusts, including requirements for the creation and management of the trust. For instance, the trust must be in writing and signed by the grantor. Additionally, Nebraska law allows for the appointment of a successor trustee if the original trustee is unable to fulfill their duties. Understanding these state-specific rules can help ensure that your living trust is valid and enforceable.

Key elements of the Nebraska Living Trust

Key elements of a Nebraska living trust include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust and distributing assets.

- Beneficiaries: The individuals or organizations that will receive the trust assets upon the grantor's death.

- Terms of the trust: Detailed instructions on how assets should be managed and distributed.

Quick guide on how to complete nebraska living trust

Prepare Nebraska Living Trust effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the desired form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents swiftly without delays. Manage Nebraska Living Trust on any platform using airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

The easiest way to modify and eSign Nebraska Living Trust without hassle

- Locate Nebraska Living Trust and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you'd like to submit your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Nebraska Living Trust and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a living trust in Nebraska?

A living trust in Nebraska is a legal entity that allows individuals to manage their assets during their lifetime and distribute them after their death. It can help avoid probate, ensuring a smoother transition of assets to beneficiaries. By setting up a living trust in Nebraska, you gain greater control over your estate.

-

How can airSlate SignNow help with creating a living trust in Nebraska?

airSlate SignNow provides a user-friendly platform for creating, editing, and signing your living trust documents in Nebraska. With easy eSigning capabilities, you can ensure that all parties involved can quickly and securely sign necessary documents. This streamlines the process of setting up your living trust in Nebraska.

-

What are the costs associated with a living trust in Nebraska?

The costs of creating a living trust in Nebraska can vary depending on the complexity of your estate and the assistance you require. While DIY options may be cheaper, hiring an attorney or using a service like airSlate SignNow may provide peace of mind. Overall, investing in a living trust in Nebraska can save money in the long run by avoiding probate costs.

-

What benefits does a living trust in Nebraska provide?

A living trust in Nebraska offers several benefits, including asset management during your lifetime, privacy in asset distribution, and avoidance of probate. With a living trust, you can specify how your assets are distributed and provide for dependents or other beneficiaries. This flexibility makes a living trust in Nebraska an attractive option for many.

-

Can a living trust in Nebraska be amended after it is created?

Yes, a living trust in Nebraska can be amended or revoked by the grantor at any time as long as they are still alive and competent. This allows you to adapt the trust to any changes in your circumstances or intentions. Utilizing airSlate SignNow’s platform makes it easy to update your living trust documents as needed.

-

What integrations does airSlate SignNow support when managing a living trust in Nebraska?

airSlate SignNow integrates seamlessly with various platforms, allowing you to manage your living trust in Nebraska efficiently. You can connect it with cloud storage solutions, CRM systems, and other productivity tools to streamline your workflow. These integrations enhance your ability to organize and access your living trust documents conveniently.

-

Is a living trust in Nebraska only for wealthy individuals?

No, a living trust in Nebraska is beneficial for individuals across different income levels. It provides a way to manage and protect your assets, regardless of their size. Many people choose a living trust in Nebraska for the control and peace of mind it offers, making it accessible for everyone.

Get more for Nebraska Living Trust

- A child and therapist moderating factors scale form

- Ucla new patient registration form

- Uniform checklist template

- Neurology new patient packet form

- Puckett ems form

- Enrollment verification form hispanic scholarship fund assets hsf

- Zero is not enough on the lower limit of agent intelligence for form

- Lease truck agreement template form

Find out other Nebraska Living Trust

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation