Individual Credit Application New Hampshire Form

What is the Individual Credit Application New Hampshire

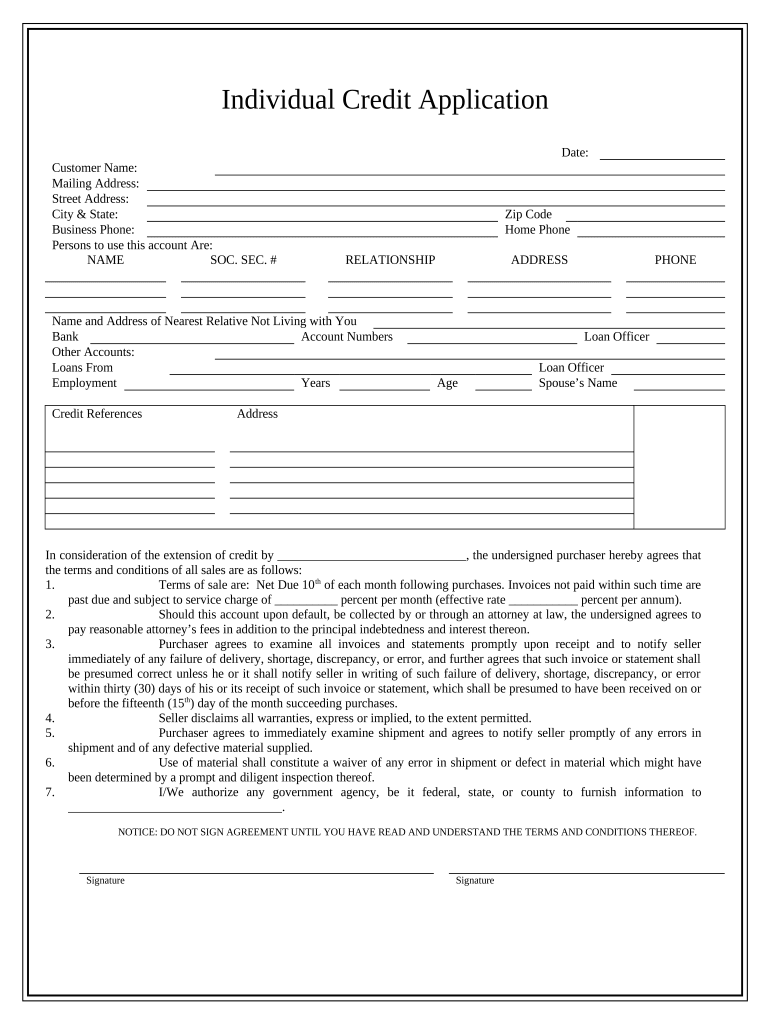

The Individual Credit Application New Hampshire is a formal document used by individuals seeking credit from financial institutions or lenders within the state. This application collects essential information about the applicant's financial status, credit history, and personal identification. It serves as a critical tool for lenders to assess the creditworthiness of potential borrowers, ensuring responsible lending practices.

Steps to complete the Individual Credit Application New Hampshire

Completing the Individual Credit Application New Hampshire involves several straightforward steps to ensure accuracy and compliance. First, gather all necessary personal information, including your full name, address, Social Security number, and employment details. Next, provide financial information such as income, existing debts, and monthly expenses. This data helps lenders evaluate your financial situation. After filling out the application, review it for any errors or omissions before submitting it. Finally, sign and date the application to validate it.

Legal use of the Individual Credit Application New Hampshire

The legal use of the Individual Credit Application New Hampshire is governed by state and federal regulations that ensure fair lending practices. The application must comply with the Equal Credit Opportunity Act (ECOA), which prohibits discrimination based on race, color, religion, national origin, sex, marital status, or age. Additionally, lenders must adhere to the Fair Credit Reporting Act (FCRA), which mandates transparency regarding how credit information is used. Proper use of the application protects both the lender and the applicant, fostering trust in the credit process.

Eligibility Criteria

To qualify for credit through the Individual Credit Application New Hampshire, applicants must meet specific eligibility criteria. Generally, individuals must be at least eighteen years old and possess a valid Social Security number. Lenders often require proof of income, such as pay stubs or tax returns, to assess the applicant's ability to repay the loan. Additionally, a satisfactory credit history is crucial, as it reflects the applicant's past borrowing behavior and repayment reliability. Each lender may have unique requirements, so it is essential to review these before applying.

Required Documents

When submitting the Individual Credit Application New Hampshire, applicants typically need to provide several supporting documents. Commonly required documents include:

- Proof of identity, such as a driver's license or passport

- Social Security card

- Recent pay stubs or income statements

- Bank statements for the past few months

- Details of existing debts, including credit cards and loans

Gathering these documents in advance can streamline the application process and improve the chances of approval.

Application Process & Approval Time

The application process for the Individual Credit Application New Hampshire typically involves submitting the completed form along with the required documents to the lender. After submission, the lender will review the application, which may take anywhere from a few hours to several days, depending on the institution's policies and the complexity of the applicant's financial situation. During this time, the lender may conduct a credit check and verify the information provided. Once the review is complete, the applicant will be notified of the decision, and if approved, the lender will outline the terms and conditions of the credit offer.

Quick guide on how to complete individual credit application new hampshire

Effortlessly Prepare Individual Credit Application New Hampshire on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow offers all the features you need to create, modify, and eSign your documents swiftly without any holdups. Manage Individual Credit Application New Hampshire on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to Modify and eSign Individual Credit Application New Hampshire With Ease

- Locate Individual Credit Application New Hampshire and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant portions of your documents or obscure sensitive information with tools specifically designed for that task by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Individual Credit Application New Hampshire to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Individual Credit Application New Hampshire?

The Individual Credit Application New Hampshire is a streamlined form designed for individuals seeking credit. It helps facilitate the loan application process, ensuring all necessary information is gathered efficiently. This application is ideal for businesses in New Hampshire looking to provide a seamless experience for their clients.

-

How does airSlate SignNow support the Individual Credit Application New Hampshire?

airSlate SignNow provides a user-friendly platform to create, send, and sign the Individual Credit Application New Hampshire digitally. This ensures that the application process is quick and hassle-free for both lenders and applicants. With airSlate SignNow, you can manage all your credit applications in one place.

-

What are the pricing options for the Individual Credit Application New Hampshire with airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of various businesses utilizing the Individual Credit Application New Hampshire. Plans are designed to cater to different volumes and features, ensuring you only pay for what you need. You can choose from monthly or annual subscriptions based on your usage.

-

Can I integrate the Individual Credit Application New Hampshire with other software?

Yes, airSlate SignNow allows seamless integration of the Individual Credit Application New Hampshire with various CRM and workflow management systems. This integration helps streamline your processes and enhances productivity. Connectivity with other applications ensures you can manage everything efficiently within your existing ecosystem.

-

What are the benefits of using airSlate SignNow for the Individual Credit Application New Hampshire?

Using airSlate SignNow for the Individual Credit Application New Hampshire offers numerous benefits, including faster processing times and reduced paper waste. The platform provides secure electronic signatures and compliance with legal standards, assuring both businesses and customers. Additionally, it enhances customer satisfaction through a streamlined application experience.

-

Is the Individual Credit Application New Hampshire easy to fill out?

Absolutely! The Individual Credit Application New Hampshire provided through airSlate SignNow is designed for simplicity and ease of use. Applicants can complete the form quickly and accurately on any device, reducing the chances of errors or omissions. This enhances the overall user experience, making it less daunting for applicants.

-

How does airSlate SignNow ensure the security of the Individual Credit Application New Hampshire?

airSlate SignNow takes the security of the Individual Credit Application New Hampshire seriously by implementing advanced encryption and compliance protocols. All data shared through the platform is secure, protecting sensitive information from unauthorized access. We prioritize your privacy and ensure a safe environment for managing credit applications.

Get more for Individual Credit Application New Hampshire

- Bibliography template ross valley school district form

- Uhdowntown police department citizens exchange of accident information accident location date uhd

- Enrollment form providers amerigroup

- Money insurance claim form important note please ensure your claim form is completed in full and returned within 7 days after

- Delaware attorney registration form

- Credit application 3 pages please complete this form in

- Bylaws amendment proposal form amfa local 32

- Confession of judgment example form

Find out other Individual Credit Application New Hampshire

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer