AP 202 Taxpayer Application to Participate in the CPA Audit Program Window State Tx Form

What is the AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State TX

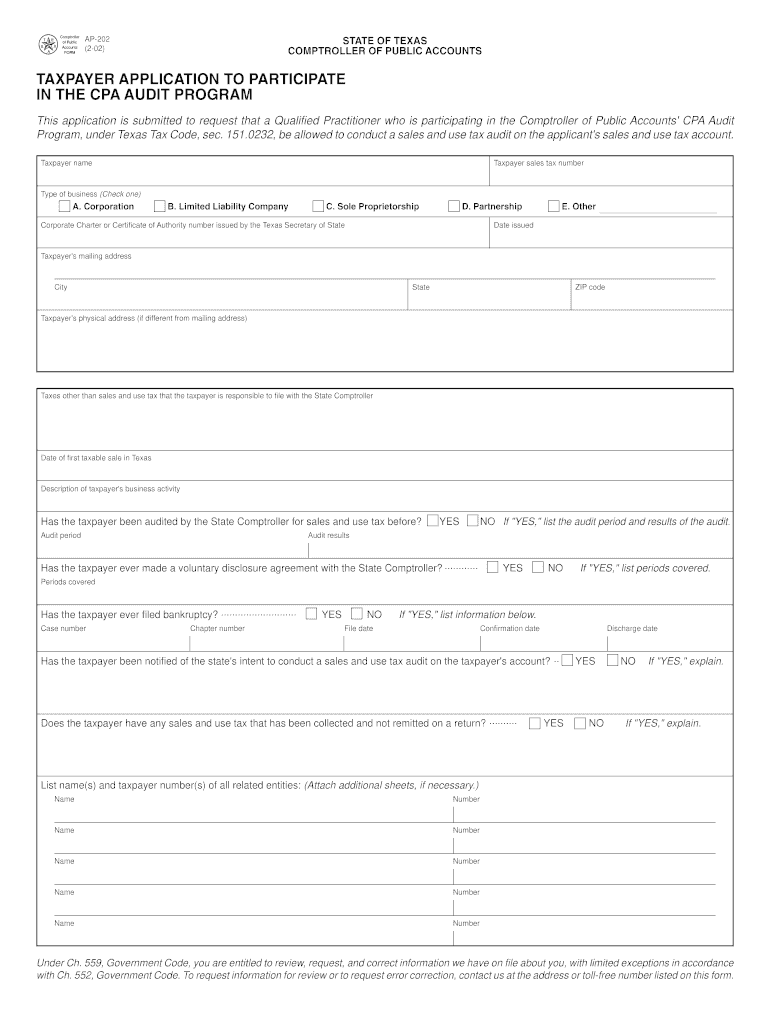

The AP 202 Taxpayer Application is a crucial document for individuals and businesses wishing to engage in the CPA Audit Program in Texas. This application allows taxpayers to formally express their intent to participate in the audit program, which is designed to ensure compliance with state tax laws. By submitting this application, taxpayers can benefit from a structured audit process that can help identify and rectify any discrepancies in their tax filings.

Steps to Complete the AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State TX

Completing the AP 202 application involves several key steps:

- Gather necessary information, including your taxpayer identification number, contact details, and relevant financial data.

- Carefully read the instructions provided with the application to understand the requirements.

- Fill out the application form accurately, ensuring all sections are completed.

- Review the application for any errors or missing information before submission.

- Submit the completed application through the designated method, whether online, by mail, or in person.

Legal Use of the AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State TX

The legal validity of the AP 202 application hinges on compliance with specific regulations governing eSignatures and document submissions. To ensure that the application is recognized legally, it must be signed using a compliant eSignature solution that meets the standards set forth by the ESIGN Act and UETA. This guarantees that the form is treated as a legally binding document, protecting both the taxpayer and the state in the audit process.

Eligibility Criteria for the AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State TX

To be eligible for the AP 202 application, taxpayers must meet certain criteria, including:

- Being a registered taxpayer in Texas.

- Having a valid taxpayer identification number.

- Maintaining compliance with state tax obligations.

- Being willing to undergo the audit process as outlined by the CPA program.

Required Documents for the AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State TX

When submitting the AP 202 application, it is essential to include specific documents to support your application. These may include:

- Proof of taxpayer identification, such as a Social Security number or Employer Identification Number.

- Recent tax returns or financial statements.

- Any correspondence with the Texas Comptroller's office related to tax matters.

Form Submission Methods for the AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State TX

The AP 202 application can be submitted through various methods to accommodate taxpayer preferences:

- Online submission via the Texas Comptroller's website, which may offer a streamlined process.

- Mailing the completed application to the designated office address.

- In-person submission at local tax offices, allowing for direct interaction with staff.

Quick guide on how to complete ap 202 taxpayer application to participate in the cpa audit program window state tx

Easily Prepare AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State Tx on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents promptly without delays. Manage AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State Tx on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Modify and eSign AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State Tx with Ease

- Locate AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State Tx and then click Get Form to commence.

- Utilize the tools at your disposal to finalize your document.

- Select important sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Edit and eSign AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State Tx to guarantee exceptional communication at any step of the form preparation procedure using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ap 202 taxpayer application to participate in the cpa audit program window state tx

How to make an eSignature for your Ap 202 Taxpayer Application To Participate In The Cpa Audit Program Window State Tx in the online mode

How to generate an electronic signature for the Ap 202 Taxpayer Application To Participate In The Cpa Audit Program Window State Tx in Google Chrome

How to make an electronic signature for signing the Ap 202 Taxpayer Application To Participate In The Cpa Audit Program Window State Tx in Gmail

How to generate an eSignature for the Ap 202 Taxpayer Application To Participate In The Cpa Audit Program Window State Tx from your smart phone

How to create an eSignature for the Ap 202 Taxpayer Application To Participate In The Cpa Audit Program Window State Tx on iOS

How to create an eSignature for the Ap 202 Taxpayer Application To Participate In The Cpa Audit Program Window State Tx on Android

People also ask

-

What is airSlate SignNow's ap 202 feature?

The ap 202 feature in airSlate SignNow allows users to streamline the document signing process. It provides businesses with an efficient way to manage electronic signatures, reducing turnaround time signNowly. This feature ensures compliance and enhances the overall workflow for document handling.

-

How much does airSlate SignNow's ap 202 solution cost?

airSlate SignNow offers competitive pricing for its ap 202 solution, making it accessible for businesses of all sizes. Pricing varies based on the number of users and features selected. For exact pricing details, it's best to contact our sales team or visit our pricing page.

-

What are the key benefits of using the ap 202 features in airSlate SignNow?

The ap 202 features in airSlate SignNow enhance productivity and improve document security. Users can eSign documents from anywhere, at any time, ensuring a faster workflow. Additionally, the integration of advanced technologies provides a user-friendly experience that reduces errors.

-

Can I integrate airSlate SignNow's ap 202 with other tools?

Yes, airSlate SignNow's ap 202 solution supports seamless integration with numerous third-party applications. This allows businesses to incorporate electronic signing into their existing workflows effectively. Integration options include CRM systems, cloud storage, and productivity tools.

-

Is airSlate SignNow's ap 202 compatible with mobile devices?

Absolutely! The ap 202 features in airSlate SignNow are fully optimized for mobile devices. This ensures that users can send, sign, and manage documents on-the-go with ease, allowing flexibility and efficiency in document workflows.

-

How does airSlate SignNow's ap 202 ensure document security?

airSlate SignNow prioritizes document security with its ap 202 features, utilizing encryption and secure access controls. All documents signed through the platform are stored securely, guaranteeing compliance with legal standards. This helps build trust with your clients and partners.

-

What types of documents can be signed with airSlate SignNow's ap 202?

With airSlate SignNow's ap 202, users can sign a variety of document types, including contracts, agreements, and forms. This versatility makes it ideal for various industries, from real estate to legal services. You can easily upload and manage any document type for eSigning.

Get more for AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State Tx

Find out other AP 202 Taxpayer Application To Participate In The CPA Audit Program Window State Tx

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple