Chapter 13 Plan Form

What is the Chapter 13 Plan

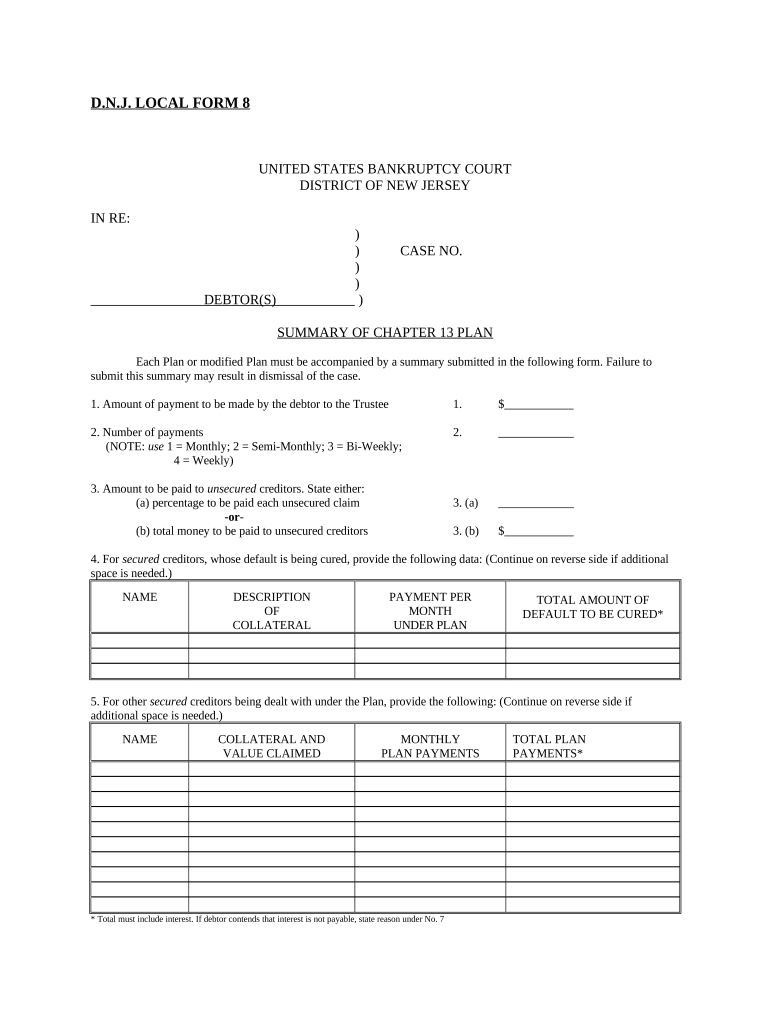

The Chapter 13 Plan is a legal framework that allows individuals with a regular income to reorganize their debts and create a repayment plan over a period of three to five years. This plan is designed for those who wish to keep their assets while paying off debts in a manageable way. It is often used by individuals facing financial difficulties, enabling them to avoid foreclosure or repossession of property. The plan must be approved by the bankruptcy court and outlines how debts will be repaid, including the amount and frequency of payments.

Key elements of the Chapter 13 Plan

A well-structured Chapter 13 Plan includes several key elements that must be addressed for court approval:

- Payment Amount: The plan must specify how much the debtor will pay each month.

- Duration: The repayment period typically lasts between three to five years.

- Debt Classification: The plan must categorize debts as secured, unsecured, or priority, influencing how they are treated in the repayment process.

- Feasibility: The debtor must demonstrate that the plan is feasible based on their income and expenses.

- Compliance with Bankruptcy Code: The plan must adhere to the requirements set forth in the Bankruptcy Code.

Steps to complete the Chapter 13 Plan

Completing a Chapter 13 Plan involves several important steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements, tax returns, and a list of debts.

- Draft the Plan: Create a detailed repayment plan that outlines how debts will be paid over the specified period.

- File the Plan: Submit the Chapter 13 Plan to the bankruptcy court along with the required forms and fees.

- Attend the Confirmation Hearing: Participate in a court hearing where the judge will review and approve the plan.

- Make Payments: Begin making payments according to the approved plan once it is confirmed by the court.

Legal use of the Chapter 13 Plan

The legal use of the Chapter 13 Plan is governed by federal bankruptcy law. It allows individuals to restructure their debts while maintaining their property. The plan must be proposed in good faith and must comply with the requirements of the Bankruptcy Code. Once approved, the plan becomes a legally binding agreement between the debtor and creditors, providing protection from collection actions during the repayment period.

Eligibility Criteria

To qualify for a Chapter 13 Plan, individuals must meet specific eligibility criteria:

- Regular Income: The debtor must have a consistent source of income to fund the repayment plan.

- Debt Limits: The total amount of secured and unsecured debts must fall below certain thresholds set by the Bankruptcy Code.

- Residency: The debtor must reside in the United States or have a domicile or place of business in the country for at least 180 days before filing.

Required Documents

Filing a Chapter 13 Plan requires several documents to be submitted to the court, including:

- Bankruptcy Petition: The formal request for bankruptcy protection.

- Schedules of Assets and Liabilities: Detailed lists of all assets and debts.

- Income Documentation: Proof of income, such as pay stubs or tax returns.

- Debt Repayment Plan: The proposed Chapter 13 Plan outlining how debts will be repaid.

Quick guide on how to complete chapter 13 plan 497319371

Complete Chapter 13 Plan effortlessly on any device

Online document management has gained momentum among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly and without issues. Manage Chapter 13 Plan on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Chapter 13 Plan effortlessly

- Obtain Chapter 13 Plan and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to retain your changes.

- Choose how you want to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Chapter 13 Plan and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a chapter 13 plan?

A chapter 13 plan is a repayment plan that allows individuals with a regular income to pay back all or a portion of their debts over three to five years. The plan is submitted to the court for approval, ensuring creditors receive payment while the individual can retain their assets.

-

How does a chapter 13 plan work?

In a chapter 13 plan, debtors propose a repayment schedule based on their income and expenses, allowing them to repay their debts within a specified timeframe. Upon successfully completing the plan, remaining dischargeable debts may be forgiven, providing a path to financial recovery.

-

What are the benefits of a chapter 13 plan?

The benefits of a chapter 13 plan include the ability to keep your home and other assets while managing debt payments. It can help prevent foreclosure and provide a structured way to pay off debts, making it a favorable option for individuals facing financial difficulties.

-

Are there any fees associated with submitting a chapter 13 plan?

Yes, there are fees associated with filing a chapter 13 plan, including court fees and attorney fees. These costs vary by location and the complexity of your financial situation, but many individuals find that the benefits of the plan outweigh the initial investment.

-

Can I modify my chapter 13 plan if my situation changes?

Yes, you can modify your chapter 13 plan if your financial situation changes signNowly. If you experience a loss of income or incur unexpected expenses, you can request a modification to the court, which can adjust your repayment terms accordingly.

-

How long does a chapter 13 plan last?

A chapter 13 plan typically lasts between three to five years, depending on your income level and the total amount of debt. The court will review and approve the plan, ensuring that it is feasible given your financial circumstances.

-

What happens if I miss a payment on my chapter 13 plan?

If you miss a payment on your chapter 13 plan, it could lead to serious consequences, including the dismissal of your case. It’s crucial to communicate with your attorney and the bankruptcy trustee if you anticipate difficulties making payments to explore options for modification.

Get more for Chapter 13 Plan

- How t fill universal standard application for state aided public housing mrvp and ahvp sample form

- Check in form 6903102

- Appointment letter format 549306857

- Supervisionsbescheinigung rztekammer schleswig holstein aeksh form

- What is sicid form for state of ca

- Thrdpdf revisions for marilynwp to pdf donecsd1001a wpd casb uscourts form

- Job application letter samples letter for job application form

- Between employer and employee contract template form

Find out other Chapter 13 Plan

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form