Non Foreign Affidavit under IRC 1445 New Jersey Form

What is the Non Foreign Affidavit Under IRC 1445 New Jersey

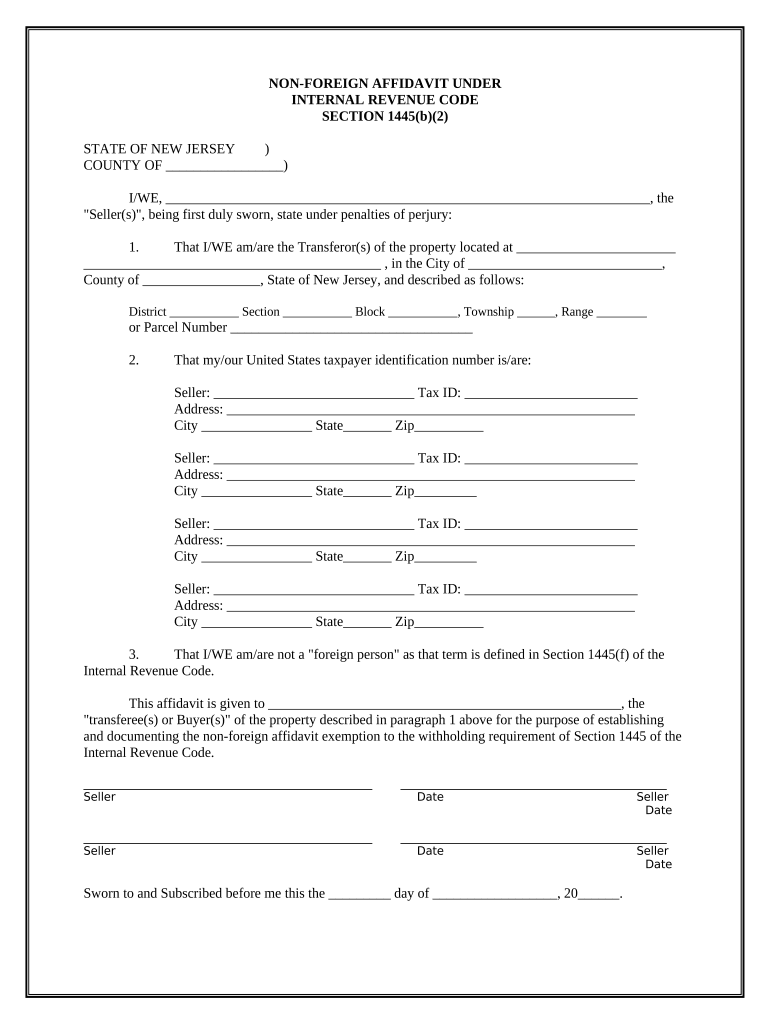

The Non Foreign Affidavit Under IRC 1445 is a legal document required in New Jersey for certain transactions involving real estate. This affidavit is primarily used to certify that the seller of the property is not a foreign person, as defined by the Internal Revenue Code. The purpose of this form is to ensure compliance with tax regulations and to avoid withholding taxes that may apply to foreign sellers. Proper completion of this affidavit is essential for both buyers and sellers to facilitate a smooth transaction.

How to use the Non Foreign Affidavit Under IRC 1445 New Jersey

Using the Non Foreign Affidavit Under IRC 1445 involves several steps to ensure that the document is filled out correctly. First, the seller must provide accurate personal information, including their name, address, and tax identification number. Next, the seller must confirm their status as a non-foreign person by checking the appropriate box on the form. It is important to sign and date the affidavit in the presence of a notary public to validate the document. After completing the affidavit, it should be submitted to the buyer or their representative as part of the closing process.

Steps to complete the Non Foreign Affidavit Under IRC 1445 New Jersey

Completing the Non Foreign Affidavit Under IRC 1445 requires careful attention to detail. Follow these steps:

- Gather necessary personal information, including your name, address, and tax identification number.

- Indicate your non-foreign status by checking the appropriate box on the form.

- Provide any additional information required by the form, such as the property address.

- Sign and date the affidavit in front of a notary public to ensure its legal validity.

- Submit the completed affidavit to the buyer or their agent prior to the closing of the real estate transaction.

Key elements of the Non Foreign Affidavit Under IRC 1445 New Jersey

The Non Foreign Affidavit Under IRC 1445 contains several key elements that must be included for it to be valid. These elements include:

- The seller's full name and contact information.

- A statement confirming that the seller is not a foreign person.

- The property address involved in the transaction.

- The seller's tax identification number.

- The seller's signature, dated and notarized.

Legal use of the Non Foreign Affidavit Under IRC 1445 New Jersey

The legal use of the Non Foreign Affidavit Under IRC 1445 is crucial for compliance with federal tax laws. By certifying that the seller is not a foreign entity, the affidavit protects the buyer from potential tax liabilities associated with foreign transactions. It is important for both parties involved in the real estate transaction to understand the significance of this affidavit, as it plays a vital role in the closing process and ensures adherence to tax regulations.

State-specific rules for the Non Foreign Affidavit Under IRC 1445 New Jersey

In New Jersey, specific rules govern the use of the Non Foreign Affidavit Under IRC 1445. These rules include requirements for notarization, the necessity of providing accurate information, and the obligation to submit the affidavit during the real estate closing process. Additionally, New Jersey law mandates that any errors or omissions in the affidavit may lead to complications in the transaction, including potential tax implications. Therefore, it is essential to follow state-specific guidelines carefully when completing this form.

Quick guide on how to complete non foreign affidavit under irc 1445 new jersey

Prepare Non Foreign Affidavit Under IRC 1445 New Jersey effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, enabling you to obtain the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without any hold-ups. Manage Non Foreign Affidavit Under IRC 1445 New Jersey on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Non Foreign Affidavit Under IRC 1445 New Jersey without any hassle

- Obtain Non Foreign Affidavit Under IRC 1445 New Jersey and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Non Foreign Affidavit Under IRC 1445 New Jersey and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 in New Jersey?

A Non Foreign Affidavit Under IRC 1445 in New Jersey is a crucial document for foreign sellers of real estate. It verifies that the seller is not a foreign individual, thereby mitigating potential withholding taxes. Understanding and properly executing this affidavit is key to ensuring compliance with the IRS regulations.

-

How does airSlate SignNow facilitate the signing of a Non Foreign Affidavit Under IRC 1445 in New Jersey?

airSlate SignNow provides an intuitive platform for creating and sending a Non Foreign Affidavit Under IRC 1445 in New Jersey. With its user-friendly eSignature tools, you can streamline your document management process and ensure timely signatures. This efficiency allows businesses to focus on completing transactions rather than grappling with paperwork.

-

What are the pricing options for airSlate SignNow when dealing with a Non Foreign Affidavit Under IRC 1445 in New Jersey?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs for handling documents like the Non Foreign Affidavit Under IRC 1445 in New Jersey. Plans typically include packages for small businesses and enterprise solutions, ensuring cost-effective access to essential eSignature features. You can choose a plan that aligns with your specific volume and usage requirements.

-

What features does airSlate SignNow offer for Non Foreign Affidavit Under IRC 1445 in New Jersey?

airSlate SignNow includes multiple features crucial for managing a Non Foreign Affidavit Under IRC 1445 in New Jersey efficiently. Key features include drag-and-drop document creation, cloud storage, secure eSignatures, and real-time tracking of document status. These features enhance your workflow and ensure that important documents are managed effectively.

-

Can I integrate airSlate SignNow with other platforms for the Non Foreign Affidavit Under IRC 1445 in New Jersey?

Yes, airSlate SignNow offers integrations with various platforms to enhance your document workflow, including CRMs and cloud storage solutions tailored for handling Non Foreign Affidavit Under IRC 1445 in New Jersey. These integrations allow for seamless data sharing and streamline your business processes. This connectivity ensures that your documents are always up-to-date and easily accessible.

-

What are the benefits of using airSlate SignNow for the Non Foreign Affidavit Under IRC 1445 in New Jersey?

Using airSlate SignNow for the Non Foreign Affidavit Under IRC 1445 in New Jersey provides numerous benefits, including enhanced security, convenience, and compliance. The platform allows for quick electronic signatures, reducing turnaround times and improving efficiency. Furthermore, its focus on compliance helps ensure that you meet all necessary legal obligations without hassle.

-

Is mobile access available for managing the Non Foreign Affidavit Under IRC 1445 in New Jersey with airSlate SignNow?

Absolutely, airSlate SignNow is accessible on mobile devices, allowing you to manage your Non Foreign Affidavit Under IRC 1445 in New Jersey from anywhere. This flexibility ensures that you can send, sign, and store documents on the go. Whether in the office or out in the field, you can maintain productivity with mobile access.

Get more for Non Foreign Affidavit Under IRC 1445 New Jersey

Find out other Non Foreign Affidavit Under IRC 1445 New Jersey

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed