Ct 33 D Fillable Form

What is the Ct 33 D Fillable

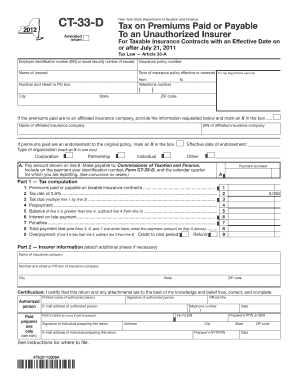

The Ct 33 D fillable form is a tax document used primarily in the state of Connecticut. It is designed for businesses to report their income and calculate the amount of tax owed. This form is essential for corporations, partnerships, and other business entities operating within the state. By utilizing the fillable version, users can easily input their data electronically, ensuring a more efficient and accurate filing process.

How to use the Ct 33 D Fillable

Using the Ct 33 D fillable form involves several straightforward steps. First, access the form through a reliable source, ensuring it is the most current version. Fill in the required fields, including business identification details, income figures, and deductions. The fillable format allows for automatic calculations, reducing the risk of errors. Once completed, the form can be saved, printed, or submitted electronically, depending on the filing requirements.

Steps to complete the Ct 33 D Fillable

Completing the Ct 33 D fillable form requires careful attention to detail. Follow these steps for successful completion:

- Download the latest version of the Ct 33 D fillable form.

- Enter your business name, address, and identification number in the designated fields.

- Input your total income and any applicable deductions or credits.

- Review the automatic calculations provided by the form.

- Ensure all information is accurate and complete before submission.

Legal use of the Ct 33 D Fillable

The Ct 33 D fillable form is legally recognized for tax reporting purposes in Connecticut. To ensure its validity, it must be completed accurately and submitted by the designated deadlines. Compliance with state tax laws is essential to avoid penalties. The form must be signed by an authorized representative of the business, affirming that the information provided is true and correct to the best of their knowledge.

Form Submission Methods

The Ct 33 D fillable form can be submitted through various methods, catering to different preferences and requirements:

- Online Submission: Many businesses opt to file electronically through the Connecticut Department of Revenue Services website.

- Mail: Completed forms can be printed and mailed to the appropriate tax office.

- In-Person: Some businesses may choose to submit the form in person at designated state offices.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 33 D fillable form are crucial for compliance. Typically, the form is due on the fifteenth day of the fourth month following the end of the business's fiscal year. It is important to check for any specific extensions or changes in deadlines that may apply. Keeping track of these dates helps avoid late fees and penalties associated with non-compliance.

Quick guide on how to complete ct 33 d fillable

Complete Ct 33 D Fillable seamlessly on any gadget

Digital document administration has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, alter, and electronically sign your documents rapidly without interruptions. Handle Ct 33 D Fillable on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and electronically sign Ct 33 D Fillable effortlessly

- Locate Ct 33 D Fillable and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal weight as a standard wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Decide how you would like to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and electronically sign Ct 33 D Fillable and ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 33 d fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form ct 33 d?

The form ct 33 d is used for reporting certain tax activities in Connecticut. It helps businesses comply with state regulations by providing necessary information for tax assessments and filings. Utilizing this form is crucial for avoiding penalties and ensuring accurate tax reporting.

-

How can airSlate SignNow help with form ct 33 d?

airSlate SignNow simplifies the process of managing and eSigning documents such as form ct 33 d. Our platform allows you to electronically fill out, sign, and send this form securely, eliminating the need for physical paperwork. This streamlines your workflow and speeds up the submission process.

-

Is airSlate SignNow cost-effective for handling form ct 33 d?

Yes, airSlate SignNow offers a cost-effective solution for managing the form ct 33 d. Our competitive pricing plans are designed to fit various business sizes, ensuring that you can use our services without exceeding your budget. You save both time and money by digitizing your document management.

-

What features does airSlate SignNow offer for form ct 33 d management?

airSlate SignNow provides a range of features that enhance the management of form ct 33 d. These include customizable templates, an intuitive interface, and robust security measures to protect sensitive information. Additionally, our platform supports real-time collaboration, making it easier for multiple stakeholders to engage with the form.

-

Can I integrate airSlate SignNow with other software for form ct 33 d processing?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing for a streamlined process in handling form ct 33 d. Whether you use CRM systems, HR software, or cloud storage services, our integrations help you maintain a smooth workflow and centralize your document management.

-

How does airSlate SignNow ensure the security of my form ct 33 d?

Security is a top priority for airSlate SignNow when handling documents like form ct 33 d. We employ advanced encryption techniques and comply with industry standards to safeguard data. This ensures that your sensitive tax information remains protected throughout the entire signing and submission process.

-

Is it easy to track the status of my form ct 33 d with airSlate SignNow?

Yes, airSlate SignNow makes it easy to track the status of your form ct 33 d. Our platform provides real-time notifications and a comprehensive dashboard that allows you to see who has signed the document and what stage it's currently at. This feature enhances transparency and helps you manage your compliance efficiently.

Get more for Ct 33 D Fillable

- De casus in kaart form

- Environmental rating scale checklist form

- Cherokee nation duplicate title form

- 14 team double elimination bracket 212330068 form

- Affidavit of separation from employment form

- Maslow s hierarchy of needs form

- Missouri voter registration form online

- Disability questionnaire 26676066 form

Find out other Ct 33 D Fillable

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple