New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate New Jersey Form

What is the New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey

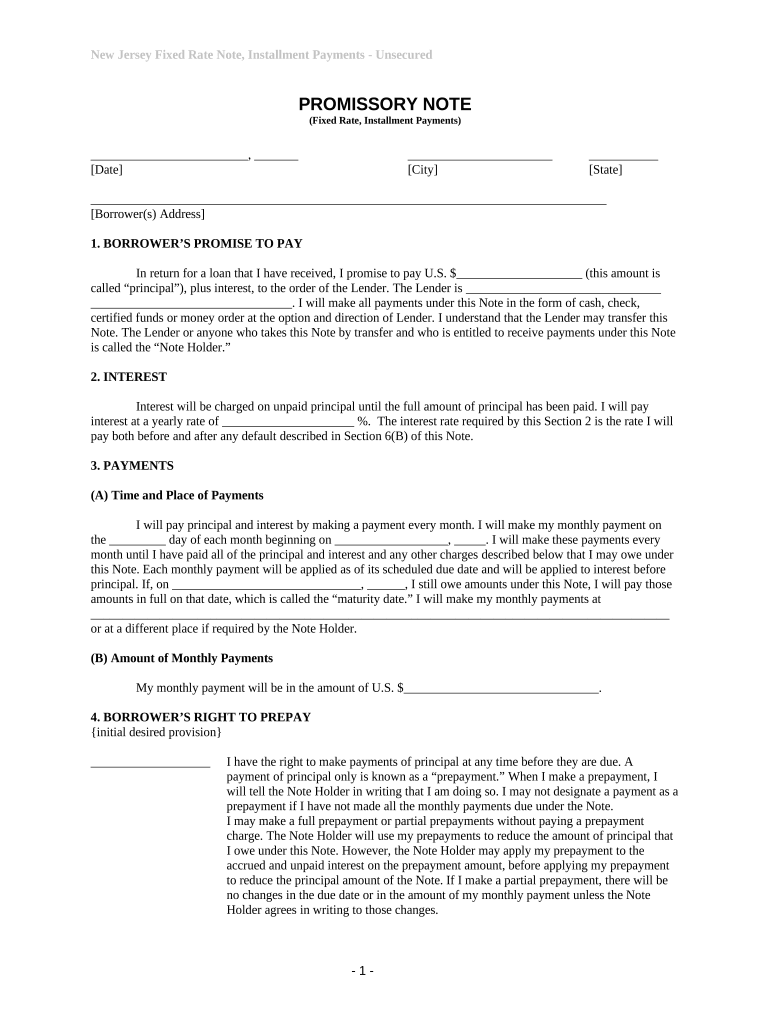

The New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms of a loan agreement between a borrower and a lender. This note specifies the amount borrowed, the interest rate, the repayment schedule, and any other relevant terms. Since it is unsecured, it does not require collateral, making it essential for personal loans where the lender relies on the borrower's creditworthiness rather than physical assets.

Key Elements of the New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey

This promissory note includes several critical components:

- Borrower and Lender Information: Names and addresses of both parties.

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the loan.

- Repayment Schedule: Details on how and when payments will be made.

- Default Terms: Conditions under which the borrower may default on the loan.

- Governing Law: Specifies that New Jersey law governs the agreement.

Steps to Complete the New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey

Completing the promissory note involves several straightforward steps:

- Gather necessary information about the borrower and lender.

- Clearly state the loan amount and interest rate.

- Outline the repayment schedule, including payment dates and amounts.

- Include any additional terms, such as late fees or prepayment options.

- Both parties should review the document for accuracy.

- Sign and date the note to make it legally binding.

Legal Use of the New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey

This promissory note is legally binding when properly executed, meaning it must be signed by both parties. It is important to ensure compliance with New Jersey's laws regarding loan agreements. The document must clearly outline the terms to protect both the lender's and borrower's rights. In case of disputes, the note serves as evidence in court, making its accuracy and clarity crucial.

How to Obtain the New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey

The promissory note can typically be obtained through legal document services, financial institutions, or online templates specifically designed for New Jersey residents. It is advisable to use a template that complies with state laws to ensure that all necessary elements are included. Consulting with a legal professional can also provide guidance on drafting a note that meets individual needs.

Examples of Using the New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey

This type of promissory note is commonly used in various scenarios, such as:

- Personal loans between friends or family members.

- Loans for purchasing a vehicle or financing home improvements.

- Small business loans where collateral is not available.

Quick guide on how to complete new jersey unsecured installment payment promissory note for fixed rate new jersey

Effortlessly Prepare New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, alter, and electronically sign your documents swiftly without delays. Manage New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey Effortlessly

- Find New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey and click Get Form to initiate.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey?

A New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey is a legally binding document that outlines the terms of a loan with fixed repayment amounts over a specified period. This document is ideal for borrowers seeking flexible payment options without needing to secure the loan with collateral.

-

How does the New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey benefit borrowers?

The New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey provides borrowers with clear repayment terms and stability through fixed rates. It allows borrowers to budget their finances effectively, thus avoiding fluctuations in payment amounts.

-

What features can I expect with the New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey?

Key features of the New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey include customizable repayment schedules, straightforward interest calculations, and an easy-to-understand format. This makes it user-friendly for both lenders and borrowers.

-

Is it easy to create a New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey using airSlate SignNow?

Yes, creating a New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey using airSlate SignNow is straightforward. The platform provides templates and step-by-step guidance, enabling users to customize their documents quickly and efficiently.

-

What are the pricing options for obtaining a New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey?

Pricing for a New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey may vary based on your specific needs and the features you choose. airSlate SignNow offers a cost-effective solution that allows you to manage documents efficiently without breaking the bank.

-

Can I eSign my New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey?

Absolutely! With airSlate SignNow, you can easily eSign your New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey. The platform ensures that all eSignatures are legally binding and secure, streamlining the signing process for all parties involved.

-

What integrations are available for the New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey?

airSlate SignNow seamlessly integrates with various applications such as CRM systems, cloud storage services, and payment processors, enhancing the usability of the New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey. This allows for a more efficient workflow and data management.

Get more for New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey

- 15 rules on how to answer an office phone professionally form

- Cover sheet for return of completed private physician forms

- Uihealthcare email form

- Gp5479us form hancock

- Club insurance request form usa table tennis usatt

- Instructions to complete this order please fill out this form

- Property loss report rmcumc form

- Doctor webmd compracticedes moines universitydes moines university clinic in des moines ia webmd form

Find out other New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate New Jersey

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free