Transfer Death Deed Form

What is the Transfer Death Deed

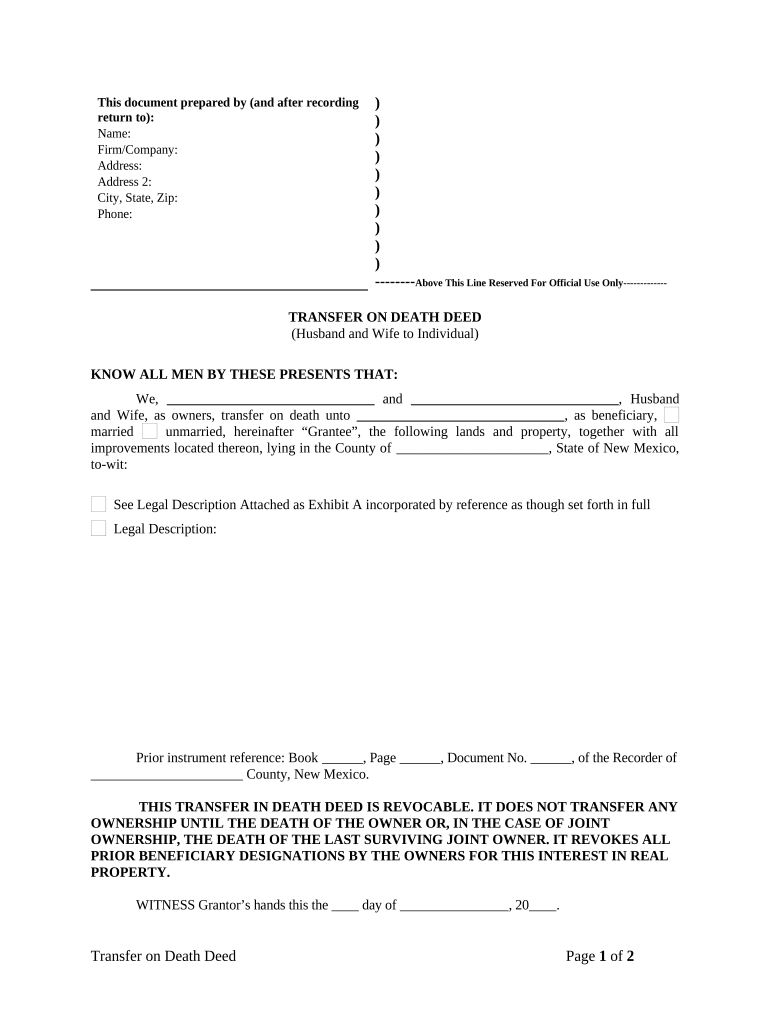

The Transfer Death Deed is a legal document that allows a property owner in New Mexico to designate a beneficiary who will automatically receive the property upon the owner's death. This deed simplifies the transfer process, avoiding the lengthy probate proceedings typically required for property inheritance. By executing this deed, property owners can ensure that their assets are transferred directly to their chosen beneficiaries without the need for court intervention.

How to use the Transfer Death Deed

To use the Transfer Death Deed effectively, the property owner must complete the form with accurate details, including the legal description of the property and the beneficiary's information. Once filled out, the deed must be signed in the presence of a notary public to ensure its validity. After notarization, the completed deed should be recorded with the county clerk's office where the property is located. This recording makes the transfer effective upon the owner's death.

Steps to complete the Transfer Death Deed

Completing the Transfer Death Deed involves several key steps:

- Obtain the official Transfer Death Deed form from a reliable source.

- Fill in the property details, including the legal description and the names of the beneficiaries.

- Sign the document in front of a notary public to authenticate the signatures.

- File the notarized deed with the county clerk's office to make the transfer legally binding.

Key elements of the Transfer Death Deed

Several key elements must be included in the Transfer Death Deed to ensure its legality and effectiveness:

- The full name and address of the property owner.

- The legal description of the property being transferred.

- The name and contact information of the designated beneficiary.

- The signature of the property owner, along with the date.

- The signature and seal of a notary public.

Legal use of the Transfer Death Deed

The legal use of the Transfer Death Deed is governed by New Mexico state law. It is essential that the deed is executed in compliance with these laws to ensure it is recognized by courts and other legal entities. The deed must be properly recorded to be enforceable, and it should clearly outline the intentions of the property owner regarding the transfer of their assets upon death.

State-specific rules for the Transfer Death Deed

New Mexico has specific rules regarding the execution and recording of the Transfer Death Deed. These include:

- The requirement for notarization to validate the document.

- The necessity of recording the deed with the county clerk's office to effectuate the transfer.

- Provisions that allow for multiple beneficiaries, should the property owner choose to designate more than one.

Quick guide on how to complete transfer death deed 497319876

Effortlessly Prepare Transfer Death Deed on Any Device

The management of online documents has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without delays. Manage Transfer Death Deed across any platform using the airSlate SignNow applications for Android or iOS and simplify your document-related processes today.

How to Modify and eSign Transfer Death Deed with Ease

- Locate Transfer Death Deed and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using the tools designed by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal weight as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method for submitting your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors necessitating the printing of new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your device of choice. Edit and eSign Transfer Death Deed and guarantee exceptional communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New Mexico transfer death deed form?

A New Mexico transfer death deed form is a legal document that allows property owners to transfer their property to beneficiaries upon their death without going through probate. This form simplifies the transfer process and ensures that your assets are distributed according to your wishes.

-

How do I complete a New Mexico transfer death deed form?

To complete a New Mexico transfer death deed form, you need to provide essential information about the property and the beneficiaries. Make sure to accurately fill in all required fields and have the form signed in the presence of a notary public to ensure its legality.

-

Is there a cost associated with the New Mexico transfer death deed form?

While the New Mexico transfer death deed form itself is not expensive, there may be fees for notary services and county recording. airSlate SignNow offers an affordable way to create and manage your documents digitally, often saving you time and money.

-

What are the benefits of using airSlate SignNow for my New Mexico transfer death deed form?

Using airSlate SignNow for your New Mexico transfer death deed form provides a convenient, secure, and efficient way to create, sign, and store your documents. Our platform simplifies the eSigning process and allows you to manage your legal documents from anywhere.

-

Can I edit my New Mexico transfer death deed form after signing?

Once a New Mexico transfer death deed form is signed and finalized, it cannot be edited or revoked. Therefore, it's essential to review all details carefully before signing to ensure accuracy and legality.

-

Does airSlate SignNow offer integrations for managing New Mexico transfer death deed forms?

Yes, airSlate SignNow offers various integrations with popular business applications, making it easier to manage your New Mexico transfer death deed form alongside other documents. Integrations streamline your workflow and enhance your document management capabilities.

-

How secure is my New Mexico transfer death deed form when using airSlate SignNow?

Your New Mexico transfer death deed form is protected by advanced security measures when using airSlate SignNow. We employ encryption and secure cloud storage to ensure that your sensitive information remains confidential and safe from unauthorized access.

Get more for Transfer Death Deed

- Printable educational leader checklist form

- Disclosure of ownership and control interest statement cdph 276 d form

- Parental consent form from lions club to test vision rvschools

- Remistart enrollment form pacific infusion center therxconnect

- Find form sfn 17156

- Hud form 50058 pdf 2453

- Hfhp provider claim dispute request form health first healthfirsthealthplans

- Unemployment benefit student hardship application form studylink

Find out other Transfer Death Deed

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free