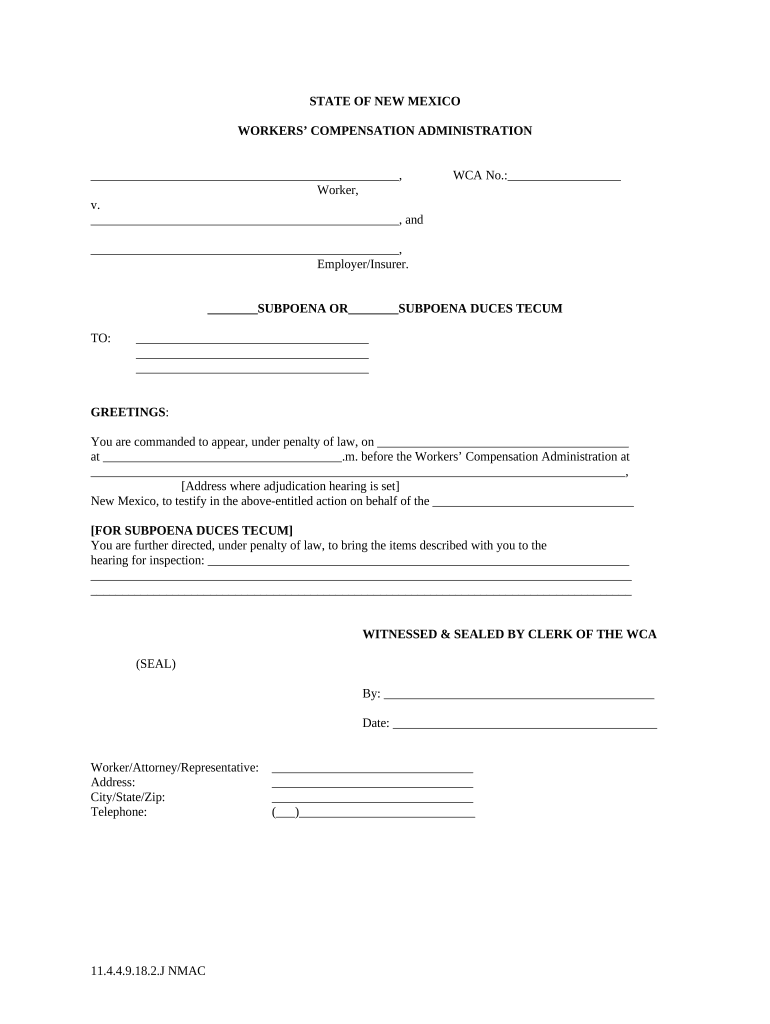

New Mexico Compensation Form

What is the New Mexico Compensation?

The New Mexico Compensation refers to a set of guidelines and forms that govern the compensation process for workers in New Mexico. This includes various aspects of employee compensation, such as wages, benefits, and other forms of remuneration. Understanding these guidelines is crucial for both employers and employees to ensure compliance with state laws and regulations.

How to Obtain the New Mexico Compensation

To obtain the New Mexico Compensation forms, individuals can visit the official New Mexico state government website or contact the New Mexico Department of Workforce Solutions. These resources provide access to the necessary forms and information regarding the compensation process. It is important to ensure that the correct forms are used to avoid delays or issues in processing.

Steps to Complete the New Mexico Compensation

Completing the New Mexico Compensation form involves several key steps:

- Gather necessary information, including personal details, employment history, and compensation specifics.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or missing information.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Legal Use of the New Mexico Compensation

The legal use of the New Mexico Compensation forms is governed by state law. To be considered valid, the forms must be completed in accordance with the guidelines established by the New Mexico Department of Workforce Solutions. This includes adhering to deadlines, providing accurate information, and obtaining necessary signatures where applicable.

Key Elements of the New Mexico Compensation

Key elements of the New Mexico Compensation include:

- Employee identification information, including name and Social Security number.

- Details of employment, such as job title and duration of employment.

- Specifics regarding compensation, including wages, bonuses, and benefits.

- Signatures of both the employee and employer to validate the form.

State-Specific Rules for the New Mexico Compensation

New Mexico has specific rules that govern the compensation process. These rules include minimum wage requirements, overtime pay regulations, and guidelines for employee benefits. Employers must familiarize themselves with these rules to ensure compliance and avoid potential legal issues.

Quick guide on how to complete new mexico compensation 497319883

Complete New Mexico Compensation seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage New Mexico Compensation on any platform via the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The easiest way to modify and eSign New Mexico Compensation effortlessly

- Locate New Mexico Compensation and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to store your changes.

- Choose how you would like to share your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you prefer. Modify and eSign New Mexico Compensation and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is new mexico compensation and how can airSlate SignNow assist with it?

New Mexico compensation refers to the benefits and reimbursements provided to employees who are injured on the job or face work-related issues. airSlate SignNow streamlines the process of creating, signing, and managing compensation documents, making it easier for businesses to handle claims and ensure compliance with local regulations.

-

How much does airSlate SignNow cost for handling new mexico compensation documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses managing new Mexico compensation documents. The subscription plans are competitively priced and allow companies to choose a package that suits their document signing frequency and team size.

-

What features does airSlate SignNow offer for new mexico compensation claims?

airSlate SignNow provides features such as document templates, customizable workflows, and real-time tracking for new Mexico compensation claims. These features help reduce paperwork and save time, ensuring that all necessary documentation is efficiently processed.

-

How can airSlate SignNow improve the efficiency of new mexico compensation processing?

By using airSlate SignNow, businesses can automate the signing and processing of new Mexico compensation documents, eliminating the delays typically associated with manual handling. This efficiency leads to faster response times for claims and improved overall claimant satisfaction.

-

Does airSlate SignNow integrate with other tools for managing new mexico compensation?

Yes, airSlate SignNow integrates seamlessly with various business tools and applications, making it easier to manage new Mexico compensation claims within existing workflows. Popular integrations include CRM systems, project management software, and accounting tools.

-

Is airSlate SignNow secure for handling sensitive new mexico compensation information?

Absolutely, airSlate SignNow prioritizes the security of all documents, including sensitive new Mexico compensation information. With features like advanced encryption and secure cloud storage, businesses can trust that their data is protected at all times.

-

Can airSlate SignNow help ensure compliance with new mexico compensation laws?

Yes, airSlate SignNow is designed to help businesses stay compliant with new Mexico compensation laws by providing access to the latest regulatory requirements. Automated workflows and templates ensure that users can easily create compliant documents without legal oversights.

Get more for New Mexico Compensation

- Ohio cacfp policy is that infant under one year of age meal counts be recorded by individual childs name form

- Food and safety license form

- Purchase agreement and invoice amway australia form

- International roaming application form airtel

- Wfnj 1j 37547421 form

- Proxy form for intermediary or 3rd party capago capago

- Formulaire p4 pl cerfa n 1193202 d claration de cessation d araplbpl

- Www co monterey ca usplanning services 11318planning servicesmonterey county ca form

Find out other New Mexico Compensation

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter