New Mexico Form

What is the New Mexico Form

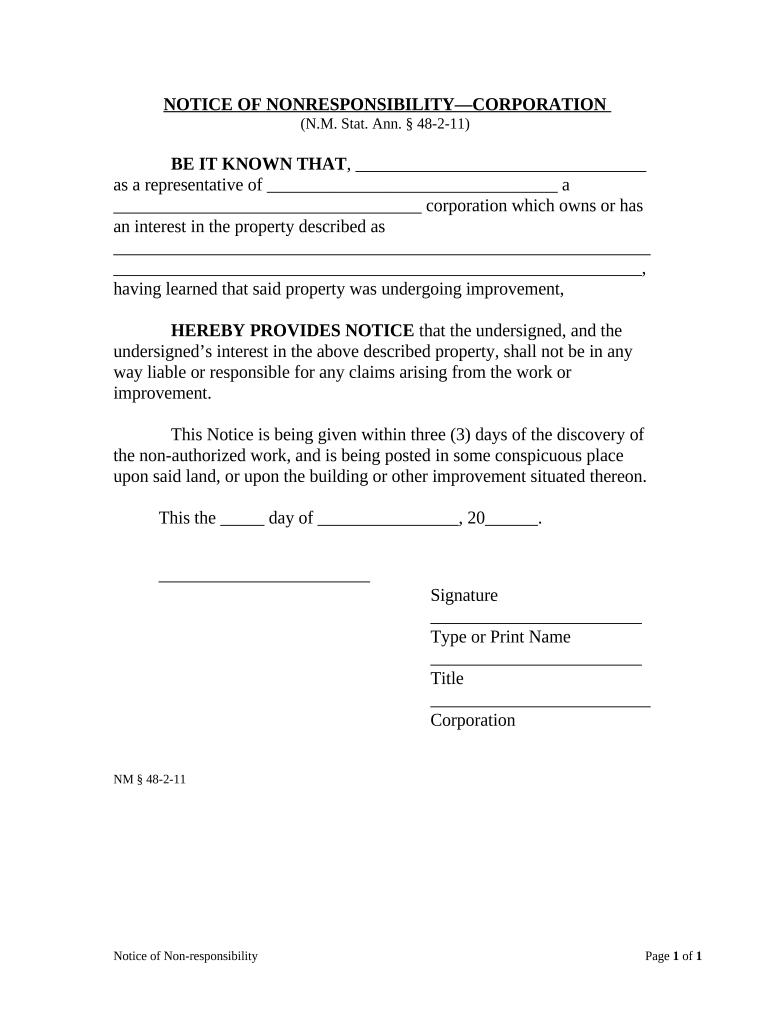

The New Mexico form is a crucial document used for various legal and administrative purposes within the state. It serves as a standardized method for individuals and businesses to submit necessary information to government agencies. Understanding the specific type of New Mexico form you need is essential, as there are different variants tailored for specific applications, such as tax filings, business registrations, or legal notices.

How to use the New Mexico Form

Using the New Mexico form involves several straightforward steps. First, ensure you have the correct version of the form for your specific needs. Next, fill out the required fields accurately, providing all necessary information. It is important to review the form for any errors before submission. Finally, submit the completed form through the designated method, whether online, by mail, or in person, depending on the specific requirements of the form.

Steps to complete the New Mexico Form

Completing the New Mexico form requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the correct New Mexico form from a reliable source.

- Read the instructions carefully to understand the requirements.

- Fill in your personal or business information as required.

- Double-check all entries for accuracy.

- Sign and date the form if required.

- Submit the form according to the instructions provided.

Legal use of the New Mexico Form

The legal use of the New Mexico form is governed by state laws and regulations. To ensure that your form is legally binding, it is essential to comply with all relevant statutes. This includes using electronic signatures where permitted and adhering to the guidelines set forth by the New Mexico Secretary of State or other relevant authorities. Understanding these legal frameworks will help you avoid potential issues with your form submission.

Required Documents

When completing the New Mexico form, certain documents may be required to support your application or submission. Commonly required documents include identification, proof of residency, and any relevant financial records. It is advisable to check the specific requirements for the type of New Mexico form you are submitting to ensure you have all necessary documentation ready.

Form Submission Methods

There are several methods available for submitting the New Mexico form. Depending on the specific form type, you may be able to submit it online through a designated portal, by mail to the appropriate agency, or in person at a local office. Each submission method may have its own guidelines and processing times, so it is important to choose the one that best suits your needs.

Eligibility Criteria

Eligibility criteria for the New Mexico form vary based on the specific type of form being submitted. Generally, individuals or entities must meet certain requirements, such as residency status or business registration, to qualify for the form. It is important to review the eligibility criteria carefully to ensure that you qualify before proceeding with the completion and submission of the form.

Quick guide on how to complete new mexico form 497319927

Prepare New Mexico Form easily on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle New Mexico Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign New Mexico Form with ease

- Obtain New Mexico Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign New Mexico Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the New Mexico form, and how can airSlate SignNow help?

The New Mexico form refers to official documents used in various transactions, which airSlate SignNow can simplify through its eSignature solutions. By using our platform, businesses can easily create, send, and eSign New Mexico forms without the hassle of traditional paperwork, ensuring efficiency and compliance.

-

What pricing options are available for using airSlate SignNow for New Mexico forms?

airSlate SignNow offers competitive pricing plans tailored to meet different business needs when managing New Mexico forms. Our subscription models range from basic features to advanced functionalities, with affordable monthly or annual billing options that suit any budget.

-

Are there any specific features for processing New Mexico forms in airSlate SignNow?

Yes, airSlate SignNow comes with essential features designed for processing New Mexico forms, including customizable templates, bulk sending options, and secure eSigning capabilities. These features facilitate a smooth experience for businesses looking to streamline their documentation process across the state.

-

How does airSlate SignNow ensure the security of my New Mexico forms?

The security of your New Mexico forms is our top priority at airSlate SignNow. We implement advanced encryption protocols, multi-factor authentication, and compliance with industry regulations to ensure that your sensitive information remains confidential and protected.

-

Can I integrate airSlate SignNow with other applications for my New Mexico forms?

Absolutely! airSlate SignNow allows you to integrate with a variety of applications including CRM systems, cloud storage services, and project management tools, enhancing the management of your New Mexico forms. This interoperability helps streamline workflows and improves overall productivity.

-

What are the benefits of using airSlate SignNow for New Mexico forms?

Using airSlate SignNow for New Mexico forms offers numerous benefits, including time-saving automation, improved accuracy, and easier access to documents. Our solution not only speeds up the signing process but also enhances collaboration among team members, leading to better business outcomes.

-

Is there a trial period for airSlate SignNow to test New Mexico forms processing?

Yes, airSlate SignNow provides a free trial period during which you can test our platform for processing New Mexico forms. This trial enables you to explore the features, experience the user interface, and assess how our eSignature solutions meet your business needs before committing.

Get more for New Mexico Form

- Bc 1206 department of commerce osec doc form

- Housing nsw additional occupant form

- Criminal record abuse history verificationdocx eriecountygov form

- Colorado uniform consumer credit code colorado attorney general coloradoattorneygeneral

- City of albuquerque documents cabq gov form

- Bernalillo county vendor master request form vmrf bernco

- Fillable online nmprc state nm application for a certificate form

- Warranty carter fence company form

Find out other New Mexico Form

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free