Quitclaim Deed from Individual to LLC New Mexico Form

What is the Quitclaim Deed From Individual To LLC New Mexico

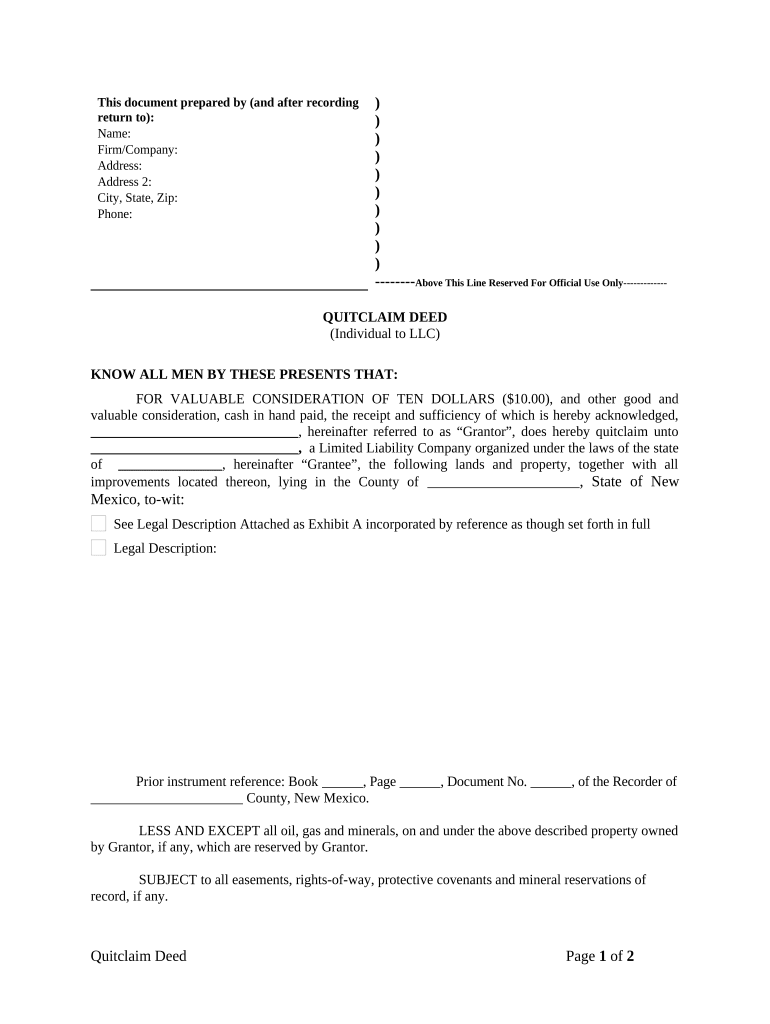

A quitclaim deed from an individual to an LLC in New Mexico is a legal document used to transfer ownership of real property. This type of deed allows the individual, known as the grantor, to convey their interest in the property to the limited liability company (LLC), the grantee, without making any warranties about the title. It is often used in situations where the grantor is transferring property to their own LLC or a business entity they are involved with. This method is typically quicker and simpler than other forms of property transfer, as it does not require a title search or guarantee of clear title.

Steps to Complete the Quitclaim Deed From Individual To LLC New Mexico

Completing a quitclaim deed from an individual to an LLC in New Mexico involves several key steps:

- Gather necessary information, including the names of the grantor and grantee, property description, and any relevant legal descriptions.

- Obtain the appropriate quitclaim deed form, which can often be found through legal resources or state websites.

- Fill out the form accurately, ensuring all details are correct and complete.

- Have the grantor sign the document in the presence of a notary public to ensure its legality.

- File the completed quitclaim deed with the local county clerk's office where the property is located.

Legal Use of the Quitclaim Deed From Individual To LLC New Mexico

The quitclaim deed is legally recognized in New Mexico and can be used for various purposes, such as transferring property ownership for estate planning, asset protection, or business structuring. It is essential to understand that this type of deed does not provide any guarantees regarding the property's title. Therefore, it is advisable for the grantee to conduct due diligence before accepting the transfer. Legal advice may also be beneficial to ensure compliance with state laws and regulations.

Key Elements of the Quitclaim Deed From Individual To LLC New Mexico

Several key elements must be included in a quitclaim deed for it to be valid in New Mexico:

- The full names and addresses of both the grantor and the LLC as the grantee.

- A clear legal description of the property being transferred, including boundaries and any identifying numbers.

- The date of the transfer and the signature of the grantor, which must be notarized.

- A statement indicating that the grantor is transferring their interest in the property to the LLC.

State-Specific Rules for the Quitclaim Deed From Individual To LLC New Mexico

New Mexico has specific rules governing the use of quitclaim deeds. The deed must be executed in accordance with state laws, including notarization requirements. Additionally, the deed should be recorded with the county clerk's office to provide public notice of the transfer. Failure to properly record the deed may result in complications regarding ownership rights in the future. It is also important to check for any local regulations that may apply.

How to Obtain the Quitclaim Deed From Individual To LLC New Mexico

To obtain a quitclaim deed in New Mexico, individuals can access forms through various sources:

- State government websites that provide legal forms and resources.

- Local county clerk's offices, which may offer specific forms for property transfers.

- Legal service providers or real estate attorneys who can assist in drafting the deed.

It is crucial to ensure that the form used complies with New Mexico's legal requirements to avoid any issues during the transfer process.

Quick guide on how to complete quitclaim deed from individual to llc new mexico

Complete Quitclaim Deed From Individual To LLC New Mexico effortlessly on any device

Managing documents online has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed files, allowing you to access the correct version and securely save it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Quitclaim Deed From Individual To LLC New Mexico on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to edit and eSign Quitclaim Deed From Individual To LLC New Mexico with ease

- Locate Quitclaim Deed From Individual To LLC New Mexico and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive data with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign function, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details, and then click the Done button to save your modifications.

- Choose how you’d like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Edit and eSign Quitclaim Deed From Individual To LLC New Mexico and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Individual To LLC in New Mexico?

A Quitclaim Deed From Individual To LLC in New Mexico is a legal document that allows an individual to transfer their ownership rights in a property to a limited liability company (LLC). This type of deed is commonly used for business transactions or estate planning. It effectively relinquishes any claim the individual may have, making it an important document for property ownership transfers.

-

How can I create a Quitclaim Deed From Individual To LLC in New Mexico?

You can create a Quitclaim Deed From Individual To LLC in New Mexico by using reliable document preparation services like airSlate SignNow. Our platform offers templates and tools that simplify the process, ensuring that all legal requirements are met. Alternatively, you may draft the deed with the assistance of a legal professional.

-

What are the benefits of using airSlate SignNow for my Quitclaim Deed From Individual To LLC in New Mexico?

Using airSlate SignNow to manage your Quitclaim Deed From Individual To LLC in New Mexico provides numerous benefits, including an intuitive interface for document preparation and eSigning. It also ensures secure document handling and compliance with local laws. Additionally, our cost-effective pricing makes it accessible for both individuals and businesses.

-

Are there any costs associated with filing a Quitclaim Deed From Individual To LLC in New Mexico?

Yes, there are costs associated with filing a Quitclaim Deed From Individual To LLC in New Mexico, which may include recording fees, taxes, and potential legal assistance fees. Utilizing airSlate SignNow can help minimize expenses, as our platform offers affordable options for document preparation and filing. Always check local regulations for specific fee requirements.

-

What features does airSlate SignNow offer for Quitclaim Deed processing?

airSlate SignNow provides features tailored for Quitclaim Deed processing, including customizable templates, secure eSignatures, and document tracking. These tools ensure that your Quitclaim Deed From Individual To LLC in New Mexico is completed efficiently and securely. Furthermore, our platform allows easy collaboration among multiple users.

-

Can I edit my Quitclaim Deed From Individual To LLC after it's signed?

Once a Quitclaim Deed From Individual To LLC in New Mexico is signed, it is typically considered a finalized legal document. However, if changes are necessary, you would need to create a new deed or a modification. airSlate SignNow allows you to draft new documents quickly, ensuring you always have the correct paperwork.

-

Is airSlate SignNow compliant with New Mexico state law for Quitclaim Deeds?

Absolutely, airSlate SignNow is designed to comply with New Mexico state law when creating a Quitclaim Deed From Individual To LLC. Our templates are regularly updated to reflect current regulations, providing peace of mind that your document meets all legal requirements. Always consult with a local attorney for specific legal advice.

Get more for Quitclaim Deed From Individual To LLC New Mexico

- Forms my vac account faqs help

- Debonair campground annual remittance form for campsite

- Casa cheque requisition form 1 casa casajmsb casajmsb

- Head office dynamic funds tower 1 adelaide st e form

- Income support application application for income support completed by applicants and given to alberta employment immigration form

- Date received stamp office use onlybach audiolog form

- Toronto fire services emergency patient care scenario form

- Www uslegalforms comform library479436 earlyearly childhood educator application renewal fill and

Find out other Quitclaim Deed From Individual To LLC New Mexico

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile

- Sign Missouri Rental property lease agreement Safe