Individual Credit Application New Mexico Form

What is the Individual Credit Application New Mexico

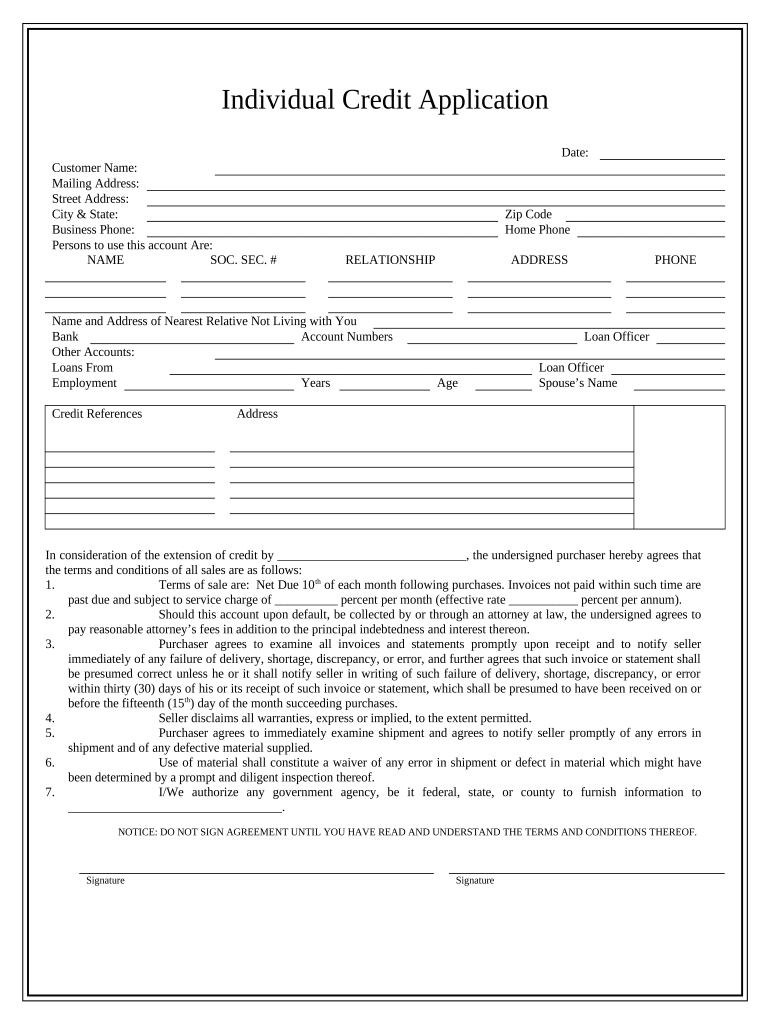

The Individual Credit Application New Mexico is a formal document used by individuals seeking credit from financial institutions within the state. This application collects essential personal and financial information to assess the applicant's creditworthiness. It typically includes details such as income, employment history, outstanding debts, and other financial obligations. The information provided helps lenders evaluate the risk associated with extending credit to the applicant.

Steps to Complete the Individual Credit Application New Mexico

Completing the Individual Credit Application New Mexico involves several straightforward steps. First, gather all necessary personal and financial information, including your Social Security number, income details, and employment history. Next, fill out the application form accurately, ensuring that all sections are completed. Review the application for any errors or omissions before submission. Finally, submit the application electronically or as instructed by the lending institution, ensuring that you retain a copy for your records.

Legal Use of the Individual Credit Application New Mexico

The Individual Credit Application New Mexico is legally binding when completed and submitted according to state regulations. It must comply with applicable laws regarding privacy and data protection, ensuring that the information provided is secure and used solely for the purpose of credit evaluation. Electronic submissions of this application are valid under the Electronic Signatures in Global and National Commerce (ESIGN) Act, provided that proper electronic signature protocols are followed.

Key Elements of the Individual Credit Application New Mexico

Key elements of the Individual Credit Application New Mexico include personal identification information, financial history, and consent for credit checks. Applicants must provide their full name, address, and contact information. Additionally, they must disclose their income sources, employment status, and any existing debts. Consent for the lender to perform a credit check is also a critical component, as it allows the lender to access the applicant's credit report for evaluation purposes.

Eligibility Criteria for the Individual Credit Application New Mexico

Eligibility criteria for the Individual Credit Application New Mexico vary by lender but generally include age, residency, and income requirements. Applicants must be at least eighteen years old and a resident of New Mexico. They should have a stable income source to demonstrate their ability to repay any credit extended. Some lenders may also consider the applicant's credit history and existing debt levels as part of the eligibility assessment.

Form Submission Methods for the Individual Credit Application New Mexico

The Individual Credit Application New Mexico can be submitted through various methods, depending on the lender's preferences. Common submission methods include online applications via the lender's website, mailing a physical copy of the application, or submitting it in person at a branch location. Each method has its own set of instructions, so it is essential to follow the lender's guidelines for successful submission.

Examples of Using the Individual Credit Application New Mexico

Examples of using the Individual Credit Application New Mexico can include applying for a personal loan, credit card, or mortgage. For instance, an individual may use this application to seek financing for a new vehicle, where the lender will assess the applicant's creditworthiness based on the information provided. Similarly, when applying for a credit card, the application helps the issuer evaluate the risk of extending credit to the applicant based on their financial profile.

Quick guide on how to complete individual credit application new mexico

Complete Individual Credit Application New Mexico effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed paperwork, as you can access the appropriate form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Individual Credit Application New Mexico on any platform using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

How to edit and electronically sign Individual Credit Application New Mexico seamlessly

- Locate Individual Credit Application New Mexico and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form—by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or inaccuracies that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Individual Credit Application New Mexico and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Individual Credit Application New Mexico?

An Individual Credit Application New Mexico is a formal request that potential borrowers submit to financial institutions to apply for credit. This document collects essential personal and financial information required to assess creditworthiness. Utilizing airSlate SignNow, you can easily create and manage these applications online.

-

How does airSlate SignNow support the Individual Credit Application New Mexico process?

airSlate SignNow simplifies the Individual Credit Application New Mexico process by allowing users to create, send, and eSign documents securely online. The platform ensures that all necessary information is captured efficiently, minimizing the chances of errors. Additionally, you can track the status of your applications in real-time.

-

Are there any costs associated with using airSlate SignNow for Individual Credit Applications New Mexico?

Yes, there are costs associated with using airSlate SignNow for Individual Credit Applications New Mexico. However, the platform offers a cost-effective solution with subscription plans tailored to fit various needs. This investment can save time and enhance document management efficiency.

-

What features does airSlate SignNow offer for Individual Credit Application New Mexico?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Individual Credit Application New Mexico. These tools help streamline the application process while ensuring compliance with legal standards. Users can leverage these features to enhance their workflow and improve customer satisfaction.

-

Can I integrate airSlate SignNow with other applications for my Individual Credit Application New Mexico?

Yes, airSlate SignNow provides integration options with numerous third-party applications, making it easier to manage your Individual Credit Application New Mexico. This allows users to automate workflows and sync data across platforms, improving overall efficiency. Integrations include CRM systems, cloud storage, and more.

-

What are the benefits of using airSlate SignNow for Individual Credit Applications New Mexico?

Using airSlate SignNow for Individual Credit Applications New Mexico offers benefits such as reduced processing time and improved accuracy. The platform's user-friendly interface facilitates easier navigation and completion of applications. Additionally, eSigning eliminates the need for physical document handling, further expediting the process.

-

Is airSlate SignNow secure for submitting Individual Credit Applications New Mexico?

Absolutely! airSlate SignNow utilizes advanced security measures, such as encryption and secure access protocols, to protect your Individual Credit Applications New Mexico. This ensures that sensitive personal information is safeguarded throughout the submission and signing process. Compliance with industry standards further enhances the security of your documents.

Get more for Individual Credit Application New Mexico

- Form 8903

- Ancient rome revision cloze exercise fill in the blanks form

- Printable st 556 form 100068947

- Blank nco reports form

- Bbs weekly summary of hours 203292829 form

- Working time directive opt out agreement form

- Application form for school place manchester city council

- Get methodist church internal organisations report form

Find out other Individual Credit Application New Mexico

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online