Tax Exempt Form Texas 1991-2026

What is the Tax Exempt Form Texas

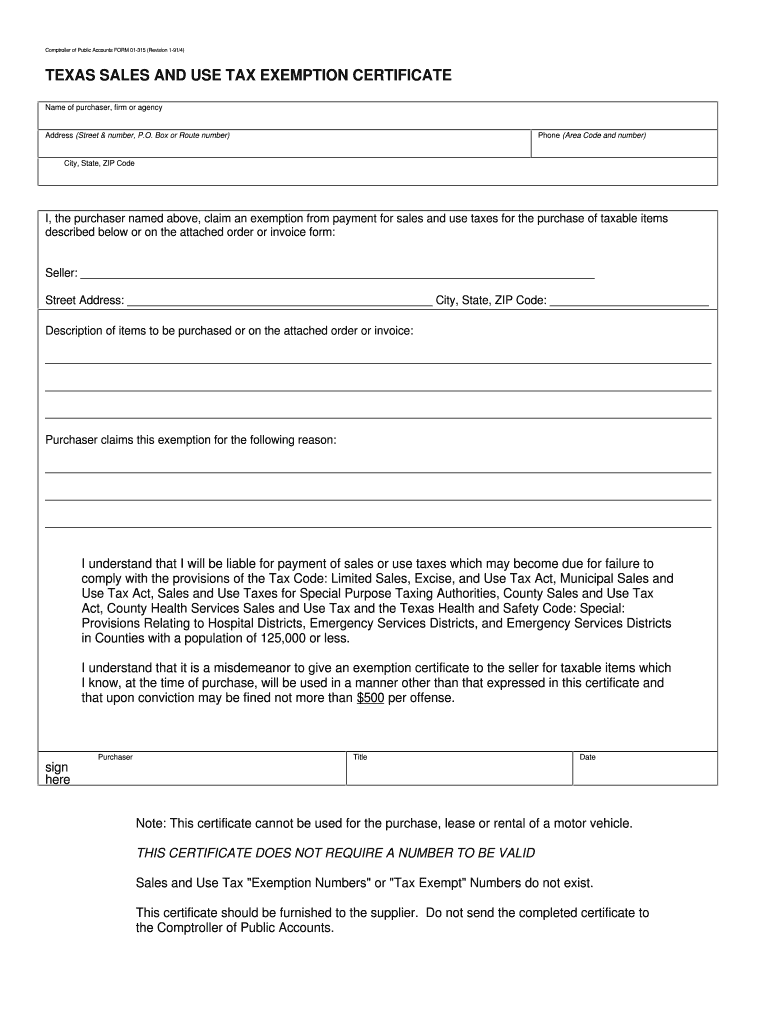

The Tax Exempt Form Texas, often referred to as the Texas sales tax exemption certificate, is a crucial document that allows qualifying entities to purchase items without paying sales tax. This form is primarily utilized by non-profit organizations, government entities, and certain businesses that meet specific criteria. By submitting this certificate, eligible purchasers can avoid the additional financial burden of sales tax on their transactions, aligning with Texas state tax regulations.

How to Obtain the Tax Exempt Form Texas

To obtain the Tax Exempt Form Texas, individuals or organizations can visit the Texas Comptroller of Public Accounts website. The form is available for download and can be printed directly from the site. It is important to ensure that the correct version of the form is used, as there may be updates or changes to the requirements over time. Additionally, some organizations may have their own internal processes for distributing this form, so checking with your organization’s finance or accounting department may also be beneficial.

Steps to Complete the Tax Exempt Form Texas

Completing the Tax Exempt Form Texas involves several key steps:

- Gather necessary information, including the name and address of the purchaser, the type of exemption being claimed, and the seller's information.

- Clearly indicate the reason for the exemption, such as non-profit status or government entity.

- Sign and date the form to certify that the information provided is accurate and truthful.

- Provide the completed form to the seller at the time of purchase to validate the tax-exempt status.

Legal Use of the Tax Exempt Form Texas

The legal use of the Tax Exempt Form Texas is governed by Texas state laws. It is essential for users to ensure they meet the eligibility criteria for claiming tax exemption. Misuse of the form, such as using it for personal purchases or by ineligible entities, can result in penalties, including fines and back taxes owed. Therefore, it is crucial to understand the legal implications and requirements associated with this form.

Key Elements of the Tax Exempt Form Texas

Key elements of the Tax Exempt Form Texas include:

- The name and address of the purchaser.

- The reason for the exemption, which must align with state guidelines.

- The seller's information, including their name and address.

- The signature of the purchaser or an authorized representative.

- The date the form is completed.

Eligibility Criteria

Eligibility for using the Tax Exempt Form Texas typically includes:

- Non-profit organizations recognized by the IRS.

- Government entities at the federal, state, or local level.

- Certain educational institutions and religious organizations.

- Businesses that qualify under specific exemptions as defined by Texas law.

Quick guide on how to complete texas sales and use tax exemption certificate troop 806

Your assistance manual on how to prepare your Tax Exempt Form Texas

If you’re wondering how to complete and submit your Tax Exempt Form Texas, here are a few brief guidelines to facilitate tax processing.

To begin, simply create your airSlate SignNow profile to change how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to edit, draft, and finalize your tax documents effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and revisit to modify information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Tax Exempt Form Texas in no time:

- Create your account and start working on PDFs in just a few minutes.

- Utilize our catalog to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your Tax Exempt Form Texas in our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to include your legally-binding eSignature (if required).

- Examine your document and rectify any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that submitting in paper form can lead to increased errors and delayed refunds. Naturally, before e-filing your taxes, consult the IRS website for filing guidelines in your area.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Why is it so hard to figure out how many exemptions and allowances one should claim on tax forms? Why isn't this specified clearly?

You should only filed the number of exemptions and/or allowances truly reflected in your household. If you are single, check Single, then it's one exemption, you. If you are Married filing Jointly, that is two exemptions(2 people) plus one exemption for each child). Or other person considered a dependent.Hope that helps. Exemptions are based on number of people in your household you can legally claim as dependents. Allowances are item that come off your taxable income for things like retirement places, childcare, etc.If you have further questions, it's best to contact a tax professional in your area. Most do free consultation, charging only for work we do for clients.

-

How illegal immigrants file taxes (presumably using ITIN) while paying taxes using fake SSN? How IRS accepts such forms as SSN used to pay tax and ITIN used for filling tax don't match?

Illegal immigrants are not authorized to work in the US and are not entitled to all the benefits of a citizen or legal resident, However, if they are here they are expected to pay taxes as any citizen would. If they choose to work, they are expected to pay income taxes.If they use a fake Social Security number to obtain work, it usually belongs to another person. This is illegal and could result in being ineligible to get a green card because any reported wages would be tracked to the account of the actual owner of the Social Security number along with any FICA/ Medicare taxes that the employer withholds.In order to isolate the tax reporting for the immigrant from that of the actual Social Security holder, the IRS issues an Individual Tax Identification Number (ITIN) to the immigrant under which he/she may report their earnings. When the copies of any W-2 or other withholding documents with fake SSN are included on the return, then the IRS now has the ability to segregate the wages that are incorrectly reported and notify Social Security Administration to segregate any reported FICA/ Medicare from the actual owner’s account.If the immigrant works “under the table” in either a cash-based transaction or self-employed status, it does not remove the obiligation to correctly report earnings. It just changes the forms required on the tax return and may incur penalties to worker and/or the employer.Disclaimer: Since you are not my client, the above message is not intended to constitute written tax advice,but general information for discussion purposes only. You should not, therefore, interpret the statements to be written tax advice or rely on the statements for any purpose.

-

How do I declare a short term capital gain tax in the ITR in India? I want to know about the ITR form number and where and what to fill in the details. This is my first time to pay a short term capital gain tax on an equity sale.

The selection of ITR form will depend upon the type of one's income.For Income from salary, house property, capital gains for ITR2 is suggestedHowever for income from above heads and business/profession ITR4 is suggestedIn both the forms under head CG, revenue from sale of equity shares are required to be mentioned along with purchase amount and expenses incurred on sale are also required to be mentioned.For short term and long term separate rows are there.Just fill up and it will take the net capital gain to respective cell in computation if income.

-

How do you use Quickbooks for dropshipping to keep your finances in check? How do I record all the sales and payments, keeping track of the finances and be ready to submit tax forms and all?

Hi Ricky,Drop shipping product affects how you would track inventory. Typically, one would invoice after the shipment is made. Do you produce inventory or just buy/sell/rep for products? If you produce the inventory yourself, you would want to capture the materials purchased, the assembly, the increase in inventory when built. Then when you ship, you can invoice and it decreases your inventory value and increases your Cost of Goods Sold.QuickBooks is a powerful tool to track all of the transactions that occur. From prepaying your vendor, customer deposits, receiving a vendor bill, invoicing your customer, receiving payments and making deposits. Can you tell I love my accounting software?

Create this form in 5 minutes!

How to create an eSignature for the texas sales and use tax exemption certificate troop 806

How to generate an eSignature for the Texas Sales And Use Tax Exemption Certificate Troop 806 online

How to create an eSignature for the Texas Sales And Use Tax Exemption Certificate Troop 806 in Chrome

How to generate an electronic signature for putting it on the Texas Sales And Use Tax Exemption Certificate Troop 806 in Gmail

How to make an eSignature for the Texas Sales And Use Tax Exemption Certificate Troop 806 straight from your smart phone

How to generate an electronic signature for the Texas Sales And Use Tax Exemption Certificate Troop 806 on iOS devices

How to make an electronic signature for the Texas Sales And Use Tax Exemption Certificate Troop 806 on Android OS

People also ask

-

What is a tax certificate in Texas?

A tax certificate in Texas is an official document issued by the county tax office that verifies whether a property has any outstanding tax payments. It serves as proof for buyers and sellers about the property’s tax status. Obtaining a tax certificate Texas can be crucial during property transactions to ensure there are no hidden liabilities.

-

How can I obtain a tax certificate in Texas?

To obtain a tax certificate in Texas, you can request one from your local county appraisal district or tax collector's office. Many counties allow you to order a tax certificate Texas online for convenience. It's essential to provide specific property details to ensure accurate processing of your request.

-

What are the benefits of using airSlate SignNow for tax certificate agreements?

Using airSlate SignNow to manage tax certificate agreements streamlines the eSigning process, making it quick and efficient. Our platform provides a secure and legally binding way to sign documents related to tax certificate Texas. Plus, you can track your documents in real-time, ensuring everything is up to date.

-

Are there any fees associated with obtaining a tax certificate in Texas?

Yes, there may be fees associated with obtaining a tax certificate in Texas, which can vary by county. Typically, these fees cover the administrative costs of processing your request. It's advisable to check with your local county tax office for any specific charges related to the tax certificate Texas.

-

How long does it take to receive a tax certificate in Texas?

The time it takes to receive a tax certificate in Texas can vary depending on the county and method of request. If you apply in person, it may be processed the same day, while online requests could take a few business days. Check the specific timelines with your local office for the most accurate estimates.

-

Can I integrate airSlate SignNow with other software for tax certificate management?

Yes, airSlate SignNow offers integrations with various software solutions, enhancing your tax certificate management workflow. Whether you use accounting, CRM, or document management systems, our platform can seamlessly connect with them. This integration streamlines processes and ensures all tax certificate Texas documents are organized.

-

What features does airSlate SignNow offer for handling tax-related documents?

airSlate SignNow provides a range of features for handling tax-related documents, including customizable templates, automated reminders, and secure cloud storage. These features ensure that your tax certificate Texas documents are not only easy to manage but also emphasize compliance and security. You can eSign, send, and track your documents all in one place.

Get more for Tax Exempt Form Texas

- Security contractor package connecticut form

- Insulation contractor package connecticut form

- Paving contractor package connecticut form

- Site work contractor package connecticut form

- Siding contractor package connecticut form

- Refrigeration contractor package connecticut form

- Drainage contractor package connecticut form

- Tax free exchange package connecticut form

Find out other Tax Exempt Form Texas

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA