New Mexico Unsecured Installment Payment Promissory Note for Fixed Rate New Mexico Form

What is the New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico

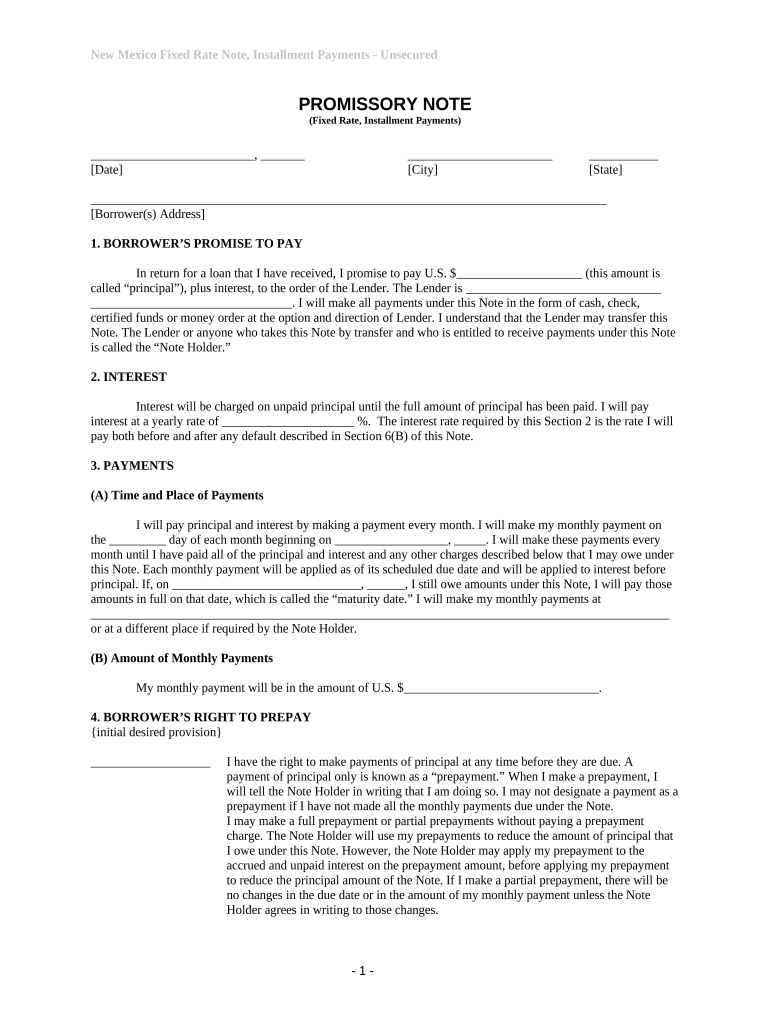

The New Mexico Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions under which a borrower agrees to repay a loan. This type of note is unsecured, meaning it does not require collateral, making it a common choice for personal loans. The document specifies the loan amount, interest rate, repayment schedule, and any penalties for late payments. It serves as a binding agreement between the lender and borrower, ensuring both parties understand their rights and obligations.

How to use the New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico

To effectively use the New Mexico Unsecured Installment Payment Promissory Note, both the lender and borrower should carefully review the terms outlined in the document. The borrower must fill in their personal information, including the loan amount and repayment terms. Once completed, both parties should sign the document to make it legally binding. It is advisable to keep a copy for personal records and provide one to the lender. This note can be used in various situations, such as personal loans, family loans, or informal lending agreements.

Steps to complete the New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico

Completing the New Mexico Unsecured Installment Payment Promissory Note involves several straightforward steps:

- Gather the necessary information, including borrower and lender details.

- Specify the loan amount and interest rate.

- Outline the repayment schedule, including the frequency of payments.

- Detail any penalties for late payments or defaults.

- Both parties should review the document for accuracy.

- Sign and date the document to finalize the agreement.

Legal use of the New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico

The legal use of the New Mexico Unsecured Installment Payment Promissory Note is governed by state laws. For the note to be enforceable, it must meet specific legal requirements, such as clear terms regarding the loan amount, interest rate, and repayment schedule. Additionally, both parties must sign the document, and it is advisable to have witnesses or notarization to enhance its legal standing. Understanding these legal aspects ensures that the document can be upheld in court if necessary.

Key elements of the New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico

Key elements of the New Mexico Unsecured Installment Payment Promissory Note include:

- Borrower and Lender Information: Names and contact details of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate applicable to the loan.

- Repayment Terms: Schedule detailing when payments are due.

- Late Payment Penalties: Fees or consequences for missed payments.

State-specific rules for the New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico

In New Mexico, specific rules apply to the use of unsecured installment payment promissory notes. These include compliance with state lending laws, which govern interest rates and repayment terms. Additionally, the document must be clear and unambiguous to avoid disputes. It is important for both lenders and borrowers to be aware of any state-specific regulations that may affect their agreement, including maximum allowable interest rates and required disclosures.

Quick guide on how to complete new mexico unsecured installment payment promissory note for fixed rate new mexico

Effortlessly Prepare New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to the conventional printed and signed paperwork, as you can obtain the correct format and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico seamlessly on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico effortlessly

- Locate New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Choose how you would like to send your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico and guarantee excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico?

A New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico is a legal document that outlines a loan agreement in which the borrower promises to pay back a fixed amount over a specified period. This type of note is generally unsecured, meaning no collateral is required. It's crucial for individuals or businesses in New Mexico looking for flexible repayment options.

-

What are the benefits of using airSlate SignNow for a New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico?

Using airSlate SignNow for your New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico simplifies the document creation and signing process. The platform ensures that your notes are legally binding and securely stored. Additionally, it provides a user-friendly interface, allowing for easy document management.

-

How much does it cost to create a New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico with airSlate SignNow?

AirSlate SignNow offers competitive pricing plans that vary based on your business needs. Creating a New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico can be done at a low cost, making it an economical solution for individuals and businesses alike. For accurate pricing, visit our website or contact our sales team for personalized options.

-

Is the New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico customizable?

Yes, airSlate SignNow allows you to customize your New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico to fit your specific terms and conditions. You can adjust payment schedules, amounts, and other clauses to reflect the agreement between parties. Customization ensures that the document meets your exact needs.

-

What features does airSlate SignNow offer for managing a New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico?

AirSlate SignNow provides various features to manage your New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico effectively. Features include document tracking, automated reminders for payment schedules, and secure eSignature capabilities. These tools enhance your document workflow and ensure that you stay organized.

-

Can I integrate airSlate SignNow with other software for managing my New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico?

Absolutely! AirSlate SignNow offers seamless integrations with numerous business applications, allowing you to manage your New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico alongside other tools you use. This interoperability enhances your overall productivity and workflow efficiency.

-

How do I ensure my New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico is legally compliant?

To ensure your New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico is legally compliant, it’s recommended to include the essential terms outlined by New Mexico laws. AirSlate SignNow provides templates designed to meet legal standards, but consulting with a legal professional is advisable for tailored advice.

Get more for New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico

- Sf 424 family grants gov form

- Imm 5690 e document checklist permanent residence provincial nominee class and quebec skilled workers imm5690e pdf form

- Assignment of ownwership and attestation of identity for the transfer of ownership of an e titled motor vehicle off road vehi form

- Drivers under 45 must fill in the medical question form

- Wb 3 vacant land listing contract exclusive right to sell form

- Young person travelling alone consent form effective 01 march

- Va form 21p 4185 report of income from property or business

- Form 7600a pdf bureau of the fiscal service

Find out other New Mexico Unsecured Installment Payment Promissory Note For Fixed Rate New Mexico

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy