Nevada Death Deed Form

What is the Nevada Death Deed

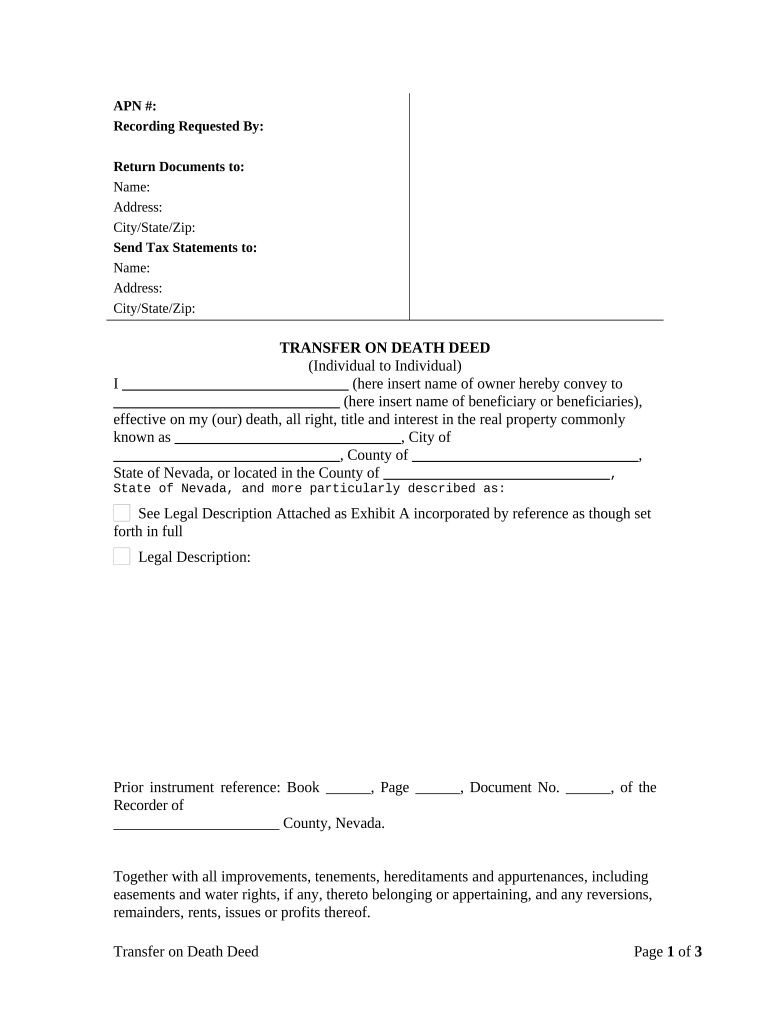

The Nevada transfer death deed is a legal document that allows a property owner to transfer real estate to a beneficiary upon their death without the need for probate. This deed is particularly useful for individuals who wish to streamline the transfer of their property and avoid the lengthy and often costly probate process. By executing this deed, the property owner retains full control of the property during their lifetime, while ensuring that the designated beneficiary receives the property automatically upon their passing.

How to use the Nevada Death Deed

To use the Nevada death deed, the property owner must complete the form with accurate information, including the names of the owner and beneficiary, a description of the property, and the date of execution. Once filled out, the deed must be signed in the presence of a notary public to ensure its validity. After notarization, the deed should be recorded with the county recorder's office where the property is located. This step is crucial, as it provides public notice of the transfer and protects the beneficiary's rights to the property.

Steps to complete the Nevada Death Deed

Completing the Nevada death deed involves several important steps:

- Gather necessary information about the property, including the legal description and address.

- Identify the beneficiary who will receive the property upon the owner's death.

- Fill out the Nevada transfer death deed form accurately, ensuring all required fields are completed.

- Sign the deed in front of a notary public to validate the document.

- Submit the notarized deed to the county recorder's office for official recording.

Legal use of the Nevada Death Deed

The Nevada transfer death deed is legally recognized under Nevada law, provided it meets specific requirements. It must be signed by the property owner and notarized, and it should include a clear description of the property and the beneficiary's information. This deed is an effective estate planning tool, allowing individuals to transfer property outside of probate, which can save time and reduce expenses for the heirs. It is essential to ensure compliance with state laws to guarantee the deed's enforceability.

Key elements of the Nevada Death Deed

Several key elements must be included in the Nevada death deed for it to be valid:

- Property Description: A clear and accurate description of the property being transferred.

- Grantor Information: The full name and address of the property owner.

- Beneficiary Information: The full name and address of the individual receiving the property.

- Signature and Notarization: The property owner’s signature must be notarized to validate the deed.

- Recording Information: The deed must be recorded with the county recorder's office to be effective.

State-specific rules for the Nevada Death Deed

In Nevada, specific rules govern the use of transfer death deeds. The deed must comply with state statutes, including the requirement for notarization and recording. Additionally, the property must be residential real estate, as certain types of property, such as commercial real estate or properties held in a trust, may not qualify for this type of transfer. It is advisable for property owners to consult with a legal professional to ensure compliance with all state-specific regulations and to address any unique circumstances related to their property.

Quick guide on how to complete nevada death deed

Complete Nevada Death Deed effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without any hold-ups. Manage Nevada Death Deed on any device with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The easiest way to edit and eSign Nevada Death Deed with no hassle

- Obtain Nevada Death Deed and click Get Form to begin.

- Use the tools we provide to fill in your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from your preferred device. Edit and eSign Nevada Death Deed and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Nevada transfer death deed?

A Nevada transfer death deed allows property owners to transfer real estate upon their death without the need for probate. This deed simplifies the transition of property ownership, making it a vital tool for estate planning in Nevada.

-

How does airSlate SignNow assist with Nevada transfer death deeds?

airSlate SignNow enables users to create, send, and eSign Nevada transfer death deeds quickly and efficiently. Our platform ensures that all necessary legal requirements are met, making the process straightforward for property owners.

-

Is there a cost associated with using airSlate SignNow for Nevada transfer death deeds?

Yes, there are affordable pricing plans available for using airSlate SignNow for creating and eSigning Nevada transfer death deeds. We offer different subscription tiers to accommodate various needs, ensuring you find a plan that fits your budget.

-

What benefits does a Nevada transfer death deed provide?

The primary benefit of a Nevada transfer death deed is that it avoids probate, allowing for a seamless transfer of property ownership. Additionally, it provides flexibility and control in how and when your property is passed on to beneficiaries.

-

Can I integrate airSlate SignNow with other tools for managing Nevada transfer death deeds?

Absolutely! airSlate SignNow integrates seamlessly with various tools, allowing you to manage your Nevada transfer death deed and other documents in one place. This enhances productivity and streamlines your document management process.

-

What steps do I need to follow to create a Nevada transfer death deed with airSlate SignNow?

To create a Nevada transfer death deed using airSlate SignNow, sign up for an account, select the appropriate template, fill in the necessary details, and send it for eSignature. Our user-friendly interface makes the entire process simple and efficient.

-

Are there specific requirements for a valid Nevada transfer death deed?

Yes, a valid Nevada transfer death deed must be properly signed and signNowd. Ensure all required information is accurately filled out to fulfill the legal standards and facilitate seamless property transfer.

Get more for Nevada Death Deed

- Affidavit template ontario fill online printable form

- Special power of attorney bdo unibank form

- Golf club rental agreement smrp golf event smrp form

- Stan mucinic form

- Dual diagnosis workbook pdf form

- Car for sale by owner contract template form

- Fill in the blanks f n s form

- Form 538 s claim for credit refund of sales tax 794951806

Find out other Nevada Death Deed

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template