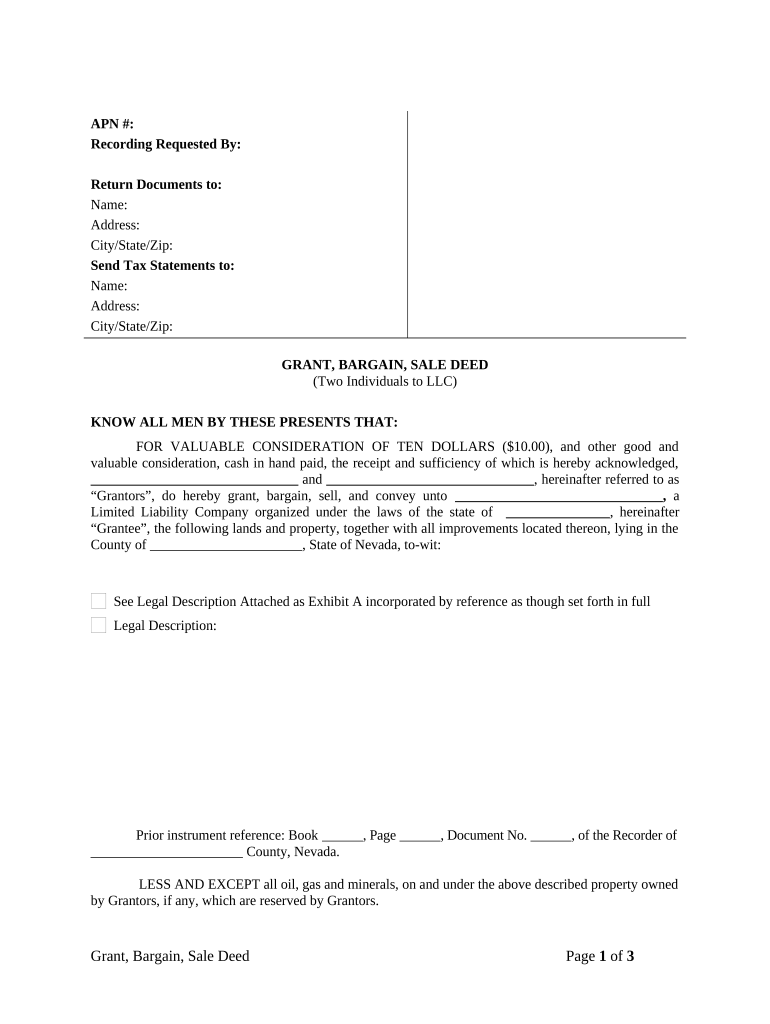

Nv Llc Form

What is the NV LLC?

The NV LLC, or Nevada Limited Liability Company, is a popular business structure that combines the benefits of a corporation and a partnership. This type of entity provides personal liability protection to its owners, known as members, while allowing for flexible management and tax options. In Nevada, forming an LLC can be particularly advantageous due to the state's business-friendly regulations and lack of state income tax.

How to Use the NV LLC

Using an NV LLC involves several key steps. First, you need to choose a unique name for your LLC that complies with Nevada naming requirements. After that, you will file the Articles of Organization with the Nevada Secretary of State and pay the required filing fee. Once your LLC is established, you can operate your business, open a bank account, and enter contracts under the LLC's name, ensuring that your personal assets are protected from business liabilities.

Steps to Complete the NV LLC

Completing the NV LLC formation process involves the following steps:

- Select a unique name for your LLC that includes "Limited Liability Company" or an abbreviation.

- Designate a registered agent who will receive legal documents on behalf of your LLC.

- File the Articles of Organization with the Nevada Secretary of State.

- Pay the necessary filing fee.

- Create an Operating Agreement to outline the management structure and operating procedures of your LLC.

Legal Use of the NV LLC

The NV LLC is legally recognized as a separate entity, which means it can own property, enter contracts, and conduct business independently of its members. This legal status provides a layer of protection against personal liability for debts and obligations incurred by the LLC. To ensure compliance with state laws, it is important to maintain proper records and adhere to all regulatory requirements.

Required Documents

To form an NV LLC, you will need to prepare and submit several documents, including:

- Articles of Organization: This document outlines the basic information about your LLC.

- Operating Agreement: While not required by law, this internal document details the management structure and operational guidelines.

- Registered Agent Consent: A declaration that your registered agent agrees to serve in that capacity.

Eligibility Criteria

To form an NV LLC, you must meet certain eligibility criteria, including:

- At least one member is required to form the LLC.

- Members can be individuals or other business entities.

- There are no residency requirements for members or managers.

Quick guide on how to complete nv llc

Complete Nv Llc effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to generate, modify, and eSign your documents swiftly without delays. Manage Nv Llc on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign Nv Llc effortlessly

- Find Nv Llc and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Nv Llc and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an NV LLC and why should I consider forming one?

An NV LLC, or Nevada Limited Liability Company, provides business owners with personal liability protection and tax benefits. By forming an NV LLC, you can enjoy flexible management structures and favorable regulations. This makes NV LLC a popular choice for entrepreneurs seeking to minimize risk while maximizing growth.

-

How much does it cost to form an NV LLC?

The cost to form an NV LLC typically includes filing fees, which vary depending on the specific services you choose. For a basic NV LLC formation, you can expect to pay around $75 plus additional costs for registered agents if needed. It's advisable to factor in ongoing compliance fees, which may be required annually.

-

What are the main benefits of using airSlate SignNow for my NV LLC?

Using airSlate SignNow for your NV LLC streamlines document management with easy eSigning features. This cost-effective solution not only saves time but also enhances security with legally binding signatures. Whether you need to send contracts or agreements, airSlate SignNow simplifies the process for your NV LLC.

-

Can I integrate airSlate SignNow with other software for my NV LLC?

Yes, airSlate SignNow offers seamless integrations with popular software platforms, making it easy to manage your NV LLC operations. You can connect it with CRMs, cloud storage, and accounting software, ensuring a streamlined workflow. This capability enhances productivity and keeps your documents organized.

-

Is airSlate SignNow secure for my NV LLC documents?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your NV LLC documents. With encryption and secure access controls, your sensitive information is safe from unauthorized access. Trust in airSlate SignNow to keep your business documents secure and compliant.

-

How does airSlate SignNow improve my business processes as an NV LLC?

airSlate SignNow signNowly improves efficiency for your NV LLC by automating document workflows. This reduces manual errors and speeds up transaction times, allowing you to focus on growth. With its user-friendly interface, team collaboration is enhanced, making processes straightforward and efficient.

-

What types of documents can I manage with airSlate SignNow for my NV LLC?

With airSlate SignNow, you can manage a variety of documents for your NV LLC, including contracts, NDAs, and tax forms. The platform supports customizable templates, allowing you to adapt documents to meet your specific needs. Streamlining these processes helps ensure your NV LLC operates smoothly.

Get more for Nv Llc

- Affidavit of loss tin id form

- Jubilee insurance company of kenya limited form

- Llc contribution agreement llc capital contributions form

- Dilations and scale factors independent practice worksheet 517711039 form

- Chinese gender calendar form

- How to write an appeal letter for parking ticket form

- Avery 5160 template blank fillable form

- Postal vote application form postal vote application form

Find out other Nv Llc

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval