Living Trust for Husband and Wife with No Children Nevada Form

What is the Living Trust For Husband And Wife With No Children Nevada

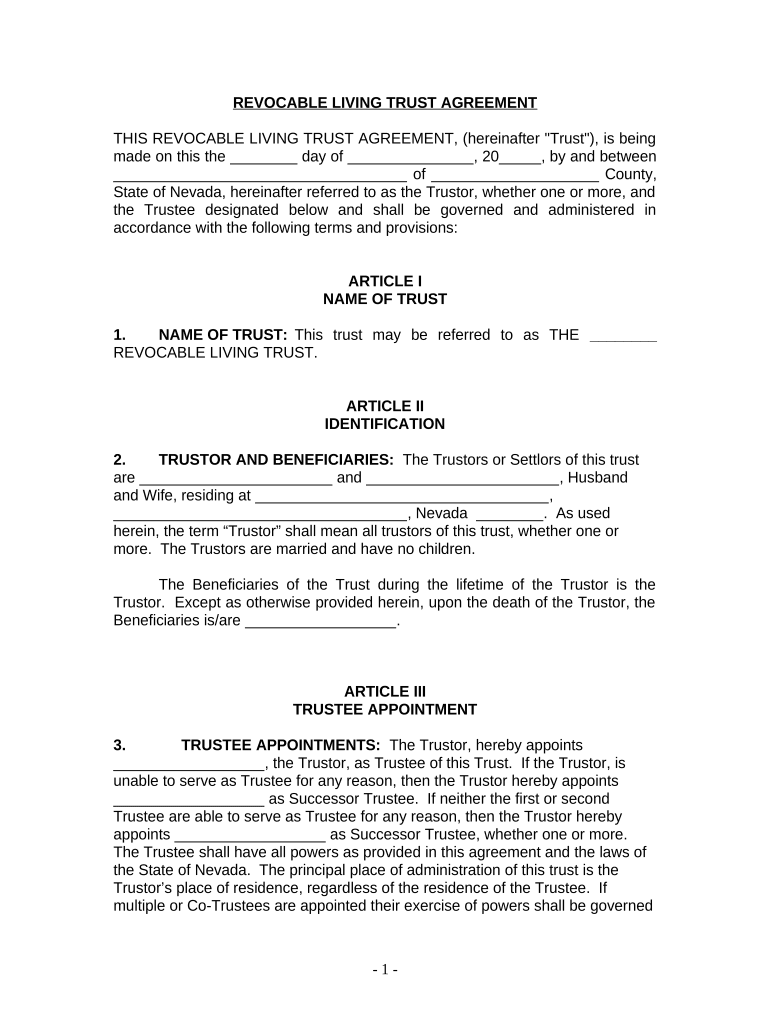

A living trust for husband and wife with no children in Nevada is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed upon their passing. This type of trust is particularly beneficial for couples without children, as it provides a straightforward way to ensure that their wishes are honored without the complexities of probate. The trust can hold various assets, such as real estate, bank accounts, and investments, allowing for seamless management and transfer of ownership.

Key Elements of the Living Trust For Husband And Wife With No Children Nevada

Several key elements define a living trust for husband and wife with no children in Nevada:

- Trustees: Typically, both spouses act as co-trustees, allowing them to maintain control over the trust assets.

- Beneficiaries: The couple can designate beneficiaries, which may include family members, friends, or charitable organizations.

- Revocability: This type of trust is usually revocable, meaning the couple can modify or dissolve it at any time during their lifetime.

- Asset Management: The trust provides a mechanism for managing assets, including provisions for handling incapacity.

- Distribution Terms: The couple can outline specific instructions for how and when assets should be distributed after their death.

Steps to Complete the Living Trust For Husband And Wife With No Children Nevada

Completing a living trust for husband and wife with no children in Nevada involves several important steps:

- Gather Information: Collect details about all assets, including property, bank accounts, and investments.

- Choose a Trustee: Decide whether both spouses will serve as co-trustees or if one will act as the primary trustee.

- Draft the Trust Document: Create the trust document, outlining the terms, beneficiaries, and distribution methods.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to ensure its validity.

- Fund the Trust: Transfer ownership of assets into the trust, which may involve changing titles or updating account information.

Legal Use of the Living Trust For Husband And Wife With No Children Nevada

The legal use of a living trust for husband and wife with no children in Nevada is primarily to avoid probate, which can be a lengthy and costly process. By placing assets in a trust, the couple can ensure that their estate is managed according to their wishes without the need for court intervention. Additionally, the trust can provide privacy, as it does not become a matter of public record like a will. This legal structure also allows for more efficient management of assets in the event of incapacity, as the co-trustee can continue to manage the trust without court involvement.

State-Specific Rules for the Living Trust For Husband And Wife With No Children Nevada

Nevada has specific rules governing living trusts that couples should be aware of:

- Trust Registration: Nevada does not require living trusts to be registered, but it is advisable to keep the trust document in a safe place.

- Tax Implications: Living trusts in Nevada do not incur state income tax, which can be advantageous for couples.

- Asset Protection: Nevada offers strong asset protection laws, making it a favorable state for establishing trusts.

- Revocation Process: The process to revoke or amend a living trust is straightforward, allowing couples flexibility in managing their estate planning.

How to Obtain the Living Trust For Husband And Wife With No Children Nevada

Obtaining a living trust for husband and wife with no children in Nevada can be accomplished through various methods:

- Legal Assistance: Consulting with an estate planning attorney can provide personalized guidance and ensure compliance with state laws.

- Online Resources: Various online platforms offer templates and tools to create a living trust, although legal advice is recommended for complex situations.

- Financial Institutions: Some banks and financial advisors provide services to help couples establish living trusts as part of their estate planning.

Quick guide on how to complete living trust for husband and wife with no children nevada

Complete Living Trust For Husband And Wife With No Children Nevada effortlessly on any device

Electronic document management has gained traction among businesses and individuals. It offers a commendable eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any interruptions. Handle Living Trust For Husband And Wife With No Children Nevada on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Living Trust For Husband And Wife With No Children Nevada effortlessly

- Obtain Living Trust For Husband And Wife With No Children Nevada and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive data with tools that airSlate SignNow offers specifically for these tasks.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choosing. Modify and eSign Living Trust For Husband And Wife With No Children Nevada and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in Nevada?

A Living Trust For Husband And Wife With No Children in Nevada is a legal document that allows a couple to manage their assets during their lifetime and specify how those assets will be distributed upon their passing. This type of trust provides flexibility and privacy, avoiding the lengthy probate process typically associated with estates.

-

What are the benefits of creating a Living Trust For Husband And Wife With No Children in Nevada?

Creating a Living Trust For Husband And Wife With No Children in Nevada offers several benefits, including the ability to manage your assets effectively, protect your privacy, and ensure a smooth transfer of property without the need for probate. Additionally, it provides peace of mind knowing that your wishes regarding asset distribution will be honored.

-

How much does it cost to set up a Living Trust For Husband And Wife With No Children in Nevada?

The cost to set up a Living Trust For Husband And Wife With No Children in Nevada can vary widely depending on whether you choose to do it yourself or hire a professional. Typically, legal fees can range from a few hundred to several thousand dollars, but using an efficient platform like airSlate SignNow can simplify the process and reduce costs.

-

Can I modify my Living Trust For Husband And Wife With No Children after it’s created?

Yes, one of the key features of a Living Trust For Husband And Wife With No Children in Nevada is its flexibility. You can modify or revoke the trust at any time as long as both parties are alive, allowing you to adapt to changes in your circumstances or wishes.

-

What assets can be included in a Living Trust For Husband And Wife With No Children in Nevada?

You can include various types of assets in a Living Trust For Husband And Wife With No Children in Nevada, such as real estate, bank accounts, investments, and personal property. However, it's important to properly fund the trust by transferring ownership of these assets to the trust to ensure proper management and distribution.

-

How does a Living Trust For Husband And Wife With No Children impact estate taxes in Nevada?

While a Living Trust For Husband And Wife With No Children in Nevada does not directly influence estate tax rates, it can help in tax planning by ensuring that your assets are distributed according to your wishes without the complications of probate. Consulting with a financial advisor can provide insights into potential tax benefits related to your trust.

-

Is a Living Trust For Husband And Wife With No Children in Nevada necessary if I have a will?

While a will is essential, it does not provide the same benefits as a Living Trust For Husband And Wife With No Children in Nevada, such as avoiding probate and maintaining privacy. Many couples choose to have both a living trust and a will to ensure comprehensive estate planning.

Get more for Living Trust For Husband And Wife With No Children Nevada

- Completionstatement revised 09012019pdf docx form

- Announcement request form harvest life changers church

- Vaap participation criteria fill out ampamp sign onlinedochub form

- Sixth grade class t shirt order form fcps

- Oregon property line adjustment form

- City of springfield development public works 225 form

- Communications tower application polk county community form

- Planting plan questionnaire portland nursery form

Find out other Living Trust For Husband And Wife With No Children Nevada

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter