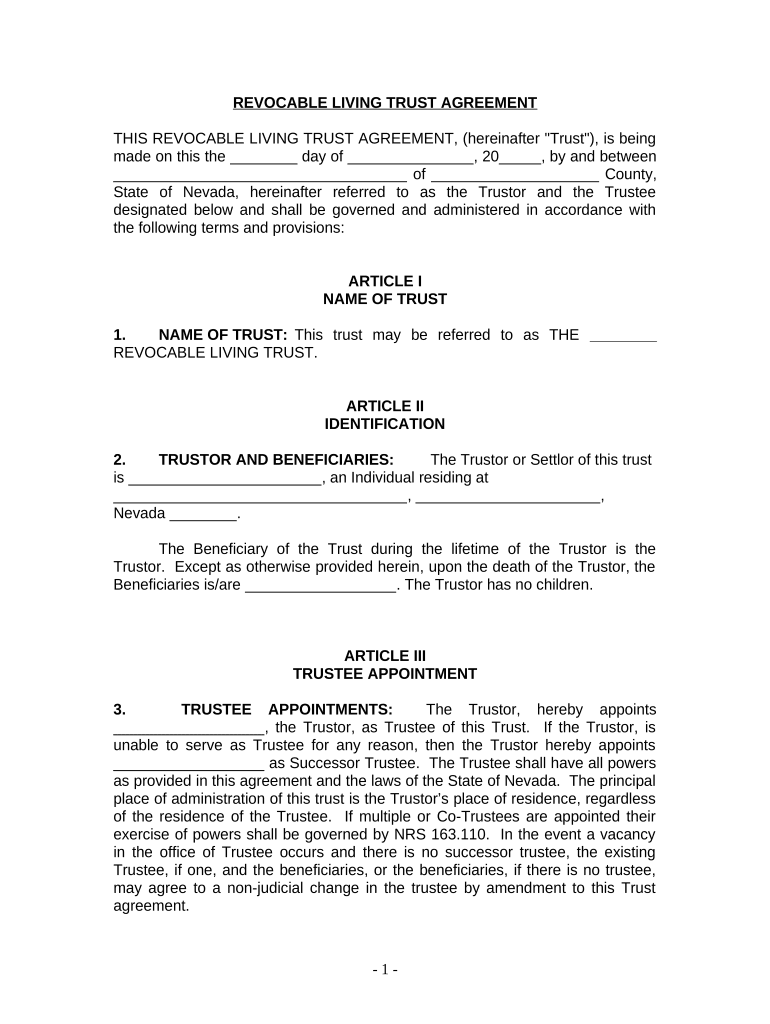

Living Trust for Individual Who is Single, Divorced or Wwidow or Widower with No Children Nevada Form

What is the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Nevada

A living trust is a legal document that allows an individual to manage their assets during their lifetime and specify how those assets should be distributed after their death. For individuals who are single, divorced, or widowed without children in Nevada, a living trust can serve as an essential estate planning tool. It helps avoid probate, which can be a lengthy and costly process. This type of trust allows the individual to retain control over their assets while providing clear instructions for their distribution, ensuring that their wishes are honored.

How to Use the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Nevada

Using a living trust involves several key steps. First, the individual must create the trust document, which outlines the terms of the trust, including the assets included and the beneficiaries. Next, the individual should transfer ownership of their assets into the trust. This may include real estate, bank accounts, and investments. Once the assets are in the trust, the individual can manage them as they see fit. Upon the individual's passing, the assets will be distributed according to the trust's terms, bypassing the probate process.

Steps to Complete the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Nevada

Completing a living trust involves a series of steps:

- Determine the assets to be included in the trust.

- Draft the trust document, specifying the terms and beneficiaries.

- Sign the trust document in the presence of a notary public, if required.

- Transfer ownership of the selected assets into the trust.

- Review and update the trust as necessary, especially after major life changes.

Legal Use of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Nevada

The legal use of a living trust in Nevada requires compliance with state laws. It is essential to ensure that the trust is properly executed and funded to be effective. A living trust can be revoked or amended by the individual at any time, providing flexibility in estate planning. Legal recognition of the trust is crucial for it to function as intended, particularly in avoiding probate and ensuring that assets are distributed according to the individual's wishes.

State-Specific Rules for the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Nevada

Nevada has specific rules governing living trusts, including requirements for execution and funding. Trusts must be signed by the grantor and may need to be notarized. Additionally, Nevada allows for the creation of revocable living trusts, which can be altered or terminated at any time. It is important to be aware of any state-specific nuances, such as tax implications and asset protection laws, when establishing a living trust.

Required Documents for the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Nevada

To create a living trust, the following documents are typically required:

- A completed trust agreement document.

- Proof of identity, such as a driver's license or passport.

- Documentation of assets to be included in the trust, such as property deeds and bank statements.

- Any relevant financial statements or account information.

Quick guide on how to complete living trust for individual who is single divorced or wwidow or widower with no children nevada

Complete Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children Nevada with ease on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly, without delays. Manage Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children Nevada on any gadget using the airSlate SignNow apps available for Android or iOS and streamline any document-related process today.

Steps to modify and electronically sign Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children Nevada effortlessly

- Find Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children Nevada and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your edits.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children Nevada and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Nevada?

A Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Nevada is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust helps avoid probate, providing a seamless transition of your estate to your desired beneficiaries.

-

Why should I consider a Living Trust if I am single, divorced, or widowed with no children?

Creating a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Nevada is beneficial for those who want to ensure their assets are managed according to their wishes. It provides clarity and control over asset distribution, making the process easier for loved ones and minimizing potential disputes.

-

How much does it cost to set up a Living Trust for an Individual Who Is Single, Divorced, or Widowed with No Children in Nevada?

The cost to set up a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Nevada can vary signNowly, generally ranging from a few hundred dollars to a few thousand, depending on the complexity of your estate and whether you seek assistance from legal professionals. Utilizing airSlate SignNow can help reduce costs by offering affordable document preparation services.

-

What are the main features of a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Nevada?

Key features of a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Nevada include asset management during your lifetime, clear distribution instructions after death, and minimizing probate expenses. Additionally, it ensures privacy since it is not subject to public probate proceedings.

-

Can I modify my Living Trust after it's created?

Yes, a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Nevada is revocable, meaning you can modify or revoke it at any time while you are alive. This flexibility allows you to adapt to changes in your life, such as financial status or personal circumstances, ensuring that your trust remains aligned with your wishes.

-

How does a Living Trust affect my tax situation in Nevada?

Establishing a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Nevada generally does not affect your personal tax situation; the trust is considered a 'pass-through entity.' However, it's always advisable to consult with a tax professional to understand any specific implications related to your estate and ensure compliance with tax regulations.

-

Can airSlate SignNow help me create a Living Trust?

Absolutely! airSlate SignNow provides tools that simplify the creation of a Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Nevada. With our easy-to-use platform, you can efficiently prepare and eSign necessary documents, ensuring a hassle-free process tailored to your needs.

Get more for Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children Nevada

- Tree felling permit city of springfield oregon form

- Simple site erosion control requirements form

- New products letter cwk wp modern fan company form

- Memorandum official web site of the city of berkeley form

- Npinventory form last xlsx

- Arizona biofuel annual report form

- Application for a sale health certificate list of ingestible form

- For ada use only form

Find out other Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children Nevada

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast