Assignment to Living Trust Nevada Form

What is the Assignment To Living Trust Nevada

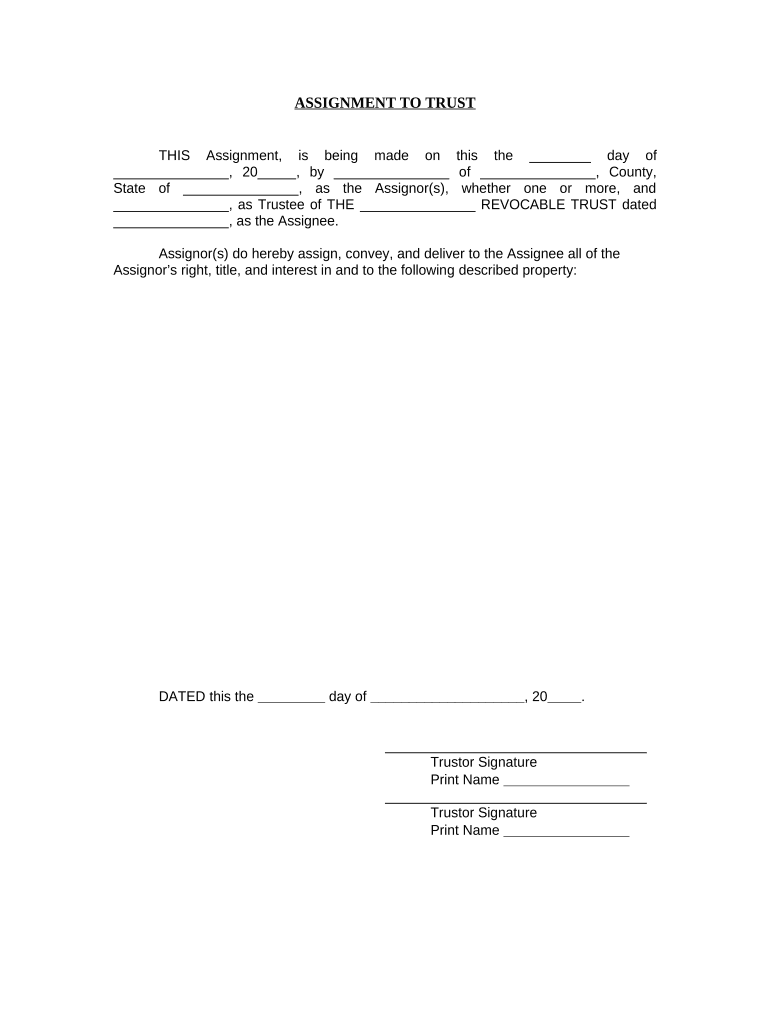

The Assignment To Living Trust Nevada is a legal document used to transfer ownership of assets into a living trust. This process helps individuals manage their assets during their lifetime and facilitates the distribution of those assets after death without the need for probate. By assigning assets to a living trust, individuals can maintain control over their property while ensuring a smoother transition for beneficiaries. This form is particularly relevant in Nevada, where specific state laws govern the establishment and management of living trusts.

Steps to complete the Assignment To Living Trust Nevada

Completing the Assignment To Living Trust Nevada involves several key steps to ensure that the transfer of assets is legally binding and effective. Begin by gathering all relevant information about the assets you wish to transfer, including titles, deeds, and account numbers. Next, fill out the assignment form accurately, ensuring that all details match the existing legal documents associated with the assets. After completing the form, sign it in the presence of a notary public to validate the document. Finally, keep copies of the completed assignment for your records and provide copies to your trustee or beneficiaries as necessary.

Legal use of the Assignment To Living Trust Nevada

The legal use of the Assignment To Living Trust Nevada is essential for ensuring that the transfer of assets is recognized by the courts and other entities. This document must comply with Nevada state laws, which dictate how living trusts are established and managed. By following the legal requirements, such as proper execution and notarization, individuals can protect their assets and ensure that their wishes are honored after their passing. It is advisable to consult with a legal professional to ensure compliance with all relevant laws and regulations.

Key elements of the Assignment To Living Trust Nevada

Key elements of the Assignment To Living Trust Nevada include the identification of the trust, the grantor's details, and a clear description of the assets being transferred. The document should specify the name of the trust, the date it was established, and the names of the beneficiaries. Additionally, it must include a detailed list of the assets being assigned, such as real estate, bank accounts, and personal property. This clarity helps prevent disputes and ensures that the trust operates as intended.

State-specific rules for the Assignment To Living Trust Nevada

Nevada has specific rules governing the Assignment To Living Trust that individuals must follow to ensure validity. For instance, the state does not require living trusts to be recorded, but it is essential to keep the assignment document in a safe place. Additionally, Nevada law allows for the revocation or amendment of living trusts, which can affect the assignment of assets. Understanding these state-specific rules is crucial for effective estate planning and asset management.

Examples of using the Assignment To Living Trust Nevada

Examples of using the Assignment To Living Trust Nevada can vary widely based on individual circumstances. For instance, a homeowner may use the assignment to transfer the title of their property into the trust, ensuring that it passes directly to their heirs without probate. Another example could involve transferring bank accounts or investment accounts into the trust, allowing for seamless management and distribution of funds. These practical applications highlight the flexibility and benefits of utilizing a living trust in estate planning.

Quick guide on how to complete assignment to living trust nevada

Complete Assignment To Living Trust Nevada effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly without interruptions. Handle Assignment To Living Trust Nevada on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign Assignment To Living Trust Nevada with ease

- Locate Assignment To Living Trust Nevada and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Adjust and eSign Assignment To Living Trust Nevada and maintain excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Assignment To Living Trust in Nevada?

An Assignment To Living Trust in Nevada is a legal document that transfers assets into a trust, allowing for better management and distribution of your estate. By using airSlate SignNow, you can easily create and execute this document, ensuring your assets are properly assigned and legally binding in compliance with Nevada laws.

-

How can airSlate SignNow assist with creating an Assignment To Living Trust in Nevada?

airSlate SignNow provides a user-friendly platform to create, edit, and eSign your Assignment To Living Trust in Nevada. With our templates and guided workflows, you can simplify the process, ensuring that your trust is established correctly and efficiently.

-

What are the benefits of using airSlate SignNow for an Assignment To Living Trust in Nevada?

By using airSlate SignNow for your Assignment To Living Trust in Nevada, you benefit from an easy-to-navigate interface, reduced paperwork, and accelerated signing processes. Additionally, you gain access to secure storage and sharing options, ensuring your sensitive documents remain protected.

-

Is there a cost associated with creating an Assignment To Living Trust in Nevada using airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it's a cost-effective solution compared to traditional methods. Our pricing is transparent, and depending on the plan you choose, you can access features specifically designed to facilitate the creation of documents like the Assignment To Living Trust in Nevada.

-

Can airSlate SignNow integrate with other tools for managing my Assignment To Living Trust in Nevada?

Absolutely! airSlate SignNow offers integrations with various tools, making it easier to manage your Assignment To Living Trust in Nevada. Whether you're using CRM systems, cloud storage, or other business applications, our platform can connect seamlessly with your existing workflows.

-

How does airSlate SignNow ensure the security of my Assignment To Living Trust in Nevada?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods, secure storage, and compliance with legal standards to ensure that your Assignment To Living Trust in Nevada is kept safe from unauthorized access and manipulation.

-

How long does it take to complete an Assignment To Living Trust in Nevada with airSlate SignNow?

The time to complete an Assignment To Living Trust in Nevada using airSlate SignNow can vary based on your specific needs. However, our efficient platform typically allows you to finalize and eSign your documents in just a matter of minutes, making the process quick and hassle-free.

Get more for Assignment To Living Trust Nevada

- Fleet vehicle inspection checklists 6 of vinlicen form

- Daniel inouye airport renew form

- Mechanics pupil transportation vehicle inspection report rule 92 3704 form

- Find court and legal forms

- Www uslegalforms comform library484802 selfself certification affidavit north dakota department of

- Affidavit of sale of involuntarily towed vehicle form

- Sewer lateral application village of bel ridge website bel ridge form

- Ag ny gov sites defaultplattsburgh complaint new york state attorney general form

Find out other Assignment To Living Trust Nevada

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors