Nevada Unsecured Installment Payment Promissory Note for Fixed Rate Nevada Form

What is the Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada

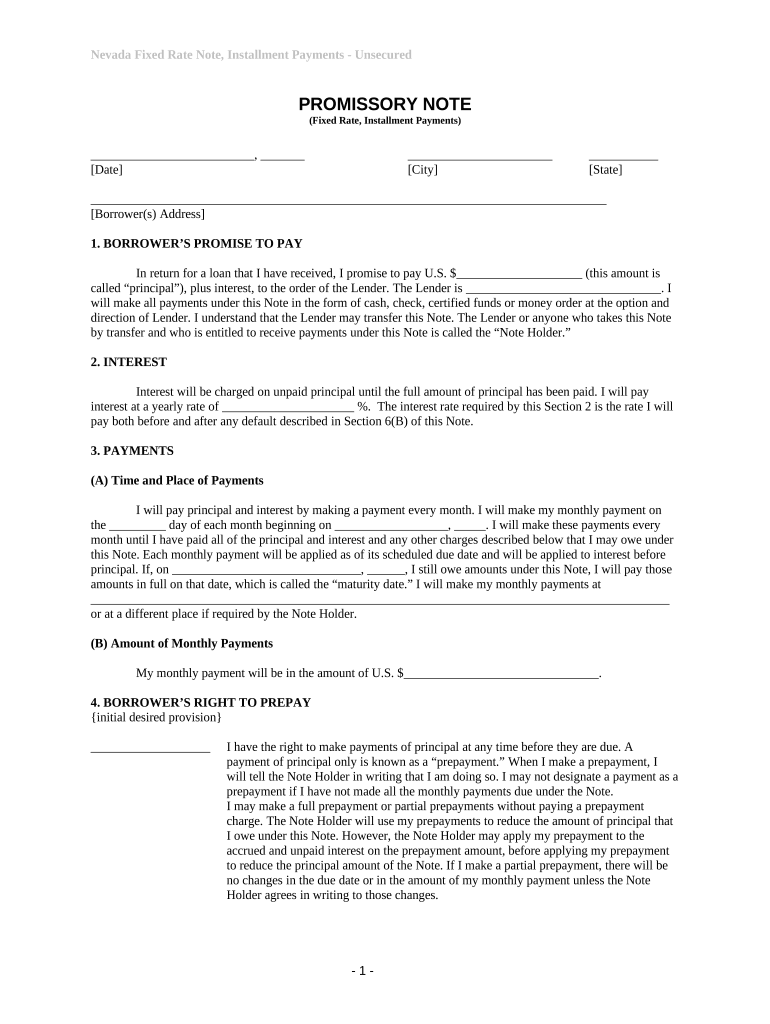

The Nevada Unsecured Installment Payment Promissory Note for Fixed Rate Nevada is a legal document that outlines a borrower's promise to repay a loan in fixed installments over a specified period. This type of promissory note is unsecured, meaning it does not require collateral to back the loan. It serves as a formal agreement between the lender and the borrower, detailing the terms of repayment, interest rates, and any applicable fees. This document is essential for both parties to ensure clarity and legal protection in financial transactions.

Key elements of the Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada

Several key elements must be included in the Nevada Unsecured Installment Payment Promissory Note to ensure its validity and enforceability. These elements include:

- Borrower and Lender Information: Names and addresses of both parties involved.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed interest rate applied to the loan.

- Payment Schedule: Details on the frequency and amount of payments.

- Maturity Date: The date by which the loan must be fully repaid.

- Default Provisions: Conditions under which the borrower may be considered in default.

Steps to complete the Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada

Completing the Nevada Unsecured Installment Payment Promissory Note involves several important steps to ensure accuracy and legality:

- Gather Information: Collect all necessary details about the borrower, lender, and loan terms.

- Fill Out the Document: Enter the required information into the promissory note template.

- Review the Terms: Ensure all terms, including payment amounts and schedules, are clearly stated.

- Sign the Document: Both parties should sign the note to indicate their agreement to the terms.

- Store the Document Safely: Keep a copy of the signed note for future reference.

Legal use of the Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada

The legal use of the Nevada Unsecured Installment Payment Promissory Note is governed by state laws and regulations. This document can be used in various scenarios, including personal loans, business financing, or informal lending between friends or family. It is crucial that both parties understand the terms and conditions outlined in the note, as it serves as a binding agreement. In the event of a dispute, this document can be presented in court to enforce the repayment terms.

How to use the Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada

Using the Nevada Unsecured Installment Payment Promissory Note effectively requires understanding its purpose and proper execution. After filling out the document, both the lender and borrower should review the terms to ensure mutual agreement. It is advisable to keep the note accessible for reference throughout the loan term. In case of any changes or disputes, having this document will provide clarity and legal backing for both parties.

State-specific rules for the Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada

In Nevada, specific rules govern the execution and enforcement of unsecured installment payment promissory notes. These include requirements for the document to be in writing, clear terms regarding interest rates, and adherence to state usury laws. Additionally, both parties must be of legal age and have the capacity to enter into a contract. Understanding these regulations is essential to ensure the promissory note is enforceable in a court of law.

Quick guide on how to complete nevada unsecured installment payment promissory note for fixed rate nevada

Complete Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada effortlessly on any device

Managing documents online has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada on any platform with airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

The easiest way to modify and eSign Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada with ease

- Obtain Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada?

A Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada is a legal document that outlines the terms of a loan between a borrower and a lender, where repayment is made in fixed installments over time. This note does not require the borrower to provide collateral, making it an attractive option for many individuals and businesses in Nevada.

-

How do I create a Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada?

Creating a Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada can be done easily using airSlate SignNow’s user-friendly interface. Simply select the template that suits your needs, fill in the required details, and you can eSign it securely for legal enforceability.

-

What are the pricing options for using airSlate SignNow for a Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada?

airSlate SignNow offers several pricing tiers to suit different needs and budgets. Depending on your usage and additional features required for creating a Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada, you can choose from basic to advanced plans, all designed to be cost-effective.

-

What are the benefits of using airSlate SignNow for a Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada?

Using airSlate SignNow for a Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada offers several benefits, including enhanced security, faster processing times, and user-friendly features. Businesses can manage their documents efficiently while ensuring legal compliance.

-

Can I customize my Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada?

Yes, airSlate SignNow allows full customization of your Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada. You can modify terms, add clauses, and adjust any details to tailor the document to your specific agreement, ensuring all parties are satisfied.

-

Is my Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada legally binding?

Absolutely. A properly executed Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada created using airSlate SignNow is legally binding. As long as it adheres to state laws and is signed by the relevant parties, it will hold up in court.

-

Does airSlate SignNow integrate with other tools for managing a Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms like CRMs and cloud storage solutions. This makes it easier to store and manage your Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada alongside your other business documentation.

Get more for Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada

Find out other Nevada Unsecured Installment Payment Promissory Note For Fixed Rate Nevada

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later