New York Form Ny

What is the New York Form NY?

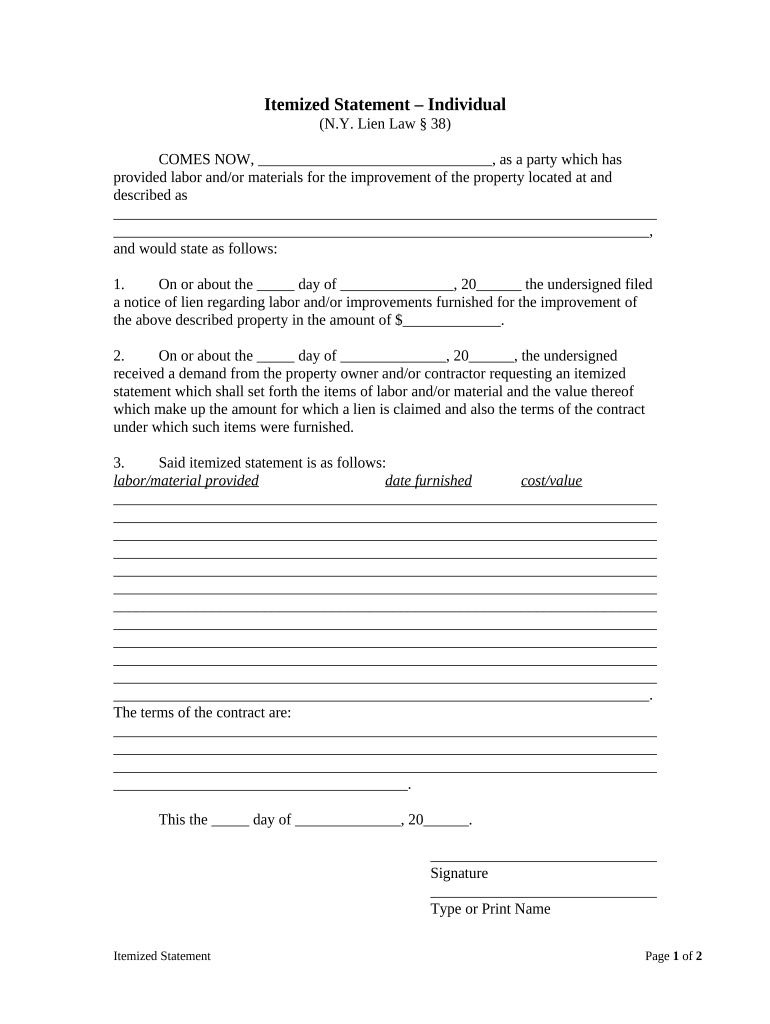

The New York Form NY serves as a crucial document for various legal and administrative processes within the state. It is often used for tax-related purposes, applications, and other official transactions. Understanding its specific use cases can help individuals and businesses navigate their obligations effectively. The form is designed to ensure compliance with state regulations and facilitate smooth interactions with governmental entities.

How to use the New York Form NY

Using the New York Form NY involves several straightforward steps. First, identify the specific purpose of the form, as this will dictate the information required. Next, gather all necessary documentation and details to complete the form accurately. Ensure that you fill out the form completely and clearly, as incomplete submissions may lead to delays or rejections. Once completed, the form can be submitted electronically or via traditional mail, depending on the requirements.

Steps to complete the New York Form NY

Completing the New York Form NY involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Review the form instructions carefully to understand what information is required.

- Gather all relevant documents, such as identification, financial records, or supporting materials.

- Fill out the form, ensuring that all fields are completed as instructed.

- Double-check the information for accuracy and completeness.

- Submit the form through the designated method, either online or by mail.

Legal use of the New York Form NY

The New York Form NY is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions. The form must be signed and dated appropriately, and in some cases, notarization may be required to validate the submission. Understanding the legal implications of the form can help users avoid potential issues.

Key elements of the New York Form NY

Key elements of the New York Form NY include the following:

- Identification Information: This section typically requires personal or business identification details.

- Purpose of the Form: Clearly stating the reason for submitting the form is crucial for processing.

- Signature: A signature is often required to validate the form, confirming that the information is accurate.

- Date: The date of submission is essential for record-keeping and compliance purposes.

Filing Deadlines / Important Dates

Filing deadlines for the New York Form NY can vary based on the specific use case, such as tax submissions or applications. It is important to be aware of these deadlines to avoid penalties or complications. Generally, deadlines are established by state regulations and may change annually, so checking the latest information is advisable. Timely submission ensures compliance and helps maintain good standing with state authorities.

Quick guide on how to complete new york form ny 497321264

Effortlessly Prepare New York Form Ny on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to quickly create, modify, and eSign your documents without delays. Manage New York Form Ny across any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The Most Efficient Way to Alter and eSign New York Form Ny with Ease

- Find New York Form Ny and click Get Form to start.

- Utilize the tools provided to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you'd like to deliver your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Forget the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign New York Form Ny and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the new york form ny and how can it be used?

The new york form ny is a legal document template designed for various transactions within New York. It simplifies the process of creating, editing, and signing essential documents, ensuring compliance with state regulations. Businesses can use it to streamline their document workflows and provide a professional touch to their transactions.

-

How does airSlate SignNow help with the new york form ny?

airSlate SignNow makes handling the new york form ny easier by providing a user-friendly platform for electronic signatures and document management. You can create, send, and track your forms in real time, which enhances productivity and minimizes delays in processing. The software also ensures that documents are securely stored and easily accessible.

-

What pricing options are available for using airSlate SignNow with the new york form ny?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes using the new york form ny. Each plan includes features tailored to your specific needs, from basic functionality for small teams to advanced features for larger enterprises. Visit our pricing page for detailed information on what suits your requirements best.

-

Can I integrate the new york form ny with other tools and platforms?

Yes, airSlate SignNow provides seamless integration with various popular applications, enhancing the usability of the new york form ny. Whether you want to connect with CRM systems, cloud storage solutions, or accounting software, our integrations make it easy to manage your documents effectively. This ensures that your workflows remain uninterrupted and efficient.

-

What are the key features of airSlate SignNow for the new york form ny?

airSlate SignNow offers several key features for the new york form ny, such as customizable templates, automated workflows, and robust security measures. These functionalities guarantee that your documents are not only compliant but also tailored to meet your business's specific needs. Additionally, the platform provides advanced tracking and analytics capabilities.

-

How does airSlate SignNow ensure the security of the new york form ny?

Security is a top priority for airSlate SignNow when handling the new york form ny. The platform employs end-to-end encryption and complies with industry standards to protect sensitive information. This commitment to security gives users peace of mind that their documents are safe and secure throughout the signing process.

-

Is there a mobile app available for the new york form ny?

Yes, airSlate SignNow offers a mobile app that allows you to manage the new york form ny on the go. Whether you are sending documents for signature or reviewing them, the app provides easy access to all your essential features. This mobile flexibility ensures that you can keep your business moving forward, regardless of your location.

Get more for New York Form Ny

- Laverne noyes scholarship application for purdue university form

- A completed tax return fp 7c is required to record any deed deed of trust modification or form

- D 30 office of tax and revenue dc gov form

- Mony10481changeofbeneficiaryandorrightsholderowner rtf form

- Sellerpurchaser affidavit of exemption sold for removal form

- Government of the district of columbia office of form

- Franchise ampamp excise tax tennessee department of revenue form

- Form st 133cats sales tax exemption certificate capital asset

Find out other New York Form Ny

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document