Living Trust for Husband and Wife with No Children New York Form

What is the Living Trust for Husband and Wife with No Children in New York

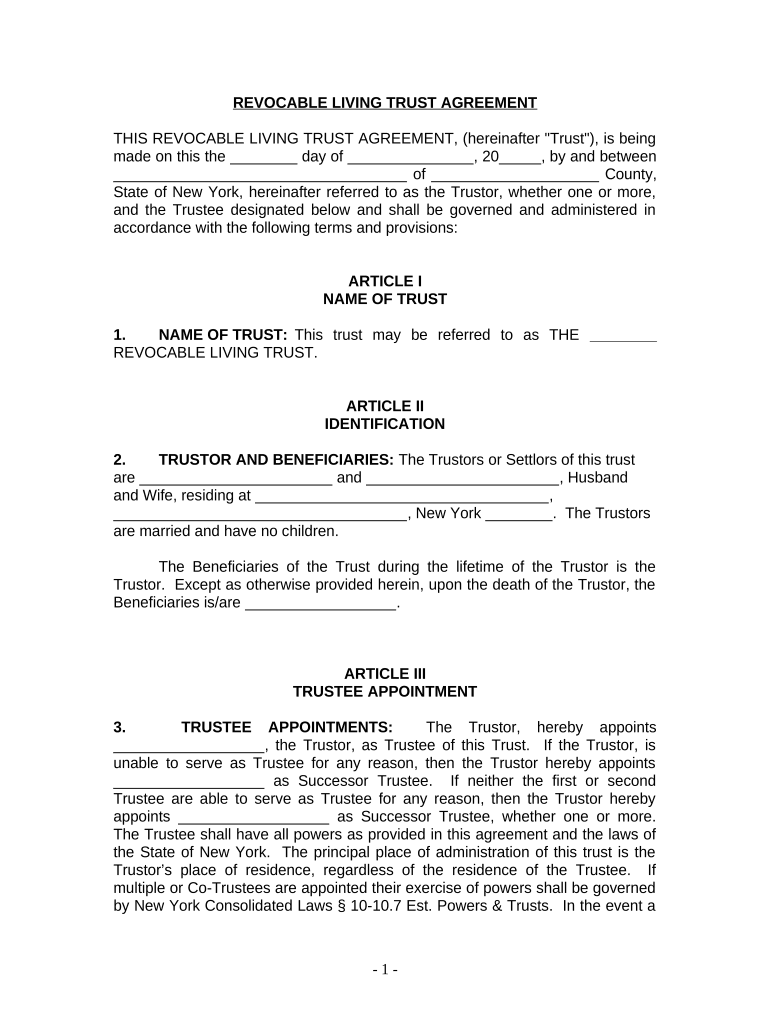

A living trust for husband and wife with no children in New York is a legal arrangement that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This type of trust is particularly beneficial for couples without children, as it simplifies the estate planning process and can help avoid probate. By establishing a living trust, both spouses can maintain control over their assets while ensuring a smooth transition of ownership upon death.

Key Elements of the Living Trust for Husband and Wife with No Children in New York

Several key elements define a living trust for husband and wife with no children in New York:

- Grantors: Both spouses act as grantors, contributing assets to the trust.

- Trustee: Typically, one or both spouses serve as trustees, managing the trust assets.

- Beneficiaries: In this scenario, the surviving spouse is usually the primary beneficiary, with provisions for other relatives or charitable organizations if desired.

- Revocability: The trust can be amended or revoked by the grantors at any time during their lifetime.

- Asset Management: The trust can hold various types of assets, including real estate, bank accounts, and investments.

Steps to Complete the Living Trust for Husband and Wife with No Children in New York

Completing a living trust involves several important steps:

- Identify Assets: List all assets to be included in the trust, such as property, bank accounts, and investments.

- Choose a Trustee: Decide who will manage the trust, typically one or both spouses.

- Draft the Trust Document: Create a legal document outlining the terms of the trust, including how assets will be managed and distributed.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public.

- Fund the Trust: Transfer ownership of the identified assets into the trust to ensure they are properly managed.

Legal Use of the Living Trust for Husband and Wife with No Children in New York

The legal use of a living trust for husband and wife with no children in New York is primarily to manage and distribute assets according to the grantors' wishes. This legal tool helps avoid the lengthy probate process, ensuring that the surviving spouse can access the trust assets without delay. Additionally, a living trust can provide privacy, as the assets held in the trust do not become public record upon death.

State-Specific Rules for the Living Trust for Husband and Wife with No Children in New York

New York has specific regulations regarding living trusts that couples should be aware of:

- Trust Creation: Trusts must be created in writing and signed by the grantors.

- Asset Transfer: Properly transferring assets into the trust is essential to ensure they are protected under the trust's terms.

- Tax Implications: Couples should consider potential tax implications, such as property taxes and estate taxes, when establishing a trust.

How to Obtain the Living Trust for Husband and Wife with No Children in New York

Obtaining a living trust for husband and wife with no children in New York can be accomplished through several methods:

- Legal Assistance: Consulting an estate planning attorney can provide personalized guidance and ensure compliance with state laws.

- Online Resources: Various online platforms offer templates and tools to create a living trust, although legal advice is recommended for complex situations.

- Financial Institutions: Some banks and financial advisors offer trust services and can assist in setting up a living trust.

Quick guide on how to complete living trust for husband and wife with no children new york

Complete Living Trust For Husband And Wife With No Children New York effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the right format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Handle Living Trust For Husband And Wife With No Children New York on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to edit and electronically sign Living Trust For Husband And Wife With No Children New York with ease

- Obtain Living Trust For Husband And Wife With No Children New York and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for those tasks.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Living Trust For Husband And Wife With No Children New York and ensure great communication at every step of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in New York?

A Living Trust For Husband And Wife With No Children in New York is a legal document that allows couples to manage their assets during their lifetime and dictate how their assets will be distributed after death. This type of trust helps avoid probate, providing a streamlined process for transferring assets. It offers flexibility and control, ensuring that the couple's wishes are honored.

-

How do I create a Living Trust For Husband And Wife With No Children in New York?

To create a Living Trust For Husband And Wife With No Children in New York, you typically need to draft the trust document, outline your assets, and specify your beneficiaries. While you can handle this process yourself, consulting with an attorney can ensure accuracy and compliance with New York laws. Using resources like airSlate SignNow can simplify the document preparation and signing process.

-

What are the benefits of a Living Trust For Husband And Wife With No Children in New York?

The benefits of a Living Trust For Husband And Wife With No Children in New York include avoiding probate, maintaining privacy, and having more control over asset distribution. Additionally, it simplifies the management of assets should one spouse become incapacitated, ensuring that your wishes are carried out efficiently. This provides peace of mind for couples without children.

-

Is a Living Trust For Husband And Wife With No Children in New York expensive to set up?

The cost for setting up a Living Trust For Husband And Wife With No Children in New York varies depending on complexity and legal fees. Generally, it can be more cost-effective than the probate process in the long run. airSlate SignNow offers affordable solutions to assist with the document signing and management, making it accessible for couples.

-

Can I amend my Living Trust For Husband And Wife With No Children in New York?

Yes, you can amend your Living Trust For Husband And Wife With No Children in New York at any time as long as you are alive and competent. Amendments can reflect changes in circumstances, such as changes in asset ownership or wishes. Ensure that any amendments are properly documented and executed, which can be facilitated through airSlate SignNow.

-

How does a Living Trust For Husband And Wife With No Children in New York work with other estate planning tools?

A Living Trust For Husband And Wife With No Children in New York works in conjunction with wills and other estate planning documents to create a comprehensive strategy. While the trust governs the distribution of assets, a will can dictate the handling of any assets not included in the trust. This coordination helps ensure that all aspects of your estate are managed according to your wishes.

-

Are there tax benefits to setting up a Living Trust For Husband And Wife With No Children in New York?

A Living Trust For Husband And Wife With No Children in New York typically does not provide signNow tax benefits during the lifetime of the grantors. However, it can help to streamline estate taxes and avoid probate-related expenses, which can indirectly save money. Consulting a tax professional is advisable to understand the implications fully.

Get more for Living Trust For Husband And Wife With No Children New York

- Hsbc online deposit slip form

- Hsbc deposit slip form

- Hsbc direct deposit form

- Medallion signature guarantee hsbc form

- Blank letter of credit form

- Us bank fleet card form

- U s loan form

- Ic 831 form 4466w wisconsin corporation or pass through entity application for quick refund of overpayment of estimated tax 794907800

Find out other Living Trust For Husband And Wife With No Children New York

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors