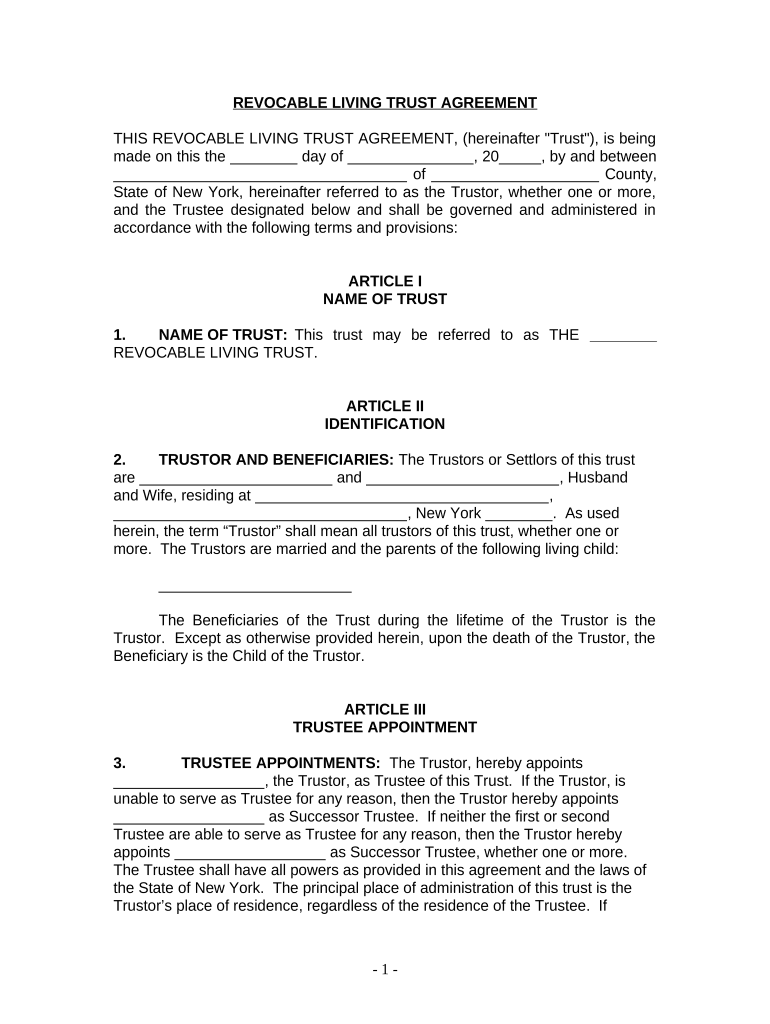

Living Trust for Husband and Wife with One Child New York Form

What is the Living Trust For Husband And Wife With One Child New York

A living trust for husband and wife with one child in New York is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets should be distributed upon their passing. This type of trust can help avoid probate, ensuring a smoother transition of assets to the surviving spouse and child. It typically includes provisions for the management of the trust assets, instructions for distribution, and may provide tax benefits.

Key Elements of the Living Trust For Husband And Wife With One Child New York

Key elements of this living trust include the identification of the grantors (the husband and wife), the trustee (who manages the trust), and the beneficiaries (the couple's child). The trust document should outline the specific assets included, such as real estate, bank accounts, and investments. Additionally, it should detail the terms of distribution, including any conditions that may apply to the child, such as age or milestones that must be met before receiving assets.

Steps to Complete the Living Trust For Husband And Wife With One Child New York

Completing a living trust involves several steps:

- Determine the assets to include in the trust.

- Choose a reliable trustee, which can be one of the spouses or a third party.

- Draft the trust document, ensuring it meets New York state requirements.

- Sign the document in the presence of a notary public.

- Fund the trust by transferring ownership of the selected assets into the trust.

Legal Use of the Living Trust For Husband And Wife With One Child New York

The legal use of a living trust in New York allows couples to maintain control over their assets while providing clear instructions for their distribution after death. This type of trust is recognized under New York law and can serve as a vital estate planning tool. It is essential to ensure that the trust complies with state laws to be enforceable and to avoid potential disputes among heirs.

How to Obtain the Living Trust For Husband And Wife With One Child New York

To obtain a living trust, couples can either work with an estate planning attorney or use reputable online platforms that provide templates and guidance. It is crucial to ensure that the chosen method aligns with New York state laws. Consulting an attorney can provide personalized advice and ensure that all legal requirements are met, while online resources may offer a cost-effective alternative for straightforward situations.

State-Specific Rules for the Living Trust For Husband And Wife With One Child New York

New York has specific rules governing living trusts, including the requirement for the trust document to be in writing and signed by the grantors. Additionally, the trust must be funded correctly to be effective. New York law also allows for the revocation of living trusts, providing flexibility for couples to make changes as their circumstances evolve. Understanding these state-specific rules is essential for the trust to be valid and enforceable.

Quick guide on how to complete living trust for husband and wife with one child new york

Finalize Living Trust For Husband And Wife With One Child New York effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents quickly without delays. Manage Living Trust For Husband And Wife With One Child New York on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign Living Trust For Husband And Wife With One Child New York with ease

- Locate Living Trust For Husband And Wife With One Child New York and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Select signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and eSign Living Trust For Husband And Wife With One Child New York and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child New York?

A Living Trust For Husband And Wife With One Child New York is a legal document that allows couples to manage their assets during their lifetime and dictate how their assets will be distributed after their death. This trust helps avoid probate, ensuring a smoother transition of wealth to the couple's child.

-

What are the benefits of establishing a Living Trust For Husband And Wife With One Child New York?

The primary benefits of a Living Trust For Husband And Wife With One Child New York include avoiding probate, maintaining privacy, and ensuring that assets are distributed according to the couple's wishes. This trust also provides flexibility in asset management during their lifetime, making it easier for couples to adjust as needed.

-

How much does a Living Trust For Husband And Wife With One Child New York cost?

The cost of establishing a Living Trust For Husband And Wife With One Child New York can vary signNowly, generally ranging from several hundred to a few thousand dollars. Factors such as the complexity of the trust and the fees charged by legal professionals can influence the total cost.

-

How do I create a Living Trust For Husband And Wife With One Child New York?

To create a Living Trust For Husband And Wife With One Child New York, you typically need to draft the trust document, specify your assets, and appoint a trustee. Utilizing services like airSlate SignNow can streamline this process by allowing you to easily eSign documents and manage your trust efficiently.

-

Can I change or revoke my Living Trust For Husband And Wife With One Child New York?

Yes, one of the primary features of a Living Trust For Husband And Wife With One Child New York is its flexibility. The trust can be modified or revoked at any time while both spouses are alive, allowing for adjustments as family circumstances or financial situations evolve.

-

What assets can be included in a Living Trust For Husband And Wife With One Child New York?

A Living Trust For Husband And Wife With One Child New York can include various types of assets, such as real estate, bank accounts, investments, and personal property. This comprehensive approach ensures that all your assets are managed according to your wishes and can be easily transferred to your child after your passing.

-

Is a Living Trust For Husband And Wife With One Child New York necessary if I already have a will?

While a will is essential for outlining your wishes after death, a Living Trust For Husband And Wife With One Child New York provides added benefits like avoiding probate and maintaining privacy. It is often recommended to have both a trust and a will to ensure comprehensive estate planning.

Get more for Living Trust For Husband And Wife With One Child New York

Find out other Living Trust For Husband And Wife With One Child New York

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement