Financial Account Transfer to Living Trust New York Form

What is the Financial Account Transfer To Living Trust New York

The Financial Account Transfer To Living Trust in New York is a legal process that allows individuals to transfer ownership of their financial accounts into a living trust. This action is crucial for estate planning, as it helps avoid probate and ensures that the assets are managed according to the grantor's wishes after their passing. A living trust can hold various types of financial accounts, including bank accounts, investment accounts, and retirement accounts. By transferring these assets into a trust, the grantor retains control during their lifetime while facilitating a smoother transition of assets to beneficiaries upon death.

Steps to complete the Financial Account Transfer To Living Trust New York

Completing the Financial Account Transfer To Living Trust in New York involves several key steps:

- Establish the Living Trust: Create a living trust document that outlines the terms and conditions of the trust, including the trustee and beneficiaries.

- Gather Financial Account Information: Collect all necessary details about the financial accounts you wish to transfer, including account numbers and financial institution names.

- Contact Financial Institutions: Reach out to each financial institution to inquire about their specific requirements for transferring accounts to a living trust.

- Complete Required Forms: Fill out any forms provided by the financial institutions, which may include a financial account transfer form or a trust certification form.

- Submit Documentation: Provide the completed forms along with a copy of the living trust document to the financial institutions.

- Confirm the Transfer: After submission, confirm with the institutions that the transfer has been processed successfully.

Legal use of the Financial Account Transfer To Living Trust New York

The legal use of the Financial Account Transfer To Living Trust in New York is governed by state laws regarding trusts and estates. This process is recognized as a legitimate means of asset management and distribution. It is essential to ensure that the trust document complies with New York state laws, including proper execution and notarization. The transfer of financial accounts into a living trust can provide legal protections for the assets and ensure they are distributed according to the grantor's wishes, thus minimizing potential disputes among heirs.

Key elements of the Financial Account Transfer To Living Trust New York

Several key elements are crucial for the Financial Account Transfer To Living Trust in New York:

- Trust Document: A legally binding document that outlines the terms of the trust, including the grantor, trustee, and beneficiaries.

- Asset Identification: Clear identification of the financial accounts and assets being transferred into the trust.

- Compliance with State Laws: Adherence to New York state laws regarding trusts, including execution and witnessing requirements.

- Notification of Financial Institutions: Informing banks and financial institutions about the trust and providing necessary documentation for the transfer.

- Tax Considerations: Understanding any tax implications that may arise from transferring accounts to a living trust.

State-specific rules for the Financial Account Transfer To Living Trust New York

In New York, specific rules govern the Financial Account Transfer To Living Trust. These include the requirement that the trust document must be properly executed and notarized to be legally valid. Additionally, New York law mandates that the trustee must act in the best interest of the beneficiaries and manage the trust assets prudently. It is also important to consider the potential impact on Medicaid eligibility and estate taxes when transferring assets into a living trust. Consulting with a legal professional familiar with New York estate law can provide guidance tailored to individual circumstances.

Required Documents

To complete the Financial Account Transfer To Living Trust in New York, several documents are typically required:

- Living Trust Document: The official document that establishes the living trust.

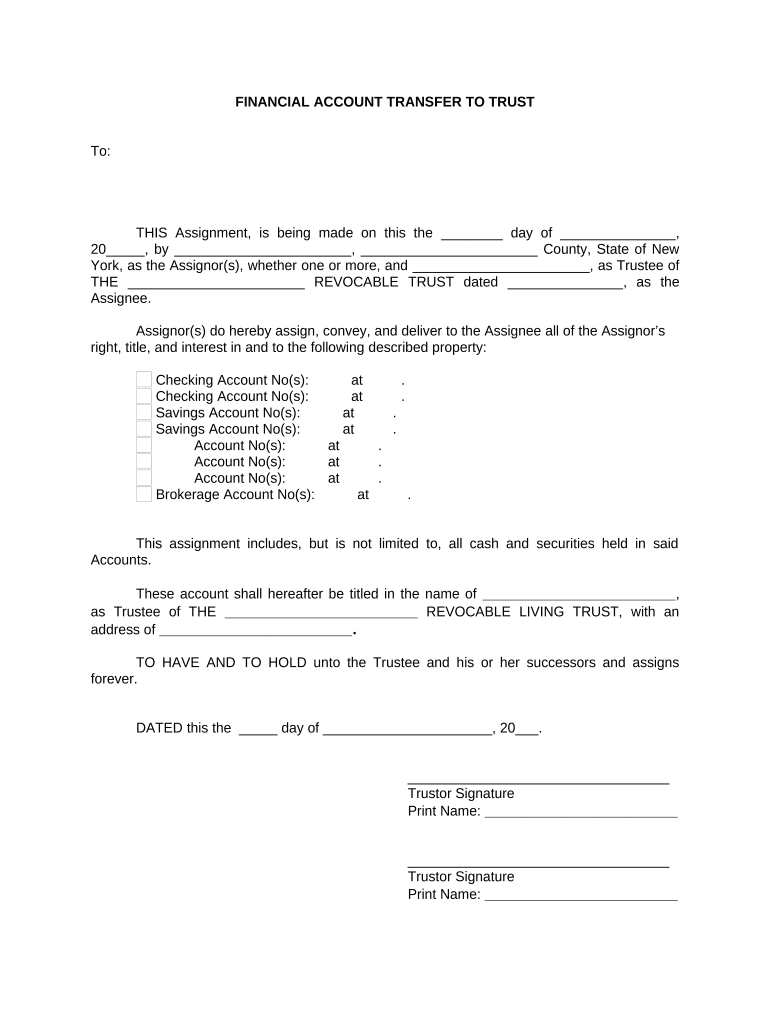

- Financial Account Transfer Form: Specific forms required by financial institutions to initiate the transfer.

- Identification: Government-issued identification for the grantor and possibly the trustee.

- Proof of Trust: A certification of trust or a copy of the trust document may be needed by financial institutions.

Quick guide on how to complete financial account transfer to living trust new york

Complete Financial Account Transfer To Living Trust New York effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without hindrances. Manage Financial Account Transfer To Living Trust New York on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The easiest way to modify and eSign Financial Account Transfer To Living Trust New York seamlessly

- Locate Financial Account Transfer To Living Trust New York and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Design your signature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Financial Account Transfer To Living Trust New York and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for a Financial Account Transfer To Living Trust New York?

The process for a Financial Account Transfer To Living Trust New York typically involves identifying the accounts to be transferred, completing the required trust documents, and submitting them to your financial institution. You'll need to provide proof of the trust's existence and its terms. It’s advisable to consult with a legal professional to ensure compliance with state laws.

-

How can airSlate SignNow help with Financial Account Transfer To Living Trust New York?

airSlate SignNow simplifies the Financial Account Transfer To Living Trust New York by allowing users to eSign and manage documents efficiently. You can prepare, send, and sign trust documents electronically, ensuring a streamlined process. This not only saves time but also keeps your documents secure and easily accessible.

-

What are the costs associated with Financial Account Transfer To Living Trust New York?

The costs related to a Financial Account Transfer To Living Trust New York may vary, depending on the financial institution and legal fees for drafting the trust. While airSlate SignNow offers competitive pricing for its document signing solutions, it is crucial to inquire about specific fees associated with your financial institution when transferring accounts.

-

Are there any benefits of using airSlate SignNow for this transfer?

Yes, using airSlate SignNow for your Financial Account Transfer To Living Trust New York comes with numerous benefits. You gain a secure, cloud-based platform for document management, which allows for real-time collaboration and tracking. Additionally, the ease of use can signNowly reduce the time spent on document handling.

-

What types of accounts can I transfer to my living trust in New York?

In New York, various types of accounts such as bank accounts, investment accounts, and retirement accounts can be transferred to a living trust. The Financial Account Transfer To Living Trust New York helps ensure that your assets are managed according to your wishes after your passing. Always check with your financial institution for specific requirements related to account types.

-

Is there a specific timeframe for the transfer process in New York?

The timeframe for a Financial Account Transfer To Living Trust New York can vary based on the institutions involved and the completeness of documentation provided. Generally, once you submit all required documents, the transfer can be completed within a few weeks. However, contacting your financial institution can provide more specific timelines.

-

What integrations does airSlate SignNow offer for managing trust documents?

airSlate SignNow integrates with various platforms such as Google Drive, Dropbox, and Salesforce, which can be beneficial when dealing with your Financial Account Transfer To Living Trust New York. These integrations allow for easy document storage and access, making it simpler to manage your trust documents effectively and securely.

Get more for Financial Account Transfer To Living Trust New York

Find out other Financial Account Transfer To Living Trust New York

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy