Exempt Employees Form

What is the Exempt Employees

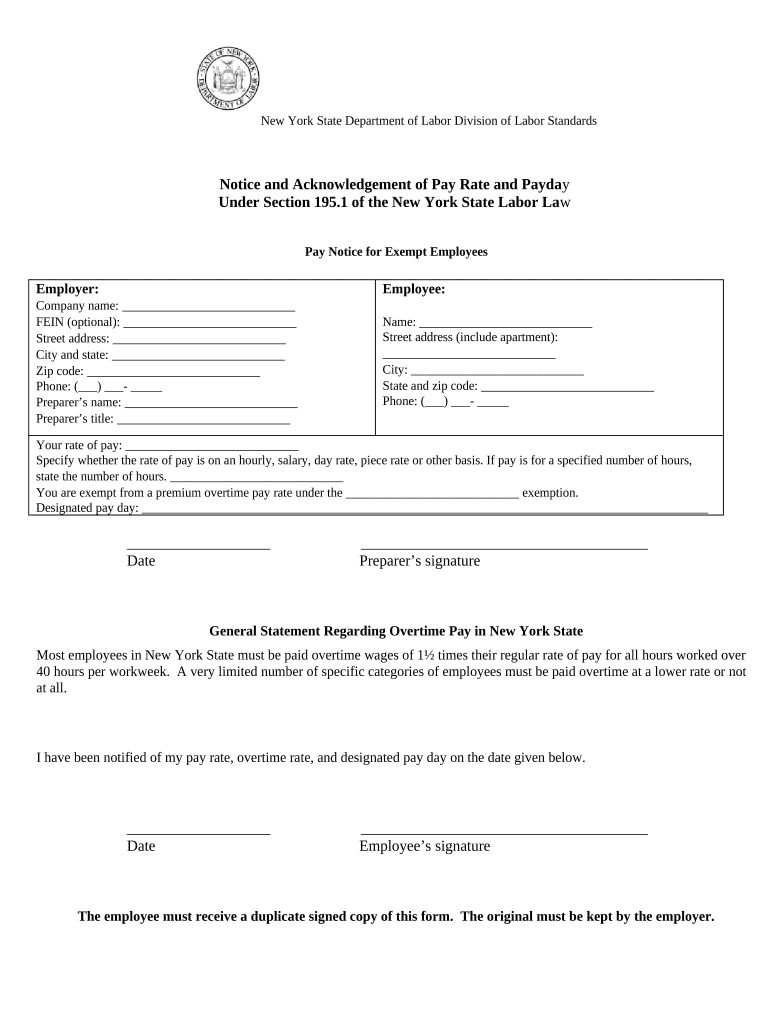

The term "exempt employees" refers to workers who are exempt from certain provisions of the Fair Labor Standards Act (FLSA), primarily concerning overtime pay. These employees typically receive a salary rather than hourly wages and are not entitled to overtime compensation for hours worked beyond forty in a workweek. Common categories of exempt employees include those in executive, administrative, professional, and outside sales roles. Understanding the classification of exempt employees is crucial for businesses to ensure compliance with labor laws and to avoid potential legal issues.

Key elements of the Exempt Employees

Several key elements determine whether an employee qualifies as exempt. These include:

- Salary Basis: Exempt employees must be paid on a salary basis, meaning they receive a fixed amount of pay each pay period, regardless of hours worked.

- Minimum Salary Threshold: The employee's salary must meet or exceed a specified minimum amount set by the Department of Labor.

- Job Duties: The employee's primary duties must fall within specific categories, such as executive, administrative, or professional tasks, which require independent judgment and discretion.

Employers must carefully evaluate these criteria to ensure proper classification and compliance with applicable laws.

Steps to complete the Exempt Employees

Completing the necessary documentation for exempt employees involves several steps:

- Determine Eligibility: Assess the employee's role and responsibilities to confirm they meet the criteria for exempt status.

- Document Salary and Duties: Maintain records of the employee’s salary and detailed job descriptions that outline their exempt duties.

- Provide Written Notice: Offer a written notice to the employee outlining their exempt status and the terms of their employment.

- Review Regularly: Periodically review the employee's status and job duties to ensure ongoing compliance with FLSA regulations.

Legal use of the Exempt Employees

Utilizing exempt employees within a business framework requires adherence to federal and state labor laws. Employers must ensure that their classification aligns with the FLSA and any relevant state laws. Misclassification can lead to significant penalties, including back pay for unpaid overtime and legal fees. It is essential for employers to stay informed about changes in labor regulations and to maintain accurate records to support their classification decisions.

State-specific rules for the Exempt Employees

Each state may have its own regulations regarding exempt employees, which can differ from federal standards. For instance, some states might set higher salary thresholds or have additional categories for exempt status. Employers should familiarize themselves with state-specific laws to ensure compliance and avoid penalties. Consulting legal professionals or labor experts can provide valuable guidance on navigating these regulations effectively.

Who Issues the Form

The form related to exempt employees is typically issued by the employer as part of their internal HR processes. Employers may also reference guidelines and templates provided by the Department of Labor or state labor agencies to ensure that their documentation meets legal requirements. Proper issuance and maintenance of these forms help protect both the employer and employee by clearly defining employment terms and conditions.

Quick guide on how to complete exempt employees

Effortlessly Prepare Exempt Employees on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without any holdups. Manage Exempt Employees on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Exempt Employees with Ease

- Find Exempt Employees and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or obscure sensitive information with tools specifically designed for that function by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method for delivering your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Exempt Employees and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a notice payday, and how does airSlate SignNow support it?

A notice payday refers to the formal notification provided to employees about their upcoming payment schedule. airSlate SignNow streamlines this process by allowing businesses to create, send, and eSign notice payday documents seamlessly, ensuring timely communication with employees.

-

How much does it cost to use airSlate SignNow for managing notice payday documents?

airSlate SignNow offers various pricing plans tailored to different business needs. Pricing is competitive and cost-effective, making it an ideal solution for managing notice payday documents without breaking the bank.

-

What features does airSlate SignNow provide for creating notice payday documents?

With airSlate SignNow, you can easily create customizable templates for notice payday drafts, add fields for signatures, and automate the distribution process. This enhances efficiency while ensuring all necessary information is captured accurately.

-

Can I integrate airSlate SignNow with other applications for managing notice payday notifications?

Yes, airSlate SignNow offers robust integrations with popular applications such as Google Drive, Salesforce, and more. This allows businesses to manage their notice payday documents alongside their existing tools seamlessly.

-

Is it easy to use airSlate SignNow for teams handling notice payday communication?

Absolutely! airSlate SignNow is designed with user experience in mind. Its intuitive interface makes it easy for teams to create and manage notice payday documents efficiently, regardless of their technical background.

-

What benefits does airSlate SignNow provide for automating notice payday processes?

By automating notice payday processes with airSlate SignNow, businesses can reduce manual errors, save time, and improve compliance with documentation laws. This leads to greater efficiency and a smoother experience for both employers and employees.

-

Can I track the status of my notice payday documents with airSlate SignNow?

Yes! airSlate SignNow includes features that allow users to track the status of their notice payday documents in real-time. You can receive notifications when documents are viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Exempt Employees

Find out other Exempt Employees

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure