St108 Form

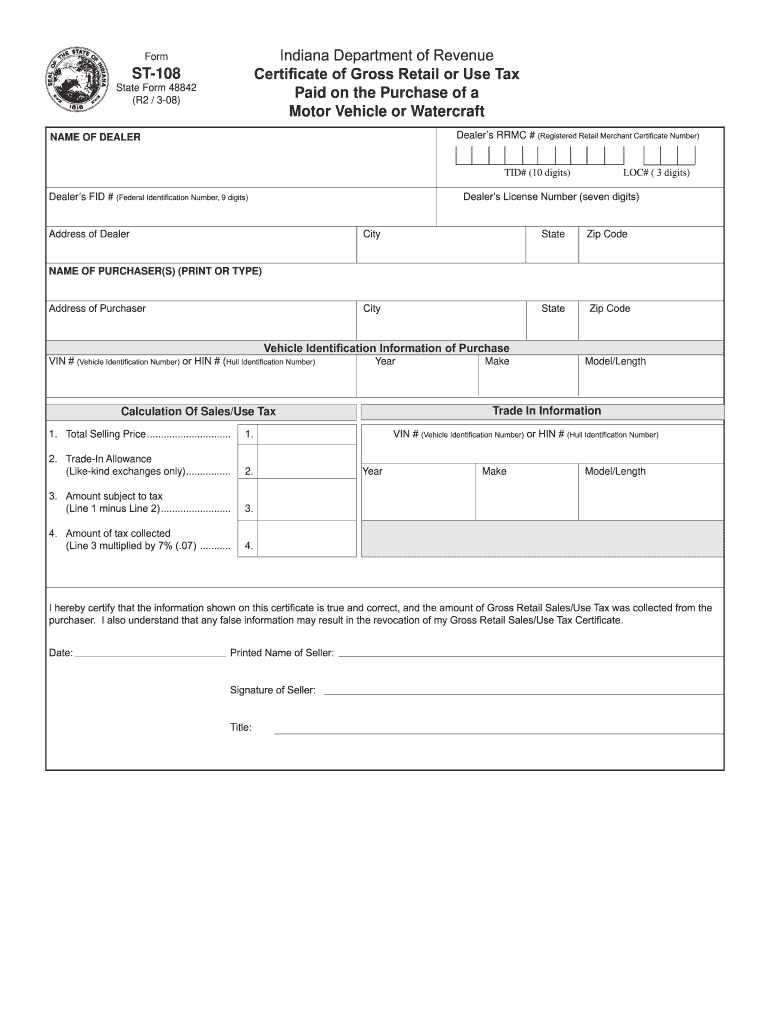

What is the St108?

The St108 is a specific form used in Indiana, primarily related to sales tax exemption. It allows certain organizations, such as non-profits and government entities, to purchase goods and services without paying sales tax. This form is essential for qualifying entities to ensure compliance with state tax regulations while facilitating their operations without the burden of additional tax costs.

How to use the St108

To utilize the St108 effectively, eligible organizations must complete the form accurately and present it to vendors at the time of purchase. The form serves as proof of the organization's tax-exempt status, enabling them to avoid sales tax on qualifying purchases. It is crucial to ensure that the information provided on the form matches the organization's official records to prevent any issues during transactions.

Steps to complete the St108

Completing the St108 involves several straightforward steps:

- Gather necessary information, including the organization's name, address, and tax identification number.

- Indicate the specific type of organization and its purpose for tax exemption.

- Clearly list the items or services being purchased under the exemption.

- Sign and date the form to validate its accuracy and authenticity.

Once completed, the St108 should be presented to the vendor at the time of purchase to ensure the exemption is applied correctly.

Legal use of the St108

The St108 is legally binding when filled out correctly and used by eligible organizations. It must comply with Indiana state laws regarding sales tax exemptions. Misuse of the form, such as using it for non-qualifying purchases, can lead to penalties, including fines and back taxes owed. Organizations should maintain proper records of their exempt purchases to support their claims if audited.

Required Documents

To complete the St108, organizations may need to provide additional documentation to verify their tax-exempt status. This can include:

- A copy of the organization's tax-exempt certificate issued by the state.

- Proof of the organization's mission or purpose, such as bylaws or articles of incorporation.

- Identification documents, such as a federal employer identification number (EIN).

Having these documents on hand can streamline the process and ensure compliance with state requirements.

Form Submission Methods

The St108 does not require a formal submission to the state unless requested during an audit. Instead, it is presented directly to vendors at the time of purchase. Organizations should keep a copy of the completed form for their records, as it may be needed for future reference or in case of an audit.

Quick guide on how to complete state form 48842

Effortlessly Prepare St108 on Any Device

Digital document management has gained popularity among both organizations and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and eSign your documents without any hurdles. Manage St108 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and eSign St108 with Ease

- Find St108 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to store your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign St108 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Do you have to fill out a separate form to avail state quota in NEET?

No..you dont have to fill form..But you have to register yourself in directorate of medical education/DME of your state for state quota counselling process..DME Will issue notice regarding process, date, of 1st round of counsellingCounselling schedule have info regarding date for registration , process of counselling etc.You will have to pay some amount of fee at the time of registration as registration fee..As soon as neet result is out..check for notification regarding counselling on DmE site..Hope this helpBest wishes dear.

-

Do I need to fill out the state admission form to participate in state counselling in the NEET UG 2018?

There is two way to participate in state counseling》Fill the state quota counseling admission form(for 15% quota) and give the preference to your own state with this if your marks are higher and if you are eligible to get admission in your state then you will get the college.》Fill out the form for state counseling like karnataka state counseling has started and Rajasthan counseling will start from 18th june.In 2nd way you will fill the form for 85% state quota and has higher chances to get college in your own state.NOTE= YOU WILL GET COLLEGE IN OTHER STATE (IN 15% QUOTA) WHEN YOU WILL CROSS THE PARTICULAR CUT OFF OF THE NEET AND THAT STATE.BEST OF LUCK.PLEASE DO FOLLOW ME ON QUORA.

-

Which form do I have to fill out to get into LNCT Bhopal? I am from another state.

Dear candidatEngineering admission in lnct Bhopal is possible based on candidates marks in board exam and with jee mains rankFor more detailsContactNavnit singh(admission counselor for Bhopal and other engineering colleges)7065197100whatsapp no-7827599577

Create this form in 5 minutes!

How to create an eSignature for the state form 48842

How to create an eSignature for your State Form 48842 online

How to generate an electronic signature for the State Form 48842 in Chrome

How to create an electronic signature for putting it on the State Form 48842 in Gmail

How to make an eSignature for the State Form 48842 right from your smart phone

How to make an electronic signature for the State Form 48842 on iOS devices

How to make an eSignature for the State Form 48842 on Android

People also ask

-

What is the St108 form and how can airSlate SignNow help with it?

The St108 form is commonly used for sales tax purposes, and airSlate SignNow makes it easy to electronically sign and send this document. With our intuitive platform, you can securely eSign the St108 form, ensuring compliance and speeding up your document workflow. Plus, you can track the status of your St108 submissions in real-time.

-

What are the pricing options for using airSlate SignNow for St108 documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those looking to manage St108 documents efficiently. Our plans are cost-effective and provide features that allow for unlimited eSigning and document storage. You can start with a free trial to see how our solution fits your needs before committing.

-

Can I integrate airSlate SignNow with other software for processing St108 forms?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications to enhance your workflow when dealing with St108 forms. Whether you use CRM tools, cloud storage, or accounting software, our platform allows for easy integration. This streamlines your document management process and simplifies the eSigning of St108 documents.

-

What features does airSlate SignNow offer to enhance the signing process for St108 forms?

airSlate SignNow includes features such as customizable templates, in-person signing, and advanced security options to enhance the signing process for St108 forms. These features ensure that your documents are signed quickly and securely. Additionally, automated reminders can help you keep track of pending St108 signatures.

-

Is airSlate SignNow suitable for businesses of all sizes when handling St108 forms?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, making it ideal for handling St108 forms. Our platform scales with your needs, providing robust features that small businesses and large enterprises alike can benefit from. Enjoy the flexibility and efficiency that comes with our eSigning solutions.

-

How does airSlate SignNow ensure the security of my St108 documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the St108 form. We use advanced encryption technology and comply with industry standards to protect your data. You can trust that your St108 documents are secure throughout the signing process.

-

What benefits can I expect from using airSlate SignNow for St108 forms?

Using airSlate SignNow for your St108 forms offers numerous benefits, including faster turnaround times, reduced paperwork, and improved organization. By going digital, you can minimize errors and streamline your workflow, allowing you to focus on what matters most in your business. Experience the convenience and efficiency of our eSigning solution today.

Get more for St108

- Legal last will form for a widow or widower with no children delaware

- Legal last will and testament form for a widow or widower with adult and minor children delaware

- Legal last will and testament form for divorced and remarried person with mine yours and ours children delaware

- Legal last will and testament form with all property to trust called a pour over will delaware

- Written revocation of will delaware form

- Last will and testament for other persons delaware form

- Notice to beneficiaries of being named in will delaware form

- Estate planning questionnaire and worksheets delaware form

Find out other St108

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement